Categories:

General Market Commentary

/

Precious Metals

Topics:

General Market Commentary

/

General Precious Metals

The Benefit of Investing via Private Placements

Earlier this week, I sent you an interview with Revival Gold (TSX-V: RVG)(OTC: RVLGF) CEO Hugh Agro.

The interview was about a resource update that would soon take the company to nearly three million ounces of gold in the safe mining jurisdiction of Idaho.

As it happens, that resource update came out later that day.

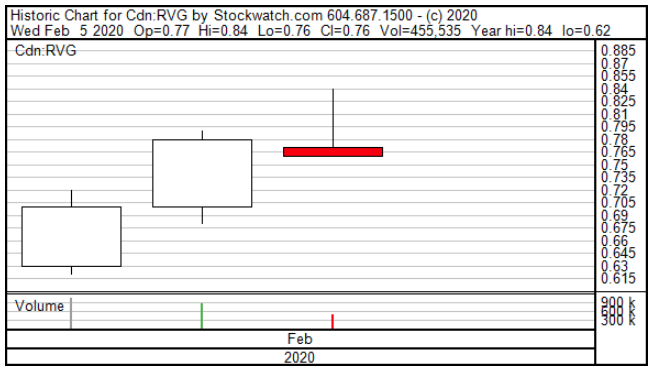

Here’s what shares have done since:

They’ve gone up more than 35% in three days to trade at C$0.84 on strong volume.

That’s a new 52-week high for the stock.

So anyone who bought Revival Gold in the past year is up. And that includes many Outsider Club premium members.

But some made more than others.

We have different levels of service around here based on risk appetite, investment goals, and themes. The very highest tier — called Nick’s Notebook — offers access to private placements to high-net-worth and/or accredited investors.

In this case, members of Nick’s Notebook and I were able to invest privately in Revival Gold at C$0.30. So when shares went to C$0.84 this week, we were sitting on a 180% gain.

And not only that. One reason — among many — that private placements are so lucrative is that they also often come with warrants. A warrant allows you to buy more stock in the future at a certain price with no downside risk!

When we got C$0.30 shares in Revival… we also got C$0.45 warrants, which we then converted to shares. Those shares are up 86% as of this week.

This is how the rich get richer. This is how I got rich. This is how I’ve made people rich and/or richer.

They don’t all work out like this, of course. That’s okay. You have no downside risk with the warrant. So when they do work out… you can use your warrant to compound the gains.

Click here to continue reading...

Click here to see more from Revival Gold Inc.