Mike Fagan's Precious Portfolio: Special Alert No. 9: Tier-3 Portfolio Addition

Alert No. 9

January 19, 2021

Special Alert: Tier-3 Portfolio Addition

Dear Precious Portfolio subscriber,

In today’s alert, we’re announcing a new portfolio addition from Tier-3 (Juniors) — Chakana Copper Corp.

Chakana provides speculators with exposure to copper, gold, and silver in what’s shaping up to be a rising market for all three metals in 2021.

Precious Portfolio Alert #9:

Tier-3: Chakana Copper Corp. (OTC: CHKKF)(TSX-V: PERU)

Tier-3: Chakana Copper Corp. (OTC: CHKKF)(TSX-V: PERU)

Canadian-based Chakana Copper Corporation is a minerals exploration company focused on advancing the Soledad copper-gold-silver project near Aija, in the Ancash region of the highly-prolific Miocene mineral belt of Peru.

Chakana’s 100%-owned, 7,400-acre Soledad Project – which is situated in central-Peru approximately 260 km north-northwest of Lima and 35 km south of Barrick’s Pierina Mine – boasts a rich copper-gold-silver commodity mix.

Timing is deemed excellent with gold currently above $1,835 an ounce, copper above $3.60 per pound, and silver north of $25 an ounce.

Considered an advanced exploration-stage project, the Chakana team has put in some 30,000 meters of drilling at Soledad and is currently wrapping up its fully-permitted 15,000-meter drill program focused on newly-identified targets across 3 primary mineralized zones.

Mineralization associated with the project is copper-gold-silver bearing tourmaline breccia pipes — many of which crop out at surface and increase in size with depth.

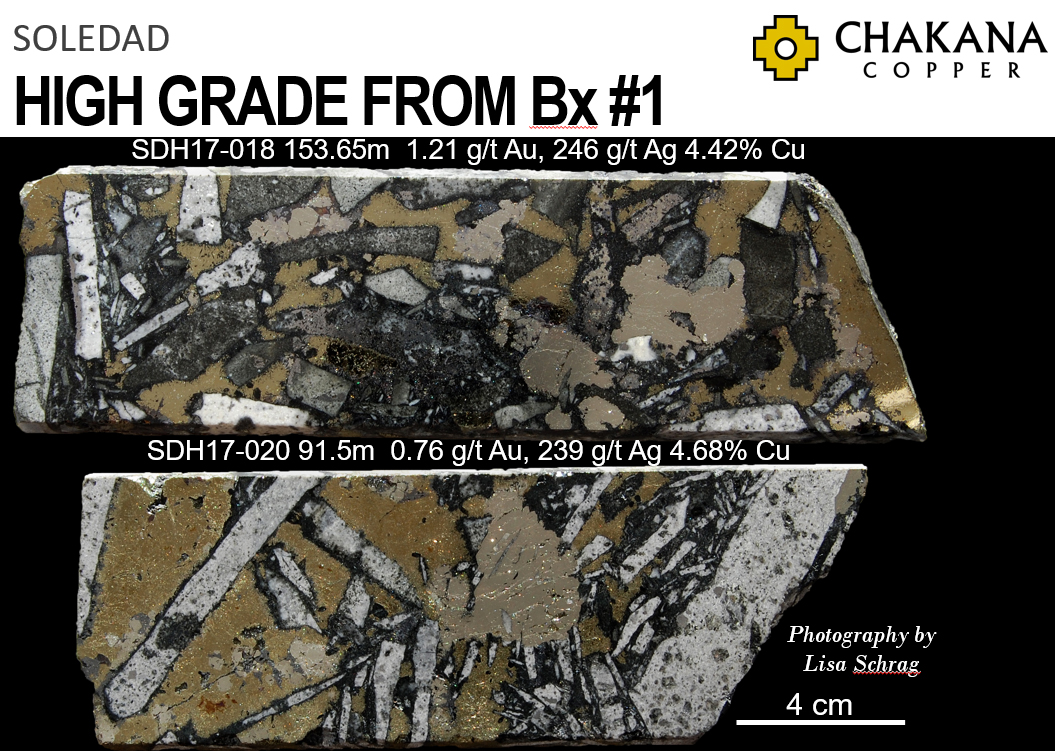

You can get a feel for the complex mineralization at Soledad as displayed by drill core from Breccia Pipe #1 (below).

And that’s not the only example of stunning drill core from the project. The company continues to do an excellent job familiarizing shareholders with the progress and results of its current Phase-3 drill program, including numerous drill core images, in its press releases.

Phase-3 Drill Program

As part of the current Phase-3, 15,000-meter drill program, Chakana is focusing on 3 primary targets: Paloma East, Paloma West, and Huancarama.

At Paloma East, assays from 4 holes produced the following highlight:

- 226 meters of 0.34 grams per tonne (g/t) gold, 0.36% copper, and 16.9 g/t silver (1.11 g/t gold equivalent) from 3 meters; including 15 meters of 2.26 g/t gold and 16.6 g/t silver from 21 metres

At Paloma West, recent assays from 4 holes produced the following highlight:

- 12.2 meters of 5.76 g/t gold, 2.98% copper, and 252 g/t silver (13.61 g/t gold equivalent) from 21.6 meters.

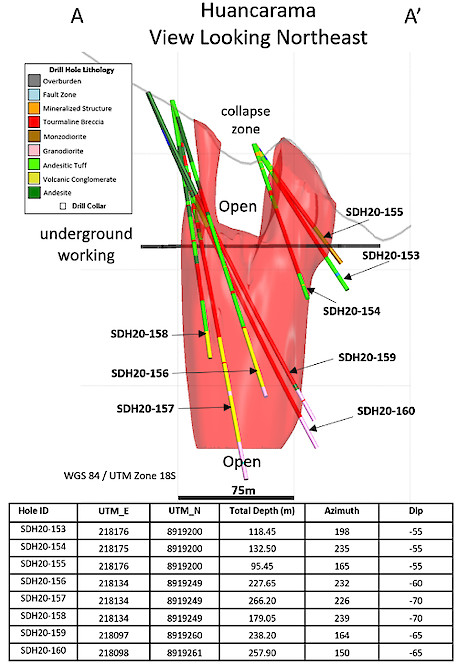

And, most recently, at Huancarama – where Chakana is targeting 5 primary breccia pipes – assays from the initial 8 holes drilled produced the following highlights:

Chakana CEO, David Kelley – an economic geologist and exploration geochemist with more than 25 years of international exploration experience – commented on the results from the Huancarama target via press release, stating:

“Results from the initial scout drilling on the eastern half of the Huancarama Breccia Complex have confirmed a large, mineralized breccia with approximate dimensions of 100m by 50m. Holes SDH20-159 and SDH20-160 are particularly important as they demonstrate long runs of continuous mineralization with some impressive zones of high-grade encountered in SDH20-160. The breccia remains open at depth and the western half of the breccia complex is currently untested. The near surface mineralization encountered thus far may have bulk mineable potential. We are continuing additional scout drilling at Huancarama to further expand the area of mineralization, and we look forward to reporting additional drill results in the near future.”

In total, Chakana Copper has completed 35,553 meters of drilling at Soledad testing 10 of 23 confirmed breccia pipes with more than 92 total targets identified.

With only about a third of the 11.5 sq mi property significantly drill-tested – and with several additional highly-altered surface outcrops identified – the potential exists for a much larger discovery at Soledad by way of the drill bit.

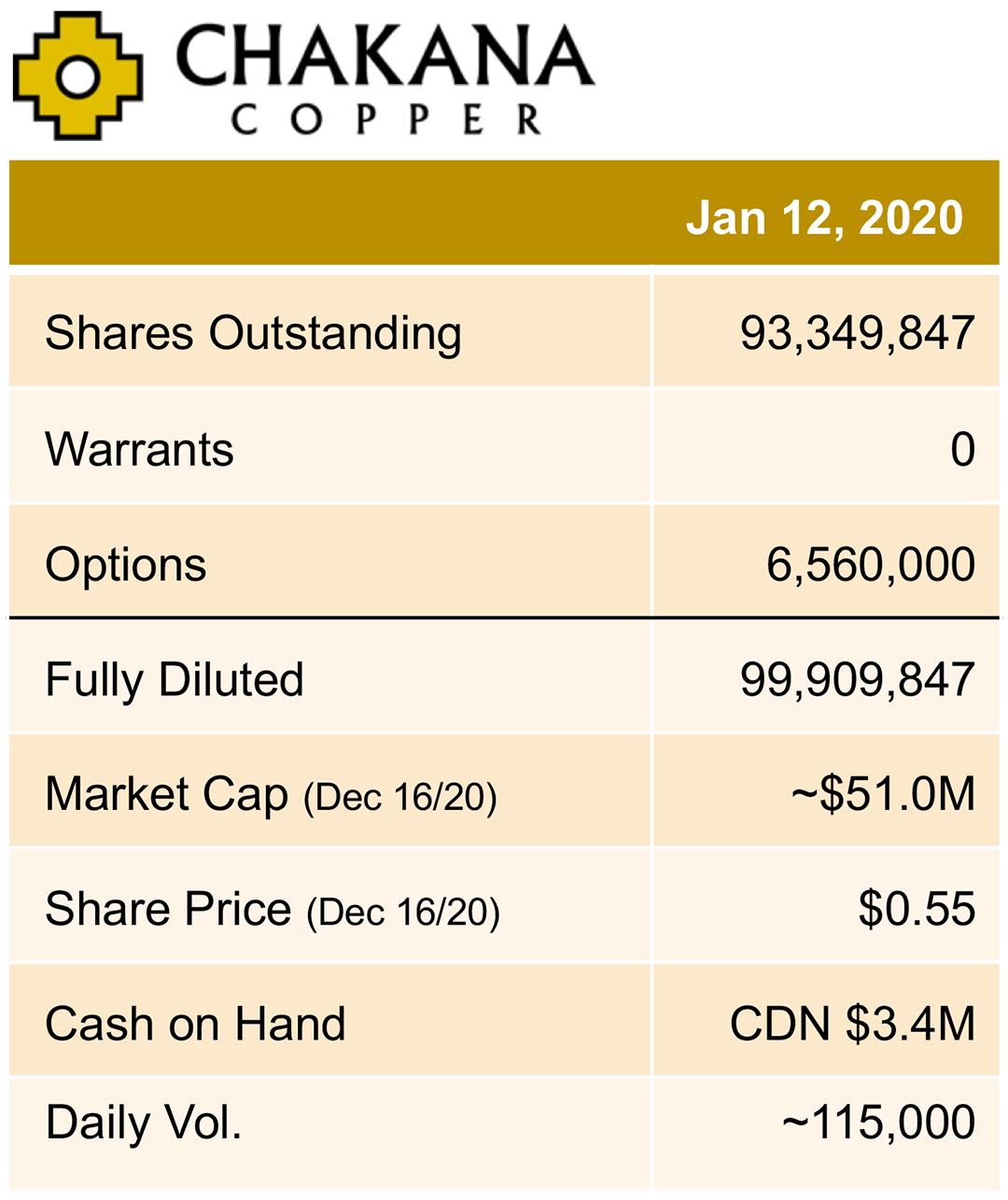

Chakana Copper has approximately 93.3 million shares outstanding for a current market cap of C$54 million.

The current exploration plan for 2021 includes additional drilling at Soledad with a focus on adding tonnage to contribute to the forthcoming maiden resource estimate. A broader aim exists to develop the resource to around the 10 million tonne mark where it could become an attractive gold-copper-silver asset to a larger producer in the current metals cycle.

Current price: US$0.45 per CHKKF share: Buy up to US$0.47

Establish your Chakana Copper (OTC: CHKKF)(TSX-V: PERU) position incrementally and look for opportunities to buy additional shares on weakness. Learn more about Chakana Copper Corporation at www.ChakanaCopper.com.

Yours In Profits,

Mike Fagan

Editor, Precious Portfolio

Mike Fagan has mining in his blood. As a teenager he staked countless gold and silver properties in Nevada alongside his dad Brian Fagan, who created the Prospect Generator model that’s still widely used today in the resource space. One of those staking projects was put into production by a major Canadian mining company — a truly rare and profitable experience. That background uniquely qualifies him as a mining stock speculator. One of the most well-known names in the business, Mike is now putting that experience to use for the benefit of Resource Stock Digest, Hard Asset Digest, and Mike Fagan's Precious Portfolio readers.

Previous Alerts

Alert No. 1 | Alert No. 2 | Alert No. 3 | Alert No. 4 | Alert No. 5 |

Alert No. 6 | Alert No. 7 | Alert No. 8