Hard Asset Digest December 2019

Hard Asset Digest

December 2019

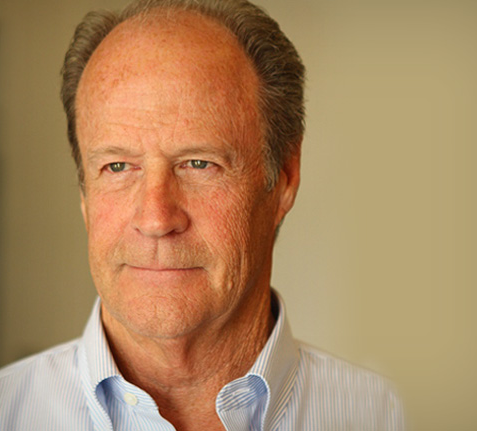

This month, I have the distinct pleasure of bringing you my exclusive interview with Mr. Van Simmons, partner and president of David Hall Rare Coins — one of the largest and most respected rare coin companies in the country.

Van is held in the highest regard by his clientele, many of whom have been with him for 30-plus years. He is respected by his peers for both his knowledge and his reputation for integrity. Van specializes in portfolio construction, set building, and helping clients acquire the world's finest rare coins and collectibles.

Van Simmons, Partner & President

David Hall Rare Coins

Van has been a rare coin collector since age twelve and a rare coin dealer since 1979. As one of the founders of the Professional Coin Grading Service (PCGS) – the largest rare coin grading service in the world – he has helped revolutionize the rare coin market. Van has over 1,400 dealers that sell his product, and PCGS has graded and certified more than 35 million coins over the last 34 years.

Van has also won acclaim as a collectibles dealer in sports cards and memorabilia, rare firearms, western memorabilia, and collectible knives. Van is a co-founder and sat on the board of directors of Collectors Universe (NASDAQ: CLCT) from 1999 to 2018. In addition to PCGS, Collectors Universe owns a number of companies including Professional Sports Authority (PSA) which grades and authenticates sports cards and currently has over 1,200 authorized dealers within its network.

Even with this wide range of interests, Van’s number one collecting passion remains rare coins. His fascination with the beauty, rarity, and historical significance of coins continues to be his lifelong pursuit.

I could go on and on, but hopefully you get the picture. The bottom line is… there’s no one in the rare coin and collectibles universe I trust more than Van Simmons. Before we get to my exclusive interview… let’s take a quick look at the rare coin and collectibles market… which truly is a market for everyone!

How to use World Class Collectibles for Wealth Maintenance, Transfer, and Creation

In today’s ultra-low interest rate, financially turbulent, and privacy deprived world… top quality, rare and important collectibles offer a way to maintain, store, and transfer real wealth on a long-term basis.

Most people don’t realize the true size and significance of these markets. Collectibles are a multi-billion-dollar arena, and many collectibles are six-figure and even seven-figure items.

The record auction price for a rare coin is $10,016,875 for a nearly perfect 1794 silver dollar. The record price for a stamp is $9.5 million for the unique 1856 British Guiana one-cent magenta. A Tiffany “Pond Lily” lamp sold for $3,372,500. Even rock and roll records, movie posters, comic books, and baseball cards can bring serious money for the best items.

Check out these incredible auctions:

-

1931 Dracula movie poster: $525,800

-

1967 Sgt. Pepper’s album signed by all four Beatles: $290,500

-

1939 Detective #27 comic book (1st Batman): $1,075,500

-

1952 Topps Mickey Mantle baseball card: $2,880,000

-

1947 Jackie Robinson baseball uniform: $2,050,000

-

David Gilmour’s (Pink Floyd) “Black-Strat” guitar sold for $3,975,000!

David Gilmour’s Black-Strat sold for $3,975,000

at Christie’s in New York on June 20, 2019

Of course, paintings and art pieces by the masters (when they’re not being stolen) regularly sell for many millions of dollars… even sometimes in excess of $100,000,000.

The Wealth Surprise!

The good news is… you don’t have to be a millionaire to participate in and benefit from the collectibles market. There are numerous high-demand rare coins and other collectibles you can buy for $5,000 to $20,000 and even many for $1,000 to $2,000.

Here’s a story (a true story) that illustrates the dramatic wealth creation, maintenance, and transfer possibilities for significant collectibles…in this case for rare coins.

For many years, Van Simmons’ business partner, David Hall, held a “Meet the Expert” session three times a year at the important Long Beach Coin show. At these sessions, people would wait in line to show David their coins and get his opinion.

At one such session a couple of years ago, a woman came up to David and said, “My father bought this coin in the 1970’s and I think he paid $20,000 for it.”

David took one look at the coin, then looked at the woman and said, “Lucky girl!”

The coin happened to be a gem-quality 1879 $4 “Stella” gold piece, one of the numismatic market’s most famous rarities. It was soon graded PR67DCAM by PCGS (of which Van Simmons is a co-founder) and subsequently sold at auction for $425,000!

1879 $4 “Stella” Gold Piece

So, as to wealth creation and maintenance, a coin that sold in the 1970’s for $20,000 was worth $425,000 in 2017.

In terms of wealth transfer, think of your children, grandchildren, or other heirs having a similar wealth surprise. If you want to do something nice for your heirs, consider buying and then saving for them some top quality, rare major market collectibles.

The Long March of Collectibles Profits

Long-term price appreciation can be seen in most major collectibles markets. Let’s look at baseball cards… yes baseball cards! The most important post-war baseball card is the 1952 Topps Mickey Mantle. Five or six years ago, near-mint examples (graded 8 on the 1-to-10 scale) were selling for $40,000 to $50,000.

During the past year, they have been bringing in $400,000 to $450,000 at auction…with multiple sales examples. So, should you buy a 1952 Mantle for $400,000? Maybe, if you really want one.

Yet, how about a choice quality 1909 Ty Cobb for $20,000? Opportunities abound!

Most major collectibles have a great multi-decade track record of significant price appreciation. And they also have great items currently available at relatively reasonable prices.

Naturally, the secret for success is buying the right items at the right price.

How To Be A Smart & Financially Successful Collector

1. Buy What You Like

There are a lot of different collectibles. You should buy what you like. If you buy what interests you, you’ll learn about the collectible, and you’ll be able to make more informed decisions. And besides, it’s OK to have fun while you’re making financial investments!

2. Stick with Major Markets and Major Items

To put it another way, don’t get too esoteric. It doesn’t matter how rare an item is if nobody cares. In collectibles, it’s not just rarity that matters. Demand is also an important issue. So, stick with the major items that people care about and collect.

3. Quality Counts!

In all collectibles, quality is a big issue. The better the condition, the bigger the buyer demand, and the higher the price. You are best served by buying the best quality you can afford. Eye appeal matters! Don’t buy unattractive coins, off-center baseball cards, or Elvis records that somebody wrote their name on.

4. Think Long-Term

Collectibles markets are expertise-driven niche markets. These are not markets where you can “Beat the Dealer.” And unless you’re an expert major dealer, you cannot be a successful short-term trader.

But you do have a distinct advantage over the dealers. You have staying power. You don’t NEED to sell. You can buy great collectibles and hold them to ride the long-term trend. Dealers don’t do that because they’re in the sales business… not the storage business. They buy and sell. You can BUY AND HOLD. THINK LONG TERM!

5. Use Third-Party Grading and Authentication

Quality is a major component of value in the collectibles markets. And, obviously, authenticity is a must. Fortunately, many markets have third-party grading and authentication companies, such as PCGS for rare coins, that can give you an unbiased expert assessment of the quality and authenticity of a collectible.

You don’t want to buy a “Very Fine” item for an “Extremely Fine” price. And you obviously don’t want to buy counterfeits. Counterfeiters are extremely talented, and grading can be subtle and subjective. You really should have an expert opinion before laying down your hard-earned cash.

6. Find an Expert You Can Trust

While third-party grading and authentication can help you make the right purchases, there are additional issues for which you can use expert assistance. Even items that have the same “official” grade can have slight differences… mostly due to eye appeal.

A true expert can guide you and make sure your purchases are the best value possible. And experts can help you find and buy the right item… and for the right price. How do you find the right expert? In my humble opinion, there’s no better place to start than Mr. Van Simmons of David Hall Rare Coins.

7. FOCUS, FOCUS, FOCUS!

As Van often says, “The easiest thing to do in the collectibles market is spend your money!” Yet, all successful collectors have one thing in common… and that’s focus!

Buy with purpose! Simply by sticking to one or two general areas or genres, you’ll have no choice but to make “informed purchases” of important items as your knowledge base and buying and selling experience broadens.

In general, you’ll be best served by adhering to these “5 Do-Not’s”

1. Do not buy items randomly. Remember, focus!

2. Do not buy “raw” items that haven’t been graded and authenticated by an expert third party.

3. Do not buy items from TV sellers; most often these are common, overpriced items.

4. Do not buy second or third editions; it’s the “firsts” that hold real value.

5. Do not focus on bargain hunting; if a price sounds too good to be true, it probably is.

The Rare Coin Advantage

Rare coins are one of the biggest collectibles markets, estimated at $8 billion in sales annually. Rare coins offer a few tremendous advantages over other collectibles. First, rare coins are, by far, the most liquid of all collectibles. It’s really easy to sell rare coins.

Second, the difference between buy and sell prices for rare coins are typically smaller than in any other collectibles genre. Rare coins also have the added bonus of a connection to the gold and silver bullion markets.

Right now, the rare coin market looks extremely positive with prices at cyclical lows and gold and silver bullion starting to get very active.

Have Fun & Make Money!

Hey, who says you can’t have fun investing?! Top quality, truly rare collectibles offer great long-term wealth creation potential, and they can be fun and educational along the way. Remember to take your time. Look and learn before you leap… and find some friends or dealers you can trust. Most importantly… buy something you like.

Van Simmons is a great guy and one of the most knowledgeable and experienced rare coin dealers on the planet. You don’t need to be a millionaire to make his acquaintance and pick his brain.

Please enjoy my exclusive interview with Van.

Yours In Profits,

Mike Fagan, editor

Hard Asset Digest

Interview with Van Simmons

Mike Fagan: Van, thank you so much for joining me today; it’s an absolute pleasure to have you on. Now, Van, you’ve been a rare coin collector since age twelve. I don’t want to age you (laughs!), but would you mind sharing with us how you got involved with rare coins and why coins resonate with you the way they do?

Van Simmons: Absolutely, Mike! You know, when I was a kid, one of my friends handed me a Standing Liberty quarter, and it was all worn out and beat up and everything. But I thought it was so great. I took it to a local coin store where I ended up selling it for forty-five cents...mind you, this was back in the early 1960s. It started making sense to me that these things had real value. Later, I started looking into designs of the Walking Liberty half-dollars and things like that.

1917 Standing Liberty Quarter

Even as a kid, I looked at them and thought, "Man, these are great pieces of art!"

The honest truth is, when President Roosevelt came into office, he wanted the most beautiful coins on earth to be designed for our country. So, starting in 1907, they came up with the $20 St. Gaudens and the $10 Indian and coins like that.

You know, coins are sort of the supreme act of sovereignty sitting there saying, "We are our own free nation, making our own gold and silver coins." The first gold coin struck in the United States was made in 1795… the 1795 Small Eagle $5 gold piece. That's one of the reasons I like them; there’s just so much history attached to them.

1795 Small Eagle $5 Gold Piece

Every US coin design, and every change in those coins, resonates with some change in American policy or something that was going on in the United States. Just a lot of history built into each coin. I like that.

MF: That’s so interesting, Van. It’s cool to see how you got hooked at such an early age. Of course, today, you’re recognized as one of the founders of the Professional Coin Grading Service (PCGS) — the largest coin grading service in the world. How did that come about?

VS: Mike, my business partner and I, David Hall, would have breakfast every so often… and one morning… this was back in the mid-1980s… we were at a local restaurant having bacon and eggs, and I exclaimed to him:

"It's ridiculous. I can buy coins from J.D. and Gordy and a couple of these guys. And when I get them, we agree with the grade of the coins. They're MS-65 or MS-67 or something like that. But most of the coins from other dealers, 95% of them, we have to return back to the dealers because we feel they are over-graded.”

"How can we stop that!"

The next day, David calls and says, "Why don't we start a coin grading service?" I replied, "Well, how do we do that?" He says, "We get all the people we agree with on the grade, and we'll form a grading standard.”

And that's what we did! It took about a year and a half to set up. We had Bruce Amspacher, Gordon Wrubel, John Danreuther, myself, David, and a couple of other guys. We’d meet once or twice a month in different hotel rooms around the country at the various coin shows where we basically set up the standards of what we were going to do.

MF: That's fascinating...you literally became the standard bearer.

VS: Yeah, we basically just said, "Here's the standard," and the industry couldn't argue because you had the top experts in the world saying, "Here's what we call the standard.”

Within thirty days or so, it was almost impossible to sell a coin unless it was graded by us. Pretty soon, prices started going up on coins graded by us; demand was so high that we eventually had a 6-month backlog in the availability of coins. Similarly, if you wanted to get a coin graded by PCGS, it was going to take six or seven months.

MF: That’s an amazing story! And all from an idea hatched while sitting around the breakfast table. Gotta love it!

VS: Yeah, it created quite an upheaval in the coin business at that time. Cash flow issues and everything else you can imagine!

MF: Very, very interesting. Now, Van, you structured and you continue to structure coin portfolios for some of the wealthiest families in the world. Yet, you also help people that are just getting started in the coins and collectibles universe.

I've heard you say several times that from $50 to $50,000,000, you're more than happy to help. How does someone who has never bought a coin… let alone owned a collection… get started?

VS: The easiest way for your readers, I think, is to simply call me; we can have a chat… they can sort of let me know what they're looking for. I just got off the phone with a retired electrician who wanted to start collecting coins and didn't know what exactly to do and wanted to start with $1,000.

Likewise, I have a retired school teacher, a lady from the south, who usually likes to spend $50 to $75 a month on old Buffalo nickels and mercury dimes. Obviously, I can't be everything to everybody, but I am trying to be everything to everybody who's seriously interested in coins and wants to do certain things with them.

If one of your readers is interested in starting a collection of coins, they can call me up and say, "What's the best area to invest in … What's the best value … What's the most fun … What do you think is the most under-priced?"

I have a lot of people who call me and say, "I only want gold coins," or, "I love silver dollars; I only want silver dollars." People have different tastes. It's more along the lines of what you're trying to accomplish.

A lot of my clients are building collections to pass from one generation to the next. A lot of people, with our confiscatory tax system that we're in right now… and getting worse by the way… are looking to place money into things that they can just hand to their children or grandchildren.

MF: So, different strokes for different folks!

VS: Exactly. Did that sort of answer your question (laughs!)?

MF: Absolutely, Van… that answers it perfectly! With that being said, here at Hard Asset Digest, we pride ourselves on being contrarians. Where do you see the most compelling opportunities in the coin market today?

VS: As you know, Mike, I am a contrarian myself. In the rare coin market, there's a couple of different areas that interest me right now. There's the gold commemoratives, which are among the most under-priced areas in the rare coin market today.

Also, a rare coin most everyone’s familiar with… the $20 gold pieces struck prior to 1933… I think if you're looking to make a gold bullion investment, or a gold investment… that’s where some of the best values are right now.

MF: And why is that? You mentioned the history of the coins… would you mind sharing a little bit of the history behind those?

VS: Sure. The $20 liberties were struck from 1849 to 1907. Back then, President Roosevelt wanted them redesigned to be the most beautiful coins in the world. They designed the $20 St. Gaudens, the $10 Indian, the $5 Indian from 1907 to 1933… coins like that.

If you just take the $20 Liberty gold pieces from 1849 to 1907… and the $20 Saint Gaudens from 1907 to 1933… a lot of people don't realize that those are among the most widely traded gold bullion coins over the last hundred, hundred and fifty years!

1850 Liberty and 1927 Saint Guadens

MF: Right.

VS: So, what's happened with those is, traditionally, since about the late 60’s, early 70’s, the premium started increasing on them where even your widely circulated, beat-up liberties were trading for 50% to 100% over the spot price of gold. Soonafter, they were pretty much all 75% to 125% over the spot price of gold.

I have a couple of clients on the east coast that were buying these up in circulated condition during the nineties. Remember, gold was $265 to $285 an ounce during that ten or eleven year period, and my clients were paying $575 to $625 per coin because that's where the premium was. It was about 100% over the spot price of gold.

More recently, when gold hit $1,900 an ounce several years ago, many of these came on the market, which diluted the premium and the collector demand, so the premium dropped down. Right now, it's around 4% and 6%.

So, a lot of people will go out and pay 4% for a Gold Eagle or they could pay 4% or 6% for an old $20 gold piece and be in a much better position. One, a much better position because if the premium increases… I don't think the premium is going to decrease anymore… but if the premium does increase, you have upside there.

The other thing is, a lot of your readers, I'm sure, and a lot of my clients, have a fear of confiscation or windfall profits tax.

MF: Very true.

VS: Yes, and in 1933 when gold was outlawed, President Roosevelt classified these as collector coins, and they were never confiscated. The American public didn't know this. Almost all of them were turned in and melted and everything else.

What you have is a case law according to the lawyers I've talked to and the judges I've talked to. You have a case law in place that makes them non-confiscatable, and as I told you, this isn't a case law by some judge in Burbank, California, that was done five years ago. It's by the President of the United States that was done over 80 years ago.

MF: Understood.

VS: Thus, you have a lot of protection there. You have a lot more upside potential with extremely limited downside. It's really a win-win situation. One, you're paying a very modest premium based on a new Gold Eagle or based on past history of these things. Like I say, it's the most widely-traded gold bullion coin around the world.

In fact, I would say over 95% of the $20 gold pieces I buy today come out of Europe and South America. My grading company has an office in Paris. We go over there once a month just to grade $20 gold pieces, and we'll grade 8,000 to 12,000 $20 gold pieces in a four or five day period and then head straight back!

MF: That's fascinating, Van! You mentioned, historically, you've seen premiums over 100%. Again, what are those premiums now?

VS: Yep, like I said, around 4% to 6%!

MF: Wow, okay, so a lot of upside potential!

VS: Yes! For circulated $20 gold pieces, you can buy bullion uncirculated gold pieces for a 6% premium, maybe. In that range. It varies a little bit day to day. It could be $20 one way or the other, but it's a very, very modest premium. You and I have a mutual friend and I told him, "If you were my brother and you owned Gold Eagles, I'd tell you to trade them for $20 gold pieces right now." It's just a much safer bet.

MF: On another topic, Van, in my lifetime, I've never seen such a coordinated effort to intrude on people's rights by governments. Whether it's the war on privacy or the war on cash, there seems to be a coordinated effort on a global scale to restrict people's freedoms.

I had the pleasure of speaking with Mr. James Dines recently, and he spoke at length about how he encourages people to use coins to help protect against that effort. I know you're a student of history, Van. In your experience, have you ever seen such an effort to restrict and monitor the movement of cash and people?

VS: No, never. Let me start off, Mr. Dines, I've been a big fan of his work forever. I’ve been reading his stuff for over 40 years… so he's going to forget more about this than I'm ever going to learn.

Mr. James Dines, The Dines Letter

Getting back to your question, there’s a war on currencies; there's a war on gold. I mean, you can even go back to Anthony Sutton's original book, The War on Gold, which explains quite a bit of it, and that was written, I think, in the 1970’s.

Going back, when Ross Perot was running for president, one of the reasons I did not vote for him was because he was in favor of building more and more computers that could follow and track every cent that everybody spends, and buys, and makes, and everything else. Even he was talking back then about going to a cashless society and going to an all-credit society. It's interesting, there's a lot of countries, as you and I have spoken about, that are eliminating cash, certainly cash in large size bills.

I've talked to a lot of clients who live in some of these countries, and I spoke with one a few months ago, and I said, "Do you use much cash?" He goes, "Never… everything goes on the debit card." I said, "What does that mean?” He goes, "Everything!" I said, "Well you must carry some cash."

He goes, "Van, I haven't had more than five dollars in my pocket in a year or two." I said, "Aren't you afraid of the government watching everything you do?" He goes, "Well, they know everything… what's the difference… the government knows everything you do."

You know, Mike, I tend to disagree because there's a lot of collectibles you can buy that the government cannot track or does not track.

But, yes, it’s a war… they're going after everything we do no matter what your political flavor is; whether you're republican or democrat, conservative or liberal. There's so much intrusion into everything we're doing and the way we live our lives. One of the things they're going to continue to do is monitor and restrict how we spend our money.

MF: Agreed. I mean, we're seeing it in India; we're seeing it in Europe. Here in the United States, we've had Larry Summers doing the college tour as I call it, floating it out to think-tanks and talking about how only criminals would oppose the restriction of cash or the doing away of large denomination bills. I think it's definitely an interesting time.

You mentioned that this client of yours hasn't had more than five dollars in his pocket for a year or two. I imagine with the scope of clients you serve, you have firsthand experience and perspective on how clients globally might be positioning themselves to counter some of those intrusive government policies.

What do you see on that front, Van? Have you seen an active movement whether here in the US or abroad of people maybe hedging themselves and buying some protection on that front?

VS: Yes, quite a bit, Mike. It’s a worldwide phenomenon where people are striving for privacy. I have a client in Paris that had a couple of original bags of $20 gold pieces, and he wanted to have them graded. As I mentioned, we have a grading office in Paris. I flew over… you know, this was a good opportunity to get to know this client.

I said to him, "What's the deal with all the $20 gold pieces?"

He goes, "Well, where else can I hide my money?" He says, "I'm not hiding it because I did anything wrong… I just want privacy."

So, you know, it sort of illustrates this growing base of people around the world who are looking for safe havens to place their money. Funny thing, I recently Googled a friend of mine's name, and I found out how much he paid for his home; how much he paid for his vacation home, etc.

I called him and said, "I didn't know your first wife's middle name was this and that." He was laughing, he goes, "How did you get that?" I said, "Well, there are websites that basically track everything everyone does!"

I think what we're starting to see is that there is a group of… whether you want to call them libertarians or contrarians or what have you… who simply do not want anyone prying into their lives and their businesses. A lot of them are buying gold and gold coins. That seems to be one of the better vehicles as long as they don't outlaw it someday or tax it to death.

MF: True… you never really know these days!

VS: Yeah, if you look at the central banks of the world… the Central Bank of India, the Central Bank of China, the Central Bank of Russia… they all have millions of ounces of gold on their books, and they certainly don't have it there by mistake.

Look at Putin; he’s been buying up gold the last several years! Whether you're a fan of him or not… I mean, he's certainly a smart, tactical player in this world. If he's building up his supply of gold — there's undoubtedly a reason for it!

I just think there's different vehicles that people choose to use. Some people use art and paintings. I collect old pocket knives and coins and a bunch of different things. It's just a nice asset to have that nobody can pry into.

MF: Absolutely, I like that idea. So what other compelling opportunities are you seeing right now in the coin space, Van?

VS: Well, when you're talking about coins, let's talk about gold bullion and silver bullion.

MF: Perfect.

VS: A lot of people call in and they'll say, "I want to buy some gold; I want to buy bars." Well, I haven't sold a bar in decades… everybody buys one ounce gold coins. The majority of the coins I've sold over the last 30 years have been $20 gold pieces and US Gold Eagles. I don't sell many Krugerrands or Maple Leafs because in the early ‘80s both of those traded on the COMEX exchange.

One of the biggest opportunities I’m seeing right now is the old circulated $20 gold pieces (see example below); these have been the most widely traded gold coins universally for the last 100+ years. Most of these that come into my office – which, by the way, is every single day – come from Europe and South America.

That’s because when the US outlawed gold in 1933, these coins went over to Europe and South America as bank depositories, and bank hordes, and personal business hordes, and things like that. Now, they're all being repatriated back to the United States.

Typically… and I'm not talking about high-grade rare coins as a rare coin collector.. .I'm talking really nice high-end circulated coins that could've been carried in someone's pocket for a while… normally trade at 50% to 100% over the spot price of gold.

Right now, you can buy them for less than a Gold Eagle!

If they were priced where they are today, they should be about $2,500 a coin, and you can buy them for about $1,495 or something — a small percentage over the spot price of gold. You know, you just sit there and you scratch your head and think, "Well, how long is this game going to last?" Because it's not going to last forever. At some point, the premium will come back like it has been for the last 40 or 50 years.

Again, if you had Gold Eagles, I'd say, "Mike, trade them for $20 gold pieces right now." It's almost an arbitrage where if gold goes up, they're going to go up… and if the premium goes up… they're going to go up even more. It's a very logical trade right now.

MF: That's phenomenal insight, Van. Now, you've always been pretty keen to remind me that you're as happy to help people with a $50 a month budget to people that have unlimited budgets such as some of your high net worth clients in Paris.

With that said, how can my readers get in touch with you if they have questions or would like to get started in the coin and collectibles space? Or, if they're simply individuals looking to preserve their wealth in these very interesting times?

MF: Well there's a couple of different ways. They can email me at Van@DavidHall.com or call me at 1-800-759-7575. It's pretty easy. I buy and sell gold, silver, and rare coins all day long.

I mean, I just got off the phone with a client who's been with me for maybe twenty years, and he's bought a lot of rare coins and a lot of gold over the years.

He just sent me a big check and said, "Well, okay, let’s buy some rare coins." And I go, "What are you looking for?" He goes, "I'm looking for something that’s going to be saleable no matter what’s going on with the US dollar 10 or 25 years from now. If the dollar goes to zero, I want something that people will still be collecting worldwide no matter what the currency realm is at the time."

I’m going to be showing him a number of very rare coins because, not only are they very desirable, they invariably increase in value over time no matter what’s going on in the world or with the US dollar.

So basically, I buy and sell a lot of things. I don't have any commissioned salespeople working for me. My office is only four or five people. An accountant, an inventory person, a couple of assistants who help me… I don't have people who are going to call you and try to talk you into anything. It's a matter of what you're looking to do.

Certainly, as you know, we give advice to a lot of people, including many of the well-known newsletter writers and financial analysts of the world. We spend a lot of time helping them figure out what to recommend and what's undervalued at any given time.

That's the biggest thing… the easiest thing to do in any market is spend money. The hardest thing to do is buy something that holds real true value.

I try to be a value investor in stocks… a value investor in real estate. It's the same thing in gold, silver, rare coins, or any collectible… it’s all about value.

MF: Wonderful, Van. Now, can I pick your brain a bit more… if the dollar did go… well, let's say it didn't go to zero, but it was devalued by 90% between now and two or three decades, and the euro no longer existed… what would you recommend in the rare coin space for a scenario like that?

VS: You mean if it does what it did the last 30 years? Is that what you're saying; devalues 90%?

MF: Exactly, if history repeats itself yet again...

VS: Well, in the rare coin market, there's a couple of things that stand out quite a bit. The gold commemoratives… in fact, I have a small article that my business partner recently wrote… if any of your readers want to email me, I'll be glad to forward it… the US Mint right now has over 60 million people on their mailing list that buy these new commemorative gold and silver coins that they make as well as palladium coins.

What a lot of people don't realize is that, from 1903 to 1926, they made 11 different types of gold commemoratives. A small percentage of the people who are buying the modern ones are starting to realize there’s these older coins that have had a collector base since 1903.

One Dollar US Gold Commemorative Coin

It's like looking at an old pair of running shoes and saying, "There's a pretty good track record here on these coins as far as desirability and collectibility."

Almost all rare coin collectors will collect gold commemoratives. They're a coin that's been way oversold and selling at steep discounts to what historically they were 15 or 20 years ago. I think those are a tremendous value.

The other thing is just the type of coins… or, for example, one of each variety of the gold coins that the US mint made. Some people collect a four-piece set; a $2.50 Liberty, a $5 Liberty, a $10 Liberty, and a $20 Liberty.

Others prefer to collect an eight-piece set, which is four of the Liberties and four of the Indian coins. This includes a $2.50 Indian, a $5 Indian, a $10 Indian, and a $20 St. Gaudens. Some will include a $3 gold piece, which is a very limited production coin.

20th Century 8-Piece Gold Type Set featuring 4 Liberty & 4 Indian Coins

You can put together a set of four coins, eight coins, ten coins, twelve coins… whatever you want in the gold type coins. A client of mine recently mailed me a check for a quarter of a million dollars to buy gold, and he goes, "You know what… I like your idea about the gold type coins. Let's buy some of the high-grade, brilliant, uncirculated, MS65 gold type coins."

So, we're putting some of that money into those particular coins. And, it wasn't that I talked him into it… he’s read a couple recent articles I've written, and, you know, it just seems ridiculous how inexpensive some of these coins are. Again, the big thing is to look for value… just like you would in a stock or any other investment.

MF: Excellent, fascinating, Van. It’s been a real pleasure as always. Thank you so much for taking the time, and I look forward to getting even more insights from you in the coming months.

VS: It’s my pleasure, Mike. I’m excited to be a part of Hard Asset Digest along with James Dines and your other experts… and I look forward to chatting with you again soon.