Mike Fagan's Precious Portfolio: Special Alert No. 7: Tier-1 Gold Coins & Bullion

Alert No. 7

December 22, 2020

Special Alert: Tier-1 Gold Coins & Bullion

Dear Precious Portfolio subscriber,

In today’s alert, I’m providing you with a sneak peak at my exclusive interview with Van Simmons — partner and president of David Hall Rare Coins and one of the most highly-regarded and sought-after coin dealers in America.

As cofounder of the PCGS (Professional Coin Grading Service) — Van has almost single-handedly revolutionized the way coins are graded around the world.

Van is one of our 5 Investing Legends. And while each specializes in a different area of the resource market — they ALL agree on one thing: Physical gold should be included in every well-balanced investment portfolio.

As a valued subscriber, you’ve been getting to know our experts for months… and by now you’re well aware of how they feel about the booming gold market we’re just now entering. In other words, the timing could not be better to consider adding some physical gold to Tier-1.

I’ve been lucky enough to call Van a colleague and a friend… and he has guided me every step of the way in my ongoing education into the world of numismatics. His knowledge of coins and bullion – and really all-things collectible – is truly unequaled in the industry.

I encourage you to reach out to Van to… at a very minimum… pick his brain about the numerous “safe-haven” advantages of owning physical gold. One call to Van and you’ll understand why many of his clients have been with him for more than 30 years.

So without further ado, here is a sneak preview… and be sure to keep an eye out for the full interview in this month’s issue of Hard Asset Digest.

Mike Fagan: Van, you and I have spoken before about the important differences between newly-minted coins versus old circulated coins; those that were struck prior to 1933.

For those in my audience who may be relatively new to numismatics — would you mind going over some of those key differences?

Van Simmons: Mike, a lot of people will think about buying gold, and the first thing they’ll do is call and want to buy gold bars. Well, almost nobody deals in gold bars anymore. They do, but it's not a desirable product.

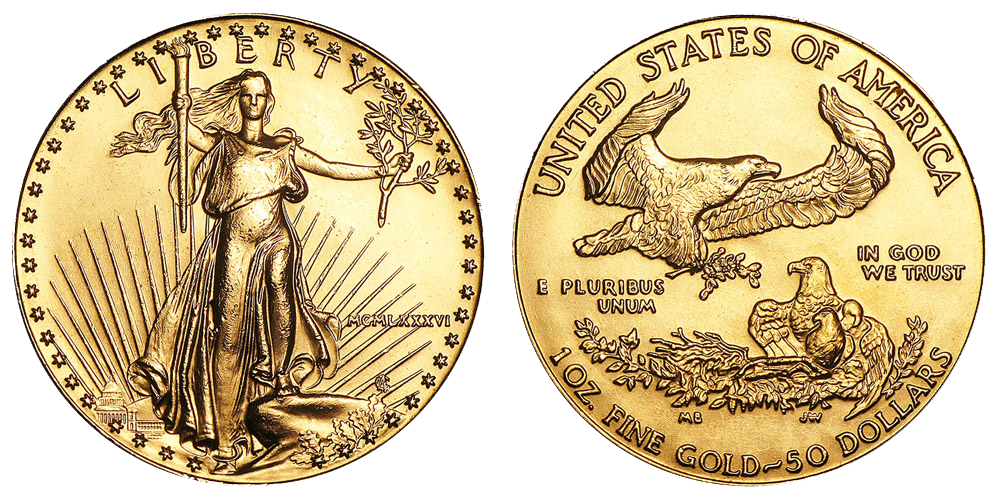

And in the late-1970s, you had people buying Krugerrands; in the early-1980s, you had people buying Maple Leafs; in the mid-80s, you had people buying the US Gold Eagle as they came out in 1986.

All during that time, the old pre-1933 $20 gold pieces were trading at 75% to 125% over the spot price of gold, which is what they always have done. In the last few years, there's been so much supply of them coming on the market that the premium has come down to where you can now buy an old $20 gold piece for about the same percentage over the spot price of gold as you can a Gold Eagle.

I mean, some days it's the same price; other days it's $5 less or perhaps $20 more… but it gives you an advantage for several reasons.

First, it works almost as an arbitrage because if you bought Gold Eagles and gold stays at $1,850 an ounce — then, ten years from now, you have that same $1,850 an ounce. Now, if you buy the old $20 gold pieces and they’re $1,850 a coin, you have the potential for that premium coming back.

And the premium doesn't have to come all the way back to 100% over spot. I mean, if it just comes back to 25% or 50% over spot, it’s a major hit over owning the Gold Eagles.

So owning the Gold Eagles at this point, to me, doesn't make a lot of sense. If you were my brother, I'd tell you to sell your Gold Eagles and buy the old $20 gold pieces. It may cost you $20 a coin or something — but it's a wise trade in my mind.

The other advantage is, when they outlawed gold in 1933, the government classified the old $10 and $20 gold pieces and things like that as collector coins, and they were never confiscated. Roosevelt was a big coin and stamp collector, and the public didn't realize it and ended up turning in most of the $20 gold pieces and $10 gold pieces and stuff like that.

Franklin D. Roosevelt

The case law on the books shows that these older coins would indeed be upheld as collectibles. Jim Rickards, in his book Currency Wars, has talked about our government putting a windfall profits tax on gold bullion of 98% or 99% at some point.

If that ever happened, these would probably bypass all of that because they're classified more as a collector coin as opposed to a bullion coin.

Mike Fagan: I like that! You get the inherent protections… PLUS you get the upside of the collectability of the coin, the rarity of it, above and beyond the actual gold content value.

Van Simmons: Right! To me, it’s almost the easiest no-brainer trade in the marketplace right now. And I don't mean to be cavalier about it. But I've been doing this full-time for over 40 years, and I was a collector for 10 or 15 years before that.

It’s like seeing a beautiful property on a beach and understanding the value there.

Feel free to reach out to Van by email at van@davidhall.com or give him a call at 800-759-7575 (M-F 8AM-5PM Pacific).

Upcoming…

In our next bi-weekly alert, we’ll be adding an additional 1 to 2 stocks to our Precious Portfolio; we are currently reviewing a number of small-cap, mid-tier, and large-cap resource stocks that meet our criteria.

Yours In Profits,

Mike Fagan

Editor, Precious Portfolio

Mike Fagan has mining in his blood. As a teenager he staked countless gold and silver properties in Nevada alongside his dad Brian Fagan, who created the Prospect Generator model that’s still widely used today in the resource space. One of those staking projects was put into production by a major Canadian mining company — a truly rare and profitable experience. That background uniquely qualifies him as a mining stock speculator. One of the most well-known names in the business, Mike is now putting that experience to use for the benefit of Resource Stock Digest, Hard Asset Digest, and Mike Fagan's Precious Portfolio readers.

Previous Alerts

Alert No. 1 | Alert No. 2 | Alert No. 3 | Alert No. 4 | Alert No. 5 | Alert No. 6