Categories:

General Market Commentary

/

Precious Metals

Topics:

General Market Commentary

/

General Precious Metals

Gold Set for Biggest Gain in a Month on Fed View, Virus Concerns

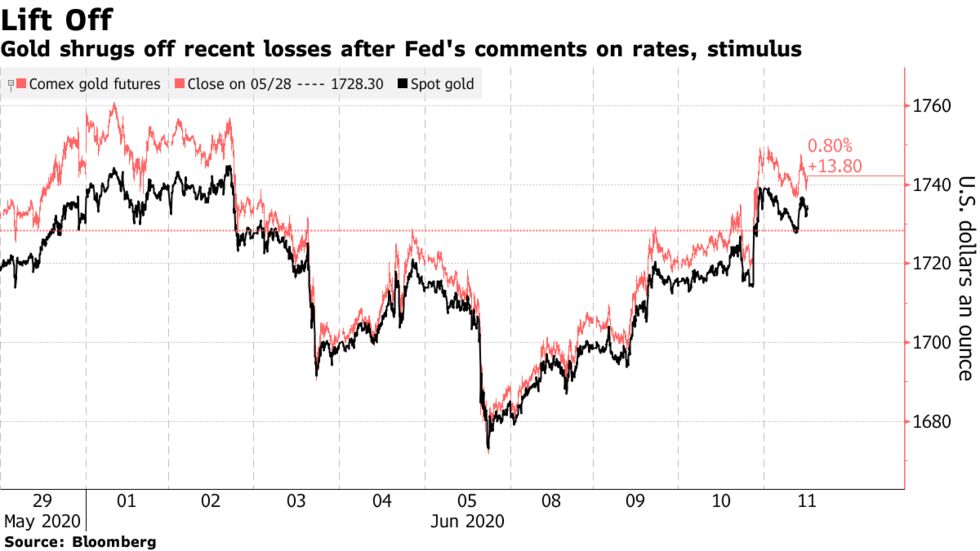

Gold futures headed for the biggest gain in more than a month after the Federal Reserve vowed to hold interest rates lower for longer and investors tracked signs of a resurgence in infections in some U.S. states.

The haven pushed higher after Chairman Jerome Powell said Wednesday the Fed is committed to “do whatever we can, for as long as it takes” to help the economy mend from the coronavirus pandemic. Almost all officials forecast keeping rates near zero through 2022, and the central bank also said it will at least maintain the current rate of bond purchases.

“You almost couldn’t come up with a better script for a strong fundamental environment for gold than what we saw from the Fed yesterday,” Matt Weller, global head of market research at Gain Capital Group LLC, said by phone. “It’s really an environment of rampant monetary stimulus, and historically that’s exactly the type of environment in which gold has thrived.”

Comex gold futures for August delivery rose 1.8% to $1,752.10 an ounce at 10:46 a.m. in New York. A close at the price would mark the biggest gain since May 7.

Holdings in exchanged-traded funds backed by gold advanced for the first time in five sessions on Wednesday.

The metal is also getting support as alarm grows over the possibility of a second wave of coronavirus cases in the U.S. Localized surges of new infections in states including Texas, Florida and California have raised concern among health experts even as the nation’s overall case count early this week rose just under 1%, the smallest increase since March.

“Gold prices are going to steadily climb higher as we see more political headlines, unrest and Covid-19 headlines,” George Gero, a managing director at RBC Wealth Management, said by phone.