Categories:

Base Metals

/

General Market Commentary

/

Precious Metals

Topics:

General Base Metals

/

General Market Commentary

/

General Precious Metals

Kutcho Copper, supported by Wheaton, releases excellent metallurgical update on the Esso Zone

If there’s one company that doesn’t really deserve to see its share price crater, it probably is Kutcho Copper (KC.V) as the company continues to work on its namesake Kutcho Copper project to provide more data to its consultants for the upcoming feasibility study on the project.

This week, Kutcho released a fresh batch of metallurgical test results on the Esso zone of the Kutcho Copper project, the zone which will be mined and processed halfway the mine life in combination with the mill feed coming from the main zone.

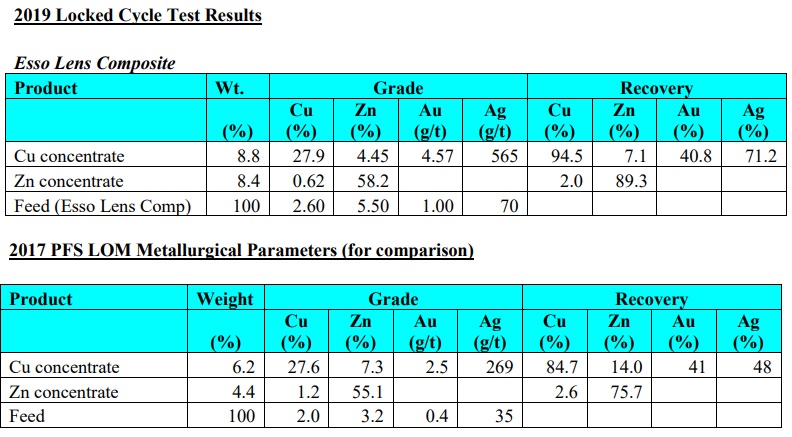

The final results of the 2019 test work are substantially better than the assumptions used in the pre-feasibility study in 2017. Whereas the zinc and copper recovery rates were just 75.7% and 84.7% in the 2017 assumptions, the new results indicate a substantial recovery boost to 89.3% for the zinc and 94.5% for the copper. The added bonus is that more of the zinc actually ends up in the zinc concentrate (instead of in the copper concentrate) which means Kutcho will see a bump in its total payability of the zinc metal.

The quality of the concentrates remained unchanged for the copper con (27.9% versus 27.6%) but there’s more gold and silver in the copper concentrate which will increase the value per tonne of concentrate and reduce the smelting and transportation expenses). The average grade of the zinc concentrate increased from 55.1% to 58.2% which means the zinc concentrate could actually command a premium price now thanks to the higher grade (although this will depend n how the (low) copper percentage will be penalized by the smelters.

The bottom line of Kutcho’s update is pretty simple. This is a good update and seeing the recovery rates increase by 10-15% will be an important driver of the economics as the Esso zone will produce 10-15% more metal at an unchanged operating cost per tonne of rock.

Click here to continue reading...

Click here to see more from Kutcho Copper Corp.