Categories:

General Market Commentary

Topics:

General Market Commentary

Peru's New "Top Ten" Landholder

Hannan Metals (TSX-V: HAN)(OTC: HANNF) just quietly launched a shot across the bow with this morning’s announcement that it has expanded its Peruvian mineral tenure by 100% to 1,869 square kilometers.

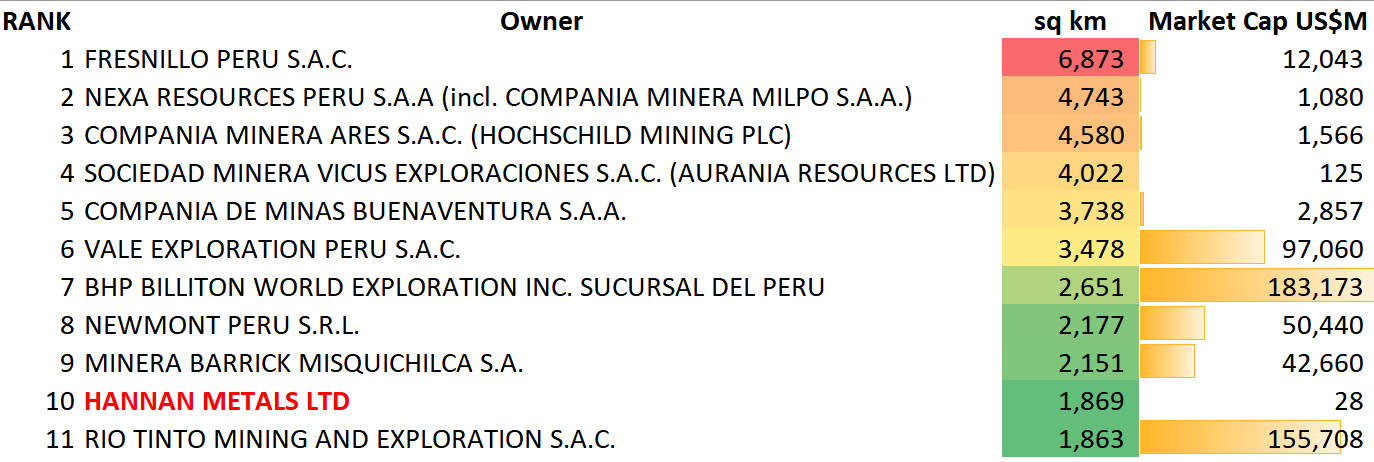

The staking has led Hannan to become a “Top Ten” concession holder in Peru.

That puts them in good company:

Most companies on that list have market caps in the hundreds of millions and billions.

Hannan, with a market cap of C$32 million, is anchored by a US$35 million joint venture on the San Martin project with JOGMEC.

Today’s announcement provides shareholders with significant exposure to copper, silver and now gold.

I spoke with CEO Michael Hudson about the news and the implications.

Enjoy...

Gerardo Del Real

Editor, Resource Stock Digest

Gerardo Del Real: This is Gerardo Del Real with Resource Stock Digest. Joining me today is the CEO of Hannan Metals, Mr. Michael Hudson. Mike, how are you? I know you're busy.

Michael Hudson: Well, we've been busy in Peru you could say, and now we can talk about it.

Gerardo Del Real: Let's talk about it. The headline reads “Hannan Expands Portfolio By 100% To 1,869 Square Kilometers, Becoming A Top 10 Tenure Holder In Peru.” Impressive work. You and I chatted last time and I highlighted to the audience the fact that despite the excellent deal that you struck on 660 square kilometers, 278 square kilometers were still 100% owned by Hannan. And I thought that was impressive in and of itself. This is absolutely spectacular! And I can't help but notice that you mention the potential for copper-gold, copper-gold porphyries. And so we know that copper-silver has been the focus up until now, but I've got to tell you, I'm really excited about the potential for copper-gold discoveries.

Michael Hudson: Well, I think you should be indeed, Gerardo. It's a real frontier part of the world, as was San Martin. So San Martin is our flagship project and we've been working that up over the last few years. And now though, we've worked on a strategy over the last six months during lockdown. I've said it before, and the best way you can pay a geologist sometimes is for them to look out of a window, and we had a lot of that looking out of the window time during our lockdowns.

And we've got lots of data and decades of experience in South America and lots of data and lots of data's become freely available from the state oil company, Peru Petro. And so we put all that together and realized that not only was the sediment-hosted copper story expandable, so as you mentioned, we've got 660 square kilometers in joint venture in a US$35 million joint venture with the Japanese government and we only consummated that deal a month or so ago, but we're exploring a third more of that. Something like, as you said, 270 or 280 square kilometers ourselves in San Martin. So that's the copper-silver story.

But if you equally go further south, a few hundred kilometers south in these high jungle areas that have seen very little exploration, now that doesn't matter what's on top of the ground, other than it just makes it a little harder to find things in jungles that until recently didn't have the infrastructure. The infrastructure has changed. These were cocoa growing areas 20 years ago and very difficult places. I was working in and around these areas. And then I remember getting lots of security briefings at the time where I could and couldn't go. And now it's really, it's very peaceful, an open part of the world that's being developed. And because of that history, it just hasn't seen much exploration and the rocks are right. This is the Andes. And this is a portion of the Andes that just has not essentially been explored. And we've got a bit of an inkling what we think is out there in this, essentially 1,000 square kilometers that we announced today. And stay tuned for more information, I suppose, but first mover advantage again in a new frontier.

Gerardo Del Real: You mentioned security briefings, and it's an odd time where we're getting security briefings here in the United States now. Right? How times have changed. Tell me a bit about the rocks, Mike, and when we'll get a handle on, I know it's early, I completely understand that, but when we'll start to peek at some of these rocks and understand what is potentially there.

Michael Hudson: Yeah. So we call this a back-arc, and that is basically the area that sits behind the magmatic arc that forms the spine of the Andes, if you like. And so the Pacific Plate's going underneath South America, and as it melts and the two plates collide, they've created a lot of mineralization right through the Andes. And in this back-arc basin, it's a slightly different tectonic situation where you've got a lot of extension occurring and you can certainly form a lot of epithermal deposits and porphyries. Some of the better porphyries in the world form in these environments also.

So it's the right model. We know there's certainly intrusions out in that part of the world that are mapped at the same age and the right age that we'd hope to see porphyry deposits form. And it's a continuum; porphyries format at various ages right through the Andes. But we're seeing the right ages, we think, for this area in which we're looking. And then I mentioned we've got a lot of data like we did at San Martin. We had a lot of Peru Petro's data that was made only freely available over the last few years. Now, I know a lot of people are talking about that now and getting hold of it, but we were essentially, I'd say one of the first groups to apply that knowledge and data to San Martin. And that's what gave us the first mover advantage into that basin and gave us the geological understanding. And now over the last months, we've staked a huge area of this area further south that has this porphyry potential.

When are we going to see some information, you ask? Well, we need these areas to be granted to go and do full work and community consultation first up, and then full work. And that takes a year, but that doesn't stop us getting on the ground and doing some reconnaissance work now, stream sediment work and prospecting, just to narrow down the areas for when we get in there and do more intensive work, like a channel sampling and eventually drilling. So we can do the reconnaissance work now. And that will really firm up the targets. And we've got people on the ground doing that now. So it's not too long away that we'll see the first results. And what will that be? Let's see. But we didn't stake these projects on a whim. We did it with a lot of thought and consideration, and we're pretty excited.

Gerardo Del Real: Today's release mentions that the top 10 Peruvian tenure holders average $50 billion, and that's in US dollars, market capitalization. Right? And here's Hannan trading at a market cap of approximately $32 million, which is a significant discount from what JOGMEC has committed to spending in order to earn up to a 75% interest in just the San Martin JV portion of the land that you hold. I have to believe, for anyone out there that's looking for copper and gold exposure, that Hannan is as close to a no-brainer as I've seen given, given that joint venture that anchors it. Right?

Michael Hudson: Yeah. Land position is a good metric. And it's certainly a very good metric in this market that exploration opportunity is being rewarded. But if you look at the top 10 holders of ground, it's just crazy. I mean, we're ahead of Rio Tinto in terms of ground holding in Peru. They're at number 11, and Newmont and BHP are just ahead of us, and then some of the large Peruvian companies, so we're really a minnow amongst the whales there. And the important thing is that big discoveries can be made in big areas and big areas are what the majors need.

So we've made ourselves very attractive in San Martin, and we had a lot of interest in that project. And we eventually, as I've said, consummated a deal with the Japanese government via JOGMEC only a month or so ago. And we're basically locking and reloading here to create another opportunity. We can explore this in our own right, and let's see what we find. Of course, there's a lot more work to be done, but having a land position in the Andes that's so large and so vast is pretty much unheard of with a tiny company like Hannan amongst some of the world's major companies. And they take the big land positions because they want to make big discoveries, and that's what we want to do too.

Gerardo Del Real: A lot to look forward to, a lot of work to get done. I'll let you get to it. Mike, is there anything else that you'd like to add today?

Michael Hudson: No, I think we've covered everything. Just watch this space, as we say. And we've got three field teams working literally very actively on our joint venture ground that were still operating and still own 100% of. JOGMEC have got to spend US$8 million before they start to earn any interest there, but they're fully funding that project. And then we've got teams on the ground in these new areas also. So yeah, we've got lots of information and news flow coming our way.

Gerardo Del Real: Excellent. Thank you so much, Mike, appreciate the update and congrats again.

Michael Hudson: Thanks, Gerardo.

For the past decade, Gerardo Del Real has worked behind-the-scenes providing research, due diligence and advice to large institutional players, fund managers, newsletter writers and some of the most active high net worth investors in the resource space. Now, he is bringing his extensive experience to the public through Resource Stock Digest, Junior Resource Monthly, and Junior Resource Trader. For more about Gerardo, check out his editor page.

*Follow Gerardo on Twitter.