Categories:

General Market Commentary

/

Precious Metals

Topics:

General Market Commentary

/

General Precious Metals

Six Reasons to Own Gold Equities Now

In November 2019, we offered Five Reasons Why Gold Stocks Make Sense. Six months have passed and gold miners have climbed steadily, following the positive path we predicted.

Through April 30, 2020, gold mining stocks were up 11.01% year-to-date (YTD) and 57.87% over the 12-month period (YOY).1 This compares to -12.36% YTD and -7.91% YOY returns for the S&P 500 Index.2 In our view, gold mining equities still have a great deal of upside to offer, given that historically gold stocks tend to outperform the metal during gold bull markets (2-3x).

We believe that we are still in the early stages of the current gold bull market which began in May 2019. Rising demand for gold and higher gold prices are followed by strong gold mining stock performance.

Here are Sprott's six reasons why investing in gold equities may make sense right now.

REASON #1. Gold Equities are on the Move, Under the Radar

Gold mining equities, despite their recent outperformance, are being ignored by most investors. This creates a value opportunity. My colleague John Hathaway, Senior Portfolio Manager, summed up this dilemma best in his recent interview with Jim Grant:

"As for gold-mining shares, John Hathaway, co-portfolio manager of the $1 billion-plus Sprott Gold Equity Fund, reports that interest is exactly nil. The Sprott bullion business is jumping, but not the mining-stock investment business....gold shares, in relation to bullion, are the cheapest they've been in his 20 years in the business: 'What astonishes me — I'm an old value investor — is that so many companies are generating free cash flow, and it is not hard to find companies with free cash flow yields of 10% or better.'"

REASON #2. Gold Stocks are Severely Undervalued

Gold bullion has delivered strong performance in 2020 and was up 11.15% YTD through April 30, 2020, and 31.39% YOY.3 At the same time, as mentioned above, gold mining stocks have risen 11.01% YTD and 57.87% YOY.1

Gold broke through significant resistance in 2019, and in 2020, gold pushed above $1,700 in April (Figure 1). Global political and macroeconomic trends ignited this first stage of the gold rally with the economic fallout of COVID-19 acting as an accelerant.

Figure 1. Gold Bullion and Gold Stocks: A Close Relationship

Source: Bloomberg as of 5/20/2020.

According to the latest research from World Gold Council (WGC), the growth in gold exchange traded funds (ETFs) helped drive global demand for the yellow metal in the first quarter, as the world economy was crushed by the COVID-19 health crisis. Global gold-backed ETFs added 298 tonnes and net inflows of US$23 billion in Q1 2020 — the highest quarterly amount ever in absolute U.S. dollar terms and the largest tonnage additions since 2006.

Figure 2. Gold-Backed ETFs Reach Record Levels

Source: World Gold Council. Data as of 3/31/2020.

REASON #3. Gold Equities are Historically Inexpensive

Price movements for physical gold and gold-mining stocks are not entirely in sync, but the relationship between them is strong and persistent, across economic cycles.

Historically, rising (and falling) gold prices have a two- to three-times multiplier effect on gold stocks: If the value of gold bullion increases by 10%, mining stocks tend to increase by 20-30%, and vice versa. The reason: Miners have significant fixed operating costs and high operating leverage, meaning big swings in physical gold prices have a larger impact on miners' profitability.

This relationship cuts both ways, which we saw after physical gold prices peaked in late 2011. As the value of gold subsequently declined, the value of gold stocks plummeted even more. Between 2011 and 2018, gold miners posted negative returns in six out of eight calendar years. Even with recent gains, gold mining stocks still have a long way to go to return to historical valuations. Figure 3 shows that since 2008 the relative valuation of gold equities to gold bullion has fallen 73% from the prior 25-year average, from 0.2497x to 0.0674x. The green line indicates the current gap and the potential outperformance of gold equities should they revert to the historical mean.

Figure 3. Gold Mining Equities are Undervalued Relative to Bullion

The ratio of XAU Index to Spot Gold (12/23/1983-4/30/2020)

Data as of 4/30/2020. Source: Bloomberg. 12/23/1983 represents the inception of the XAU.

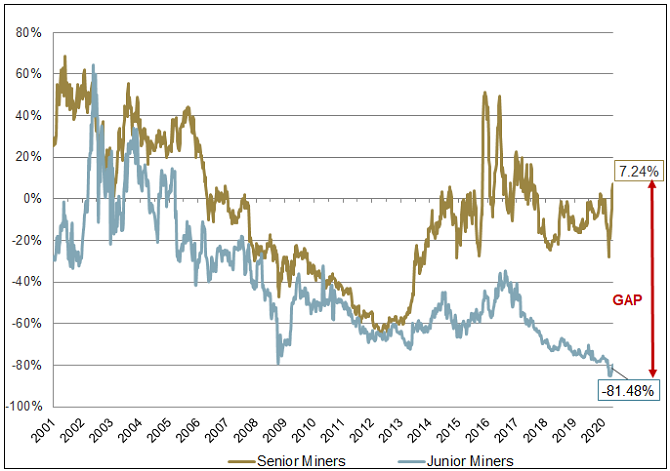

While miners as a group still trade below their net asset values, the discounts of smaller, "junior" miners are especially extreme, as much of the recent rally has been driven by the largest, "senior" gold miners. The valuation gap between North American junior and senior gold miners is the widest it has ever been (Figure 4.)

Figure 4. Junior Miners are Trading at an 81% Discount

Senior miners are currently trading at a ~7% premium to their underlying net asset values (NAVs), while junior miners are trading at an ~81% discount.

Source: BMO Capital Markets, FactSet. North American senior vs. junior gold miners. As of 4/30/2020.

REASON #4. Supplies are Limited: You Can't Print Gold

Most investors grasp the importance of investing in companies whose business models are protected by "competitive moats." Gold miners have this in spades, as it can take 15 years from the discovery of a new gold mine to successful ore production. The barriers to entry are enormous for newcomers in this sector, given the need for expensive and specialized equipment, environmental approvals and political considerations.