Categories:

General Market Commentary

/

Precious Metals

Topics:

General Market Commentary

/

General Precious Metals

Gold Spreads Blow Out Again as Traders Withdraw in Fear

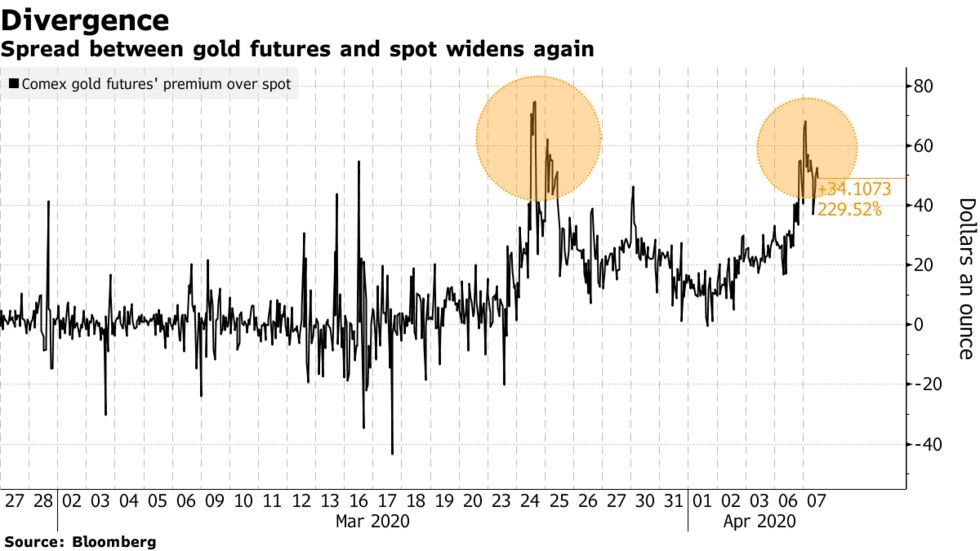

The telltale signs of dislocation are showing up in the gold market again.

Gold traded in New York and London -- two markets that used to move in lockstep before the coronavirus crisis -- have diverged.

An ounce of gold sold on the Comex was about $50 more expensive than in London on Tuesday. In normal times, the difference would be a few dollars.

The same thing happened two weeks ago, when traders panicked that logistical disruptions and flight cancelations would create a shortage of gold bars in New York. This time, the reasons are different. There’s plenty bullion available, but traders say there’s still too much risk and they’d rather stay away.

“You have a bunch of shell-shocked market makers who are literally hiding under their desks and do not and possibly can not make markets in any size, shape or form,” said David Govett, head of precious metals trading at Marex Spectron. “Hence we have the lack of liquidity, the small volumes and the wide spreads.”

Spot gold was $1,654 an ounce as of 1:05 p.m. in London, compared with futures at $1,703 in New York.