Categories:

Energy

/

General Market Commentary

Topics:

General Energy

/

General Market Commentary

Is Skyharbour Resources poised to move higher with recent rise in uranium price (+22%) ?

Skyharbour Resources (TSX-V: SYH) / (OTCQB: SYHBF) is in a strong position to benefit from a rebound happening right now (finally!) in uranium prices. The Management team, Board & technical advisors are world-class, especially for a company with a market cap of C$ 9.8 M = US$ 7.0 M. {see April presentation pages 4-6}.

For years pundits have been saying that a recovery in the uranium price was 3 to 12 months away. They have been wrong. For the first time in two years there’s been a noteworthy bounce in the spot price.

Spot uranium price up 22% in past five weeks…

The uranium market has relatively sticky demand as producers are required to deliver material into long-term contracts. By contrast, supply is highly concentrated in a handful of mines & jurisdictions. In the past five weeks, the spot price is up 22% to $29.10/lb. from $23.85/lb. {investing.com}. That’s a 4-yr. high.

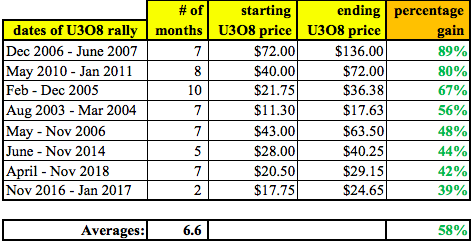

As can be seen in the chart below, the eight largest upward moves in spot prices range from 39% to 89%, with an average of 58%. These spikes took place over an average of 6.6 months. Two important things to consider; first this data reflects historical spot prices, not long-term contract prices.

Second, the current 22% bounce is only in month two of its ascent. If history is a guide, there could be further upside well into the Summer or even Fall. Having said that, there’s no certainty that the price will continue rising.

If we are at the beginning of a significant move higher, the price could move north of $35/lb. An “average” breakout move of 58% would bring the spot price to ~$38/lb. Even more important is what might happen to the long-term contract price.

Skyharbour could outperform giants like Cameco & NexGen

Over the past 51 months, the average premium paid above spot for long-term contracts has been ~36% {Cameco website}. That implies a contract price of $52/lb., {36% above the $38/lb. figure}. Is this too aggressive? Not necessarily, a majority of uranium producers have no interest in locking in long-term deals under $45/lb.

The current premium is 12%. Could we see a $45/lb. or $50/lb. contract awarded this year? A move to $45/lb. would likely generate a lot of excitement. We haven’t seen that level since June 2015.

Although there’s been a modest rebound in uranium stocks, I strongly believe that an increase in the contract price from the current $32.5/lb. to $45/lb. (or more) would spark another, possibly larger, move for the sector. It’s worth noting that historically the spot price traded above $70/lb. from December 2006 to March 2008 and hit a monthly high of $136/lb. in June 2007.

I find it interesting that industry leaders Cameco, Denison Mines, NexGen Energy, Fission Uranium & Uranium Energy are up more from their lows (+86%) than Skyharbour. Higher risk, smaller market cap juniors are poised to have outsized gains if the uranium price continues to climb.

Good things are happening for Skyharbour….

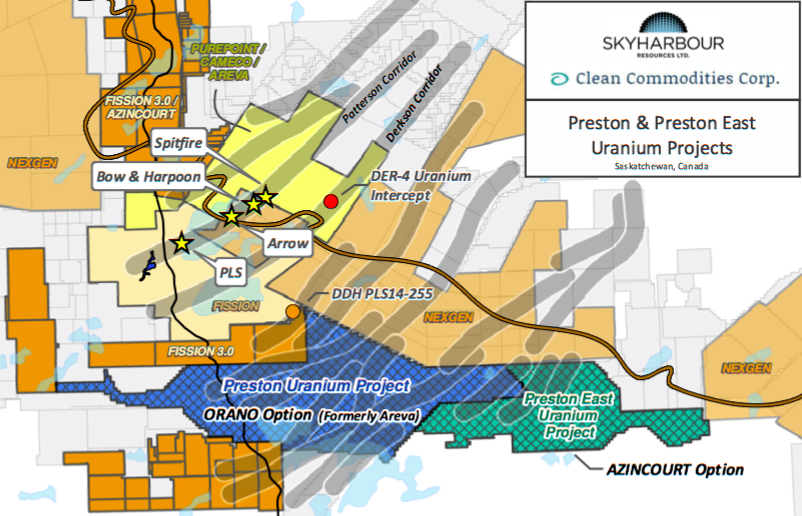

CEO Jordan Trimble and his team have prudently assembled a basket of six properties in the eastern half of the world famous Athabasca uranium basin. The portfolio covers > 250,000 hectares and contains wholly-owned assets as well as farmed-out properties. Three projects are being actively explored, but management is only funding exploration at its 100%-owned Moore Uranium project.

On March 9th, option partner Orano Canada Inc. commenced its exploration programs at the Preston Uranium project located near NexGen’s high-grade Arrow deposit and Fission Uranium’s Triple R project. Orano can earn up to 70% of a 49,635-hectare central portion of the Preston Uranium project for C$8 million over six years. Skyharbour owns 50% of the Preston project. Orano is currently about half way through the C$8 million earn in.

On February 13th, Skyharbourannounced the start of, and is now wrapping up, a 2020 winter diamond drill program at its flagship, 100%-owned, 35,705-hectare Moore Uranium project. This project is ~15 km east of Denison Mines’ Wheeler River. Management announced plans for 2,500 m of drilling in 6 to 9 holes to follow up on last year’s exploration successes.

An option to acquire the Moore project was obtained from Denison in June 2016. Twelve contiguous claims total a sizable 35,705 hectares (~88,230 acres) located just east of the midpoint between the Key Lake mine & mill complex and Cameco’s McArthur River mine. The Project has seen extensive historical exploration, including roughly $50 million of inflation-adjusted exploration expenditures. More than 140,000 meters have been drilled in > 380 holes.

100%-owned Moore project has seen a lot of drilling

Unconformity style uranium mineralization was discovered on the Moore property at the Maverick Zone in April 2001. Historical drill results include 4.0% eU3O8 over 10m incl. 20% eU3O8 over 1.4m. In 2017, Skyharbour announced select assays of 6.0% U3O8 over 5.9m incl. 20.8% U3O8 over 1.5m at a vertical depth of ~265m.

Click here to continue reading...

Click here to see more from Skyharbour Resources Ltd.