Hard Asset Digest August 2020

August 2020

In this month’s issue, I’m bringing you my exclusive interview with Jeff Phillips — founder and president of Global Market Development.

Click here to jump straight to the interview.

Over the last 25 years, Jeff’s firm has been instrumental in the financing and consulting of numerous highly successful resource companies. Investors who’ve followed his insights on precious metals, rare earths, uranium, and oil & gas have made some truly remarkable gains over the years.

Jeff has served as the principal financial backer of a number of precious metals resource companies including Animas Resources and Pediment Gold, both of which were later bought out by gold producers at substantial premiums.

He was among the very first resource stock experts to recognize the immense potential value of consolidation in the silver market back when silver was trading below $5 per ounce.

He proceeded to consult with and participate in the financing of Silver Standard, which went on to command a $1 billion market cap.

Mr. Phillips was also among the first market experts to recognize the global stranglehold China was putting on rare earths metals back in 2009. He immediately proceeded to finance all three of America’s publicly-traded rare earths mining companies realizing it would pay off handsomely once the market caught up to what he already knew.

Those who followed his insights in this market niche witnessed exponential gains as China’s rare earths dominance eventually reached the mainstream financial news outlets.

In this issue… Jeff and I cover a number of topics including revisiting the rare earths sector where we’ll take a look at Leading Edge Materials as well as a private company by the name of MP Materials that’s preparing to take public a district-scale rare earths deposit later this year.

We’ll also revisit Jeff’s uranium and gold picks from our October interview to see where those companies are presently in terms of their respective development stage AND whether or not they remain a buy at current price levels. Plus, Jeff gives us two new picks from the junior copper-gold space.

Gold’s Wild Ride!

It’s been a truly remarkable, if not head-spinning month for the yellow metal!

Gold led-off August at $1,900 an ounce; raced to all-time highs near $2,100; retreated back to $1,900; bounced again to $2,000 on news of Warren Buffett’s half-a-billion dollar investment into Barrick Gold… and has since settled – at least for the moment – at around $1,950 per ounce.

The short-term gyrations look like this:

Yet, the longer-term uptrend underpins what we’ve been saying ever since we launched Hard Asset Digest back in October:

We are in a very healthy gold bull market that’s headed MUCH, MUCH HIGHER!

Even the Oracle of Omaha – whose personal disdain for gold as an investment has been well-documented – IS NOW BUYING GOLD STOCKS.

Major media outlets are latching onto the Buffett-Berkshire story… exposing an even larger pool of deep-pocketed investors to the value of gold and gold stock speculation during these extraordinary times.

And the more investment dollars that find their way into the gold space the better as it brings additional impetus to what you already know as a member of Hard Asset Digest: That we are witnessing the greatest gold bull market in history!

Recently, Hard Asset Digest friend and contributor – Brien Lundin of Gold Newsletter – was asked for his opinion on gold’s upside from current levels.

His reply…

“... if you use past bull markets as a gauge, gold should go up 3 to 8 times from its bear market lows. That would put this next price peak somewhere between $3,000 to $8,000 an ounce.”

That’s quite a statement from Brien, and, honestly, I couldn't agree more.

If you’ve been participating in the winners our experts have been consistently handing you each and every month — Congratulations — and be prepared for even more!

Brien Lundin is widely regarded as the world’s top gold expert. You can access my most recent interview with Brien here. His New Orleans Investment Conference – the oldest and most respected investment event of its kind – is coming up October 14-17 and will be held virtually for the first time ever. This year’s panel of speakers is top-notch as always. Be sure to register early for this fully guaranteed event.

You Asked For It… and It’s Now Here

A Brand New Portfolio Service!

Last month, we discussed a few of our recent winners like:

- First Mining Gold (TSX: FF)(OTC: FFMGF): Up 75% from US$0.20 to currently US$0.35 per share

- Teranga Gold (TSX: TGZ)(OTC: TGCDF): Up 48% from US$7.50 to currently US$11.15 per share

- Hannan Metals (TSX.V: HAN): Up 125% from C$0.20 to currently C$0.45 per share

And we’ve brought you many, many more including:

- Agnico Eagle (TSX: AEM)(NYSE: AEM): Up 60% from US$50 to currently US$80 per share

- Ely Gold Royalties (TSX.V: ELY)(OTC: ELYGF): Up 242% from US$0.35 to currently US$1.20 per share

- Revival Gold (TSX.V: RVG)(OTC: RVLGF): Up 100% from C$0.55 to currently C$1.10 per share

…to name just a few!

Each and every one of those wins has occurred in just the few short months since our October launch!

The bottom line is that we are in the teeth of a powerful gold bull market — and this extraordinary wealth-building exercise has only just begun.

Literally everything we’ve told you has panned out…

…gold is setting record highs…

…our picks are continuing to move up…

…and the yellow metal will soon march even higher thanks to our government’s untethered debt creation and money printing.

One thing we’ve been hearing a lot lately is that our readers WANT MORE information on specific elements of the precious metals sector, including advice on…

…constructing a balanced precious metals portfolio…

…approaching the various tiers of the precious metals market…

…and managing specific stock positions.

In response, we’re taking the expertise that ONLY our distinguished panel of legends can provide… plus my vast experience in the sector… and combining it into a brand new service called Mike Fagan’s Precious Portfolio.

In it, we’ll be covering all of the things I just mentioned plus a whole lot more.

Naturally, our experts will continue bringing you their unique perspectives and investing ideas in each monthly issue of Hard Asset Digest.

Yet, for those interested in maximizing their experience via timely updates on fast-moving situations AS THEY HAPPEN – including specific buy, hold, and sell signals – we think our new portfolio service may be just what you’re looking for!

We’ll be launching next month — so keep an eye out for that.

In the meantime, please enjoy my exclusive interview with Mr. Jeff Phillips.

Yours In Profits,

Mike Fagan, editor

Hard Asset Digest

Exclusive Interview with Jeff Phillips

President of Global Market Development

Mike Fagan: Jeff, it’s great to connect with you. You and I speak often… and we quite literally came up through the business together. We’ve certainly witnessed some incredible market bubbles during that span.

The last time I interviewed you for Hard Asset Digest was back in October of last year for our inaugural issue.

Back then, you said something quite profound that has stayed with me and feels all the more meaningful today. I asked you about preparing for market turmoil in a debt-driven economy, and you said that the most important thing is to enjoy your family and friends first and to work on improving your health as a priority — and then everything else will fall in line.

Obviously, you don’t have a crystal ball, but I think your words touched a lot of people in our audience… so I’d like to start by saying, first, how are you and your family holding up, and, second, what are your feelings about the deep health and financial crisis America and the world is now facing?

Jeff Phillips: Mike, happy to be here and thank you for those kind words.

It’s been a whirlwind of a year as we all can attest, and I think it’s important to take pause and reflect on the human toll so many families are enduring as opposed to just looking at the numbers, which are also so devastating.

Mike, in our new reality, whatever that may end up being, a spotlight has been shone on the importance of staying healthy whether that be through exercise, eating healthy, quitting smoking or what have you.

And continually striving to improve one’s mental health and helping those around us to cope. I think there are a lot of underlying emotional factors inherent in dealing with the pandemic that we’re oftentimes not even fully aware of.

I’ve found that just going out on regular nature walks with my wife and daughter are so therapeutic, and it’s something I plan on continuing no matter what happens with the virus.

So yes, we are all healthy and being cautious while also striving for balance to a point where it feels like life is still somewhat normal… even though we know it’s not and won’t be for some time.

In terms of the markets, our government’s fiscal response to the virus has been unprecedented and will likely approach $20 trillion before it’s all said and done. That type of untethered money printing simply is not sustainable in any form or fashion especially with the massive debt and deficits our nation was already facing before the pandemic arrived.

I don’t see how this is not going to result in an equally unprecedented debasement of the purchasing power of fiat currencies all across the globe including, or perhaps, most importantly — the US dollar.

Of course, one thing we do know with certainty is that all of this paper printing is good for gold with the yellow metal being the only asset on earth that’s been proven over the centuries to be a true safe haven and eternal store of value.

Again, my passion has always been gold speculation both as a metal and through the publicly traded companies that seek its retrieval from earth’s geology.

All metals for that matter… but I especially like gold!

So I’m continuing to focus on that, and I think we're going to see a very strong environment for gold and silver over the next three to five years.

MF: Speaking of gold, Jeff, in our last interview, we discussed the gold market, which, at the time, was right about $1,500 an ounce. I remember you saying you were confident we’d see gold retesting the highs we witnessed back in 2011 near $1,900 an ounce.

Wait, now I am starting to think you actually do have a crystal ball (laughs)!

Gold has since outperformed even your lofty expectations, recently setting all-time highs above $2,000 an ounce before pulling back a bit. What’s your take on the yellow metal?

JP: Yeah, Mike, it’s interesting. You know, when I made that prediction, it was before COVID-19, and even then I thought we'd see the old highs taken out sometime in 2020 as a result of the low interest rate, high-debt environment we’re living in.

The money printing has already been unmatched in our history, and we’re only in the very early innings.

In the short-term, it’s really difficult to know what gold is going to do. We’ve had a big run up above $2,000 an ounce, and now we’re experiencing what I would call a very predictable pullback.

Yet, that’s what you want in a healthy bull market. You’re always going to see intermittent profit-taking.

I think the next move up could be substantial. In fact, it wouldn’t surprise me to see gold reach $2,400 an ounce by year-end.

That being said, I don't speculate in companies based on what I think gold and silver are going to do in the short-term. And that goes for base metals companies too.

My criteria involves evaluating companies based on the prospects for success at lower metals prices. If a company can produce and mine at $1,500 an ounce gold… then it’s going to be even more profitable at $2,000 an ounce gold or $3,000 an ounce gold.

So that’s sort of my mindset for gold and silver prices and resource stock speculation in general.

MF: All good points, Jeff. Before we get into gold stocks, let’s talk about physical gold ownership. I recently began building my own rare coin portfolio with Van Simmons of David Hall Rare Coins, whom we both know and respect — and I’m very glad I did!

What are your feelings about owning physical gold, whether it be by weight or via rare coins, and can you tell my readers a little bit about your decades-long relationship with Van Simmons?

Partner & President

David Hall Rare Coins

JP: Yeah, I've known Van for more than 20 years now, and we’ve become quite good friends.

Mike, as you know, I’m a total history buff, and I love all things collectible… so I rely on Van not just for gold coins and bullion but also for art and other collectibles from all over the world.

Van's been a collector’s collector his entire life, so we really connect on that level.

In terms of gold ownership for your readers, a lot of it comes down to a person’s own unique financial position and retirement approach. But in general, I believe all investors should have at least some of their savings in physical gold whether it be in the form of coins or bars.

It’s sort of like having fire insurance for your house. If the whole financial system burns down, you’re going to be very happy you have some of your assets in physical gold. And it won’t matter if that’s in rare coins or bullion.

You can certainly buy newer commemorative gold coins that are still minted today by the US government and by the governments of other friendly nations such as Canada – and you pay a slight premium to the gold price on those.

Mike, you and I have discussed this before, and I think we both tend to favor the older rare gold coins, such as the Liberty and Saint Gaudens, as opposed to the newly minted varieties.

Reason being… not only do you get that value appreciation from the actual gold content if the price of gold goes up — you also get the premium on the collectible factor, which can be quite extraordinary at times depending on how old and rare a coin is along with its condition.

Remember, in 1933, the US government made it illegal for citizens to own gold. The government held the $35 per ounce price until 1971 when Nixon announced that the US would no longer convert dollars to gold at a fixed value — thus completely abandoning the gold standard.

During that long span where gold ownership was outlawed, citizens were permitted to keep their rare gold coins. So that’s just one more reason why I tend to lean toward the older coins — plus being a collector and history buff of course!

My advice for your readers who’ve yet to start a gold collection is to, at a very minimum, give Van a call to pick his brain a little. Van’s a great guy who enjoys what he does and who’s passionate about sharing his expertise with others no matter what size collection they’re contemplating.

The other great part of collecting rare gold coins and gold bullion is that it’s a lot of fun! I really enjoy reading up on the coins I’ve collected over the years; they’re interesting to look at, and they’re a wonderful conversation piece.

They’re also something you can put away and eventually gift to your children or grandchildren to get them started on their own collection or to provide them with some wealth in a form that’s much more interesting than merely writing a check.

MF: Absolutely… that’s my long-term plan as well. I too like the fact that you get the premium on gold plus the rarity factor with the older coins — so I think that's a good way to go.

JP: Correct. And you know, Van is widely respected in the industry as the cofounder of the PCGS (Professional Coin Grading Service) along with David Hall.

Van's a straight shooter. If your listeners are interested in finding out how to build a portfolio, he’s someone I’m more than comfortable recommending.

I trust Van explicitly to tell me the best coins to buy.

MF: Absolutely. I'm always urging my readers to get in touch with Van. At the end of this interview, I'll include some information on how they can go about doing that.

Jeff, you’ve always been a contrarian, and you made an absolute killing in the rare earths stocks starting back in 2009. What’s happening in that space now?

I know there aren’t a lot of pure publicly traded rare earths stocks, but are there any you’re currently looking at as being substantially undervalued?

JP: Well, Mike, as you mentioned — there are very few left. Back in 2008-09, I began closely following four or five companies that had rare earths assets and gold assets on top of that.

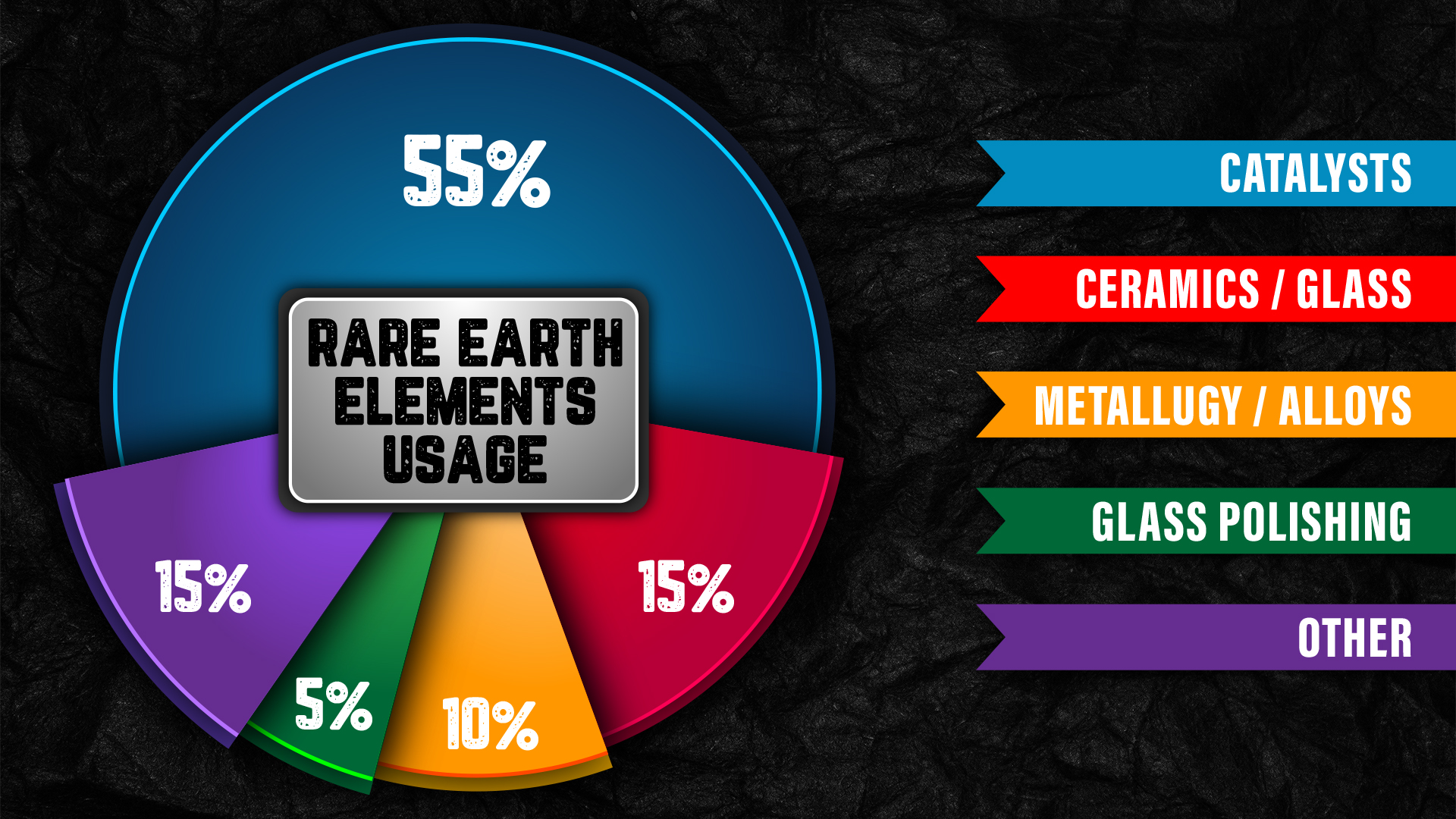

For those who may be unfamiliar, rare earths metals make up a group of elements on the periodic table that are difficult to pronounce yet are vital to the manufacture of so many devices we use today such as cell phones and computers — and also military defense systems.

These metals are pretty much all controlled by China.

As you may recall back then, the Chinese government had cut off rare earths elements to the Japanese as retaliation for some fishing boat incident — sending prices soaring.

I had been consulting for and financing a few of the rare earths companies that existed in the US at that time and ended up making a small fortune on those before the bubble eventually burst.

Today, there’s a few pretty big rare earths companies out there such as Lynas Corp. (OTC: LYSCF) which produces from its Mount Weld project in western Australia.

Something interesting I saw the other day is that the group [MP Materials] that originally purchased the Mountain Pass Mine near Baker, California, when Molycorp went bankrupt after the last bubble are now taking that project public again.

I believe the Mountain Pass Project has a $1.5 billion valuation, and it’s the only integrated rare earths mining and processing site in North America. They just raised half a billion dollars and will be going public in the fourth quarter of this year via a merger with Fortress Value Acquisition Corporation — so that’s pretty exciting!

I think it could spark a resurgence in the US rare earths industry with many more junior companies entering the space over the next few years.

In terms of right now, there is one company I have been buying. It’s a Canadian firm called Leading Edge Materials (TSX.V: LEM)(OTC: LEMIF).

The company has some big name investors and is developing a number of rare earths elements in Europe. It’s currently trading around US$0.15 per share — so very early stage yet one that I’m slowly accumulating a position in.

MF: Excellent. It seems like quite a bit is happening in the space. We'll have to reconnect in a few months to evaluate what's happening so I can update my audience.

I’m especially interested in the Mountain Pass project in California, which is just a few hours drive for both of us. Perhaps we can take a road trip up there for a site survey and to meet the principals.

JP: Absolutely, let’s plan on that!

MF: Great! Sticking with the contrarian theme, there hasn’t been a lot of love for uranium stocks the last number of years — pretty much since Fukushima in 2011.

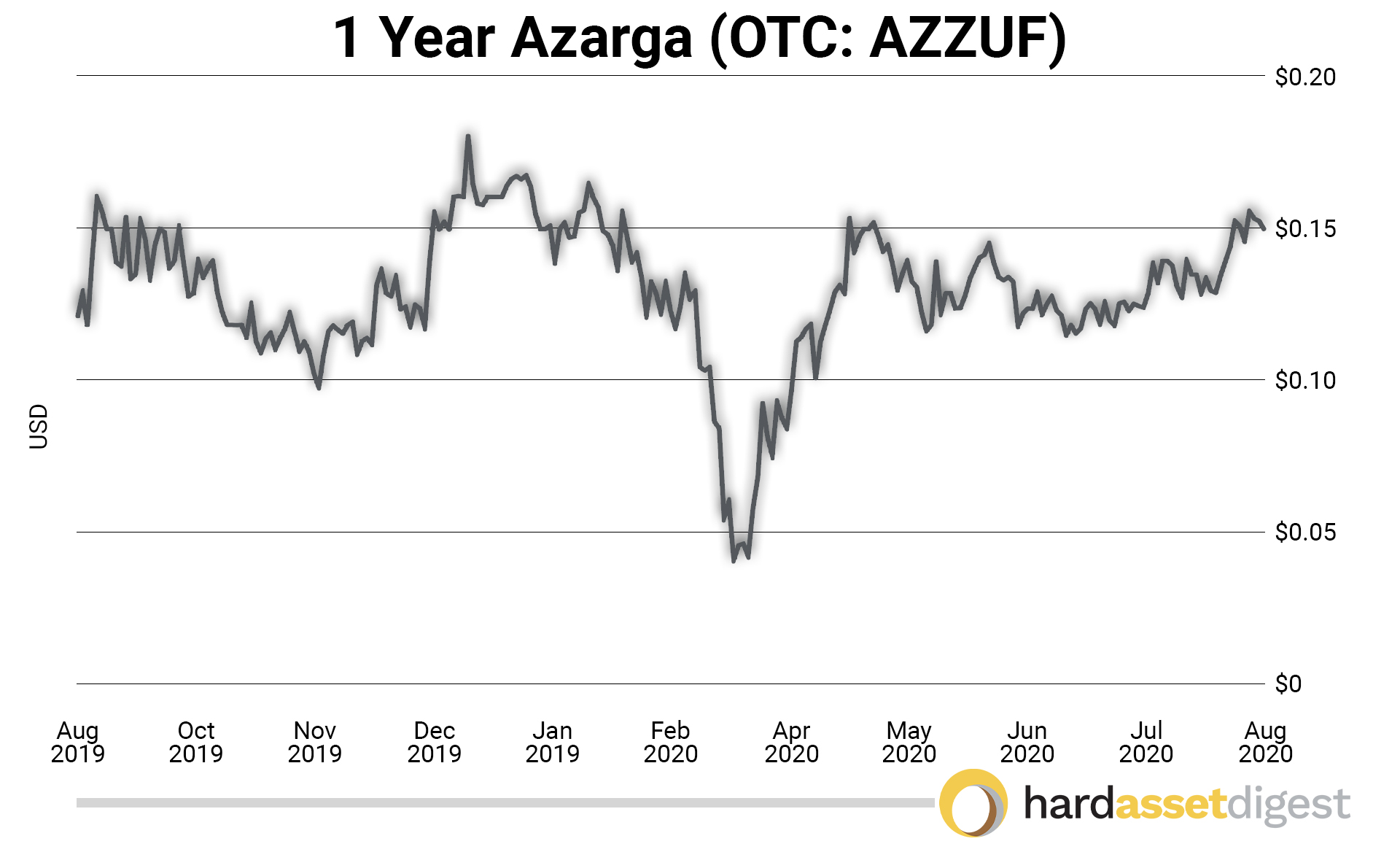

Last time we spoke, you mentioned you liked Azarga Uranium as one of only a very small handful of US uranium developers that has the potential to become a near-term domestic uranium producer.

What’s happening with Azarga at present, and do you still like the company at current price levels?

JP: Yes, I believe the current price is right about where it was when we spoke in October — around US$0.15 a share.

I still like the company. I often buy companies for years before they end up taking off — assuming I'm right about the asset.

Azarga Uranium (TSX: AZZ)(OTC: AZZUF) is developing the Dewey Burdock project, located in South Dakota. It’s one of the best undeveloped ISR (in-situ mining) uranium projects in the entire United States.

It has size; about 18 million pounds. It also has a very high grade by ISR standards; over 0.1% which is twice the grade of some of the other ISR uranium projects currently in production or licensed for production in the United States.

They received their NRC (Nuclear Regulatory Commission) license in 2014. Last year, they received their Class III and Class V underground injection control permits from the Environmental Protection Agency.

This month, they're expected to receive one of the final key permits for building the Dewey Burdock mine.

Remember, with uranium prices, you have to be patient. But I do believe we’ll eventually see much higher prices because you simply cannot mine uranium in the US, or anywhere in North America for that matter, at $30 uranium.

We need at least $50/lb uranium, and I think we’ll get there in due time.

We’ve seen quite a bit of production from Kazakhstan and Canada go offline from COVID-19 disruptions, and we’ve seen some support for US uranium production mandates from the US Nuclear Fuel Working Group.

So certainly there are some forces in-play that point to higher uranium prices going forward.

I really like Azarga as a contrarian play. Number one, I think it's going to be a fully permitted mine. Once uranium prices heat up, I think the market will be quick to realize that Azarga is one of only a few juniors with permitted projects on US soil that are ready to go.

So yeah, Azarga is a company that could do very well once we get that upward price movement we’ve been anticipating for what seems like an eternity.

Yet, that’s what being a contrarian is all about. You're speculating in stocks and sectors that are essentially out of favor. You find companies with solid asset bases and buy them cheap when everyone else is looking the other direction.

Then when things turn in your favor — you're already locked and loaded to reap the lion’s share of gains!

MF: Exactly! Jeff, as a boutique resource banker, you finance and consult for a lot of different resource companies across the full spectrum of metals — from precious and base metals all the way to strategic metals like the rare earths and uranium.

For the beginner or novice resource speculator out there, can you talk about the importance of management and share structure in these types of high-risk, high-potential-reward ventures?

JP: You have to have both of those two things, Mike. I look for management teams that have had success in the past in either developing or selling an asset that's benefited the shareholder base.

There are mining executives who’ve never built a mine yet their last four or five companies have gone up 5-fold or 10-fold on impressive development results.

So you look for management teams with past successes.

Most often when I'm looking to put a large chunk of money over time into a company, I'm looking for a management team that’s done something very credible in the past — which is to sell an asset to a major.

There aren’t too many people in this space who can claim they've done that, so I place a high degree of value on teams that have achieved that milestone to the benefit of shareholders.

As you know, Mike, all metals tend to run in cycles so you need a management team that understands timing and also has the wherewithal to hang in there for the long haul since it can oftentimes take multiple cycles for a large asset to come together and pay dividends.

The way a mining venture is structured is equally important. Just like our inept government, many of these companies simply overprint money completely diluting the early shareholders.

You want to get involved in junior mining companies that are mindful of shareholder dilution and are cashed-up to complete their near-term objectives. If a company is successful in the early exploration and drilling rounds, it becomes a lot easier to complete a capital raise via terms that are favorable for the company and its stakeholders.

That’s where reading a company's filings becomes so important. You can learn a lot about a company’s true motives by evaluating how a company is structured.

I like being involved in companies where management has significant skin in the game and where the majority of the shareholders are insiders or institutional investors who are in it for the duration… as opposed to a slew of individual traders looking for a quick flip on the first uptick.

So you have to look at a lot of different things — but management and share structure are critical.

MF: Getting back to gold and gold stocks, this is a sector that can be broken down into so many different segments with varying levels of risk.

In the junior gold sector, I know you favor the developers that have substantial ounces in the ground that can one day either develop a mine themselves or be taken out by a larger company at a substantial share-price premium.

Before we get into any specific stocks, can you talk about the junior sector and the differences between the pure explorers and the developers?

JP: Well, you have to be especially careful in the junior gold space because you get a lot of companies that are simply dusting off old projects in the hopes of generating excitement in a rising commodity market.

You’ll see pure exploration companies that may have a few drill holes or are planning an initial drill program on a property that’s little more than a shot in the dark — a pipedream so to speak.

That sort of speculation can add additional risk to an already risky endeavor.

Of course, it can pay off in spades if the company hits on its drilling — but you don’t want to own too many of those. That’s why I tend to lean toward the developers… companies that have a proven resource and perhaps a PEA.

The economics of a deposit are equally important. I don’t want to buy a company that needs $2,000 or $2,500 gold to be profitable. It’s much better if you can find a company that can be profitable at $1,350 gold or at $1,500 gold.

Then, any further upward movement in the underlying commodity price essentially becomes icing on the cake. You end up participating fully on the upside while also getting additional downside risk protection if prices head south.

You look at a developer like Great Bear Resources (TSX.V: GBR) (OTC: GTBAF) which has gone from, say, US$0.40 a share in mid-2018 to US$11 per share today on its high-grade gold discovery in Ontario’s Red Lake Mining District.

They’re hitting intercepts like 80 grams per tonne gold over 10 meters with regularity. It’s an insanely rich deposit and it’s great for the overall junior resource market.

If you were able to get into that stock early while they were still a pure explorer… well you’re a very happy shareholder in a company that has systematically moved up the ladder to become a bona fide developer.

Again, there are different ways to play the junior resource space whether by looking at pure explorers with proven management or development stage companies that are advancing a district scale asset.

The bottom line is that you need to know what you’re doing. It’s a high-risk space. You don’t ever want to make the mistake of calling it investing; it’s “speculating” pure and simple!

It’s important to have a knowledgeable resource broker that can guide you toward calculated speculations… such as what Rick Rule’s firm, Sprott USA, provides.

And you want to invest in at least 2 or 3 of the well-respected mining newsletters out there such as your own and those of the experts you’re in regular contact with as the top interviewer in natural resources.

MF: I appreciate that, Jeff (laughs!). And, yes, I have to say I am one of those fortunate Great Bear shareholders who got in early! I’m holding every share in expectation of an eventual buyout by a major… perhaps as early as the first half of next year.

JP: Excellent, and I agree!

MF: Jeff, let’s go over a few of the gold stocks from our October interview.

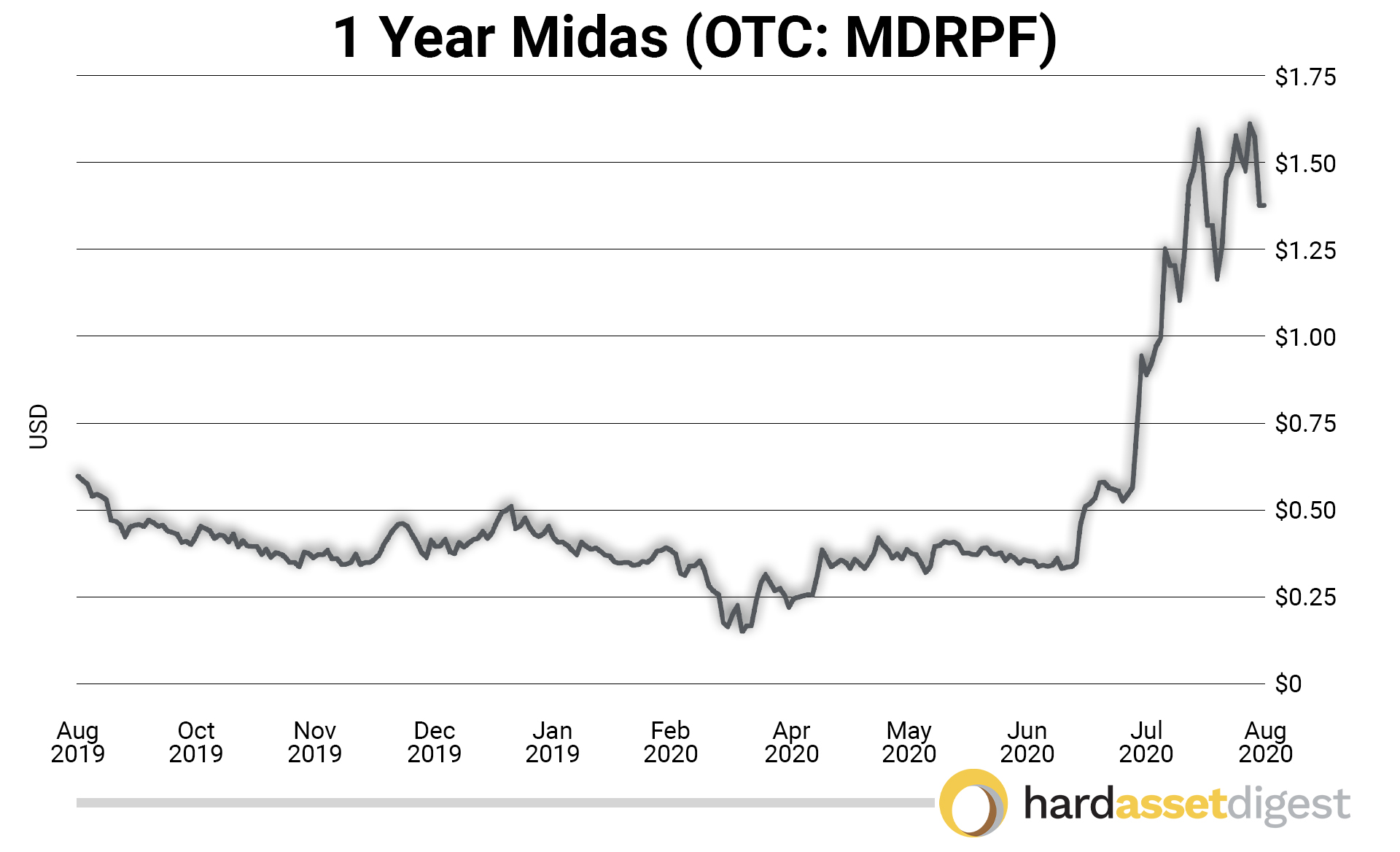

Midas Gold was trading around US$0.45 per share back then and recently moved up to around US$1.35 per share. What’s happening permitting-wise at the company’s Stibnite Gold Project, Idaho — and do you like Midas at current price levels?

JP: Yeah, Midas Gold (TSX: MAX)(OTC: MDRPF) has successfully emerged from what I might refer to as a boring period marked by delays in permitting and the like.

Indeed, you can see Midas has broken through that malaise with flying colors with a solid share-price performance of-late — which is essentially a triple from where things stood back in October.

The company just released a draft EIS (Environmental Impact Statement) on its Stibnite Gold Project, and I believe individuals now have 60 days to comment on the proposed redevelopment plan for the site.

Once the government completes that phase, the Forest Service will have 15 days to address any comments. Then it becomes final and you're off into the final stages of permitting.

Midas is a company that, if permitted, will become a significant gold and silver producer. We’re talking somewhere in the neighborhood of 340,000 ounces of annual gold production for 12-plus years.

To put that into perspective, Mike, there are only 18 mines in first-world countries – Canada, Australia, US, etc. – that are producing more than 300,000 ounces a year. There are only 18 of them out there.

So the Stibnite Gold Project is a pretty rare asset to be independently owned by a junior mining company. And it would also be the only source of domestically mined antimony — a critical mineral in the production of lots of different metals, batteries, and flame-retardant materials.

My belief has always been that Midas will eventually be bought out by a major. I can’t tell you the price, but it’s a tremendous asset that could add significant ounces to a major.

Barrick is one of their largest shareholders... I believe they own 20% of Midas. I can see Barrick wanting to own the Stibnite Project as it would be a natural fit, geographically, with some of their Nevada mines.

It just makes sense… and I personally believe it’s why they invested in Midas in the first place.

I think there are any number of top-tier miners that are simply waiting for the final permitting phase to be resolved. As you know, the large miners are doing extraordinarily well in the current market climate. Thus, with an asset of this size on the line, a bidding war for Midas could easily be in the cards.

In the short-term, Midas appears inextricably linked to the price of gold, which certainly is not a bad thing in a bull market like we have today.

Once they have the permits in-hand — I’d say it’s game on!

MF: Jeff, also in Idaho, Revival Gold is developing the 3 million ounce Beartrack-Arnett Gold Project. Back in October, Revival was trading around C$0.55 per share.

Its stock has been on a tear moving all the way up from a pretty substantial pullback near C$0.35 in mid-March to above a dollar per share Canadian now.

I know the company is working on a PEA (Preliminary Economic Assessment). What else can you tell me about Revival Gold?

JP: Mike, I think last time we talked, Revival Gold (TSX.V: RVG)(OTC: RVLGF) was sitting on a resource of about 2 million ounces at Beartrack-Arnett — and they’ve since expanded that to around 3 million ounces.

They’re drilling again now via a two-rig, 5,000-meter program with the goal of getting to 5 million-plus ounces through step-out drilling.

I really like the company and the project. It’s the largest past-producing gold mine in Idaho, and, like you said, the company has a PEA underway as we speak.

They also recently completed a bought deal financing which was originally slated for a capital raise of C$10 million and eventually grew to C$15 million… so the company is more than cashed-up to complete this current drilling round.

I’m very impressed with the economics of the deposit. Revival is trading somewhere around $15 per ounce in the ground which is far below many of its peers. So I think there’s lots of upside still to be had.

The company is led by Hugh Argo who’s a former executive VP with Kinross Gold. I really like the team he’s put together, and the company has a lot of institutional investors who are big believers in what the company is aiming to accomplish at Beartrack-Arnett.

Hugh named the company Revival Gold when he started it two and a half years ago because he believed there would be a resurgence in the gold price.

He's been right on that too!

A resource expansion from 3 million to 5 million ounces would be monumental for shareholders and would further elevate the company’s profile as a potential takeover target.

I still own all of my shares because I'm playing Revival for the longer-term. If someone had asked me if I thought the company was a good buy after they announced their most recent financing, I would have said to wait until the financing closes because there'll undoubtedly be some weakness.

We’re definitely seeing that now with the pullback from C$1.40 to around a buck a share at last check.

Again, I think it’s a stock that’s going to be trading much higher a year from now… especially if their drills continue to hit paydirt.

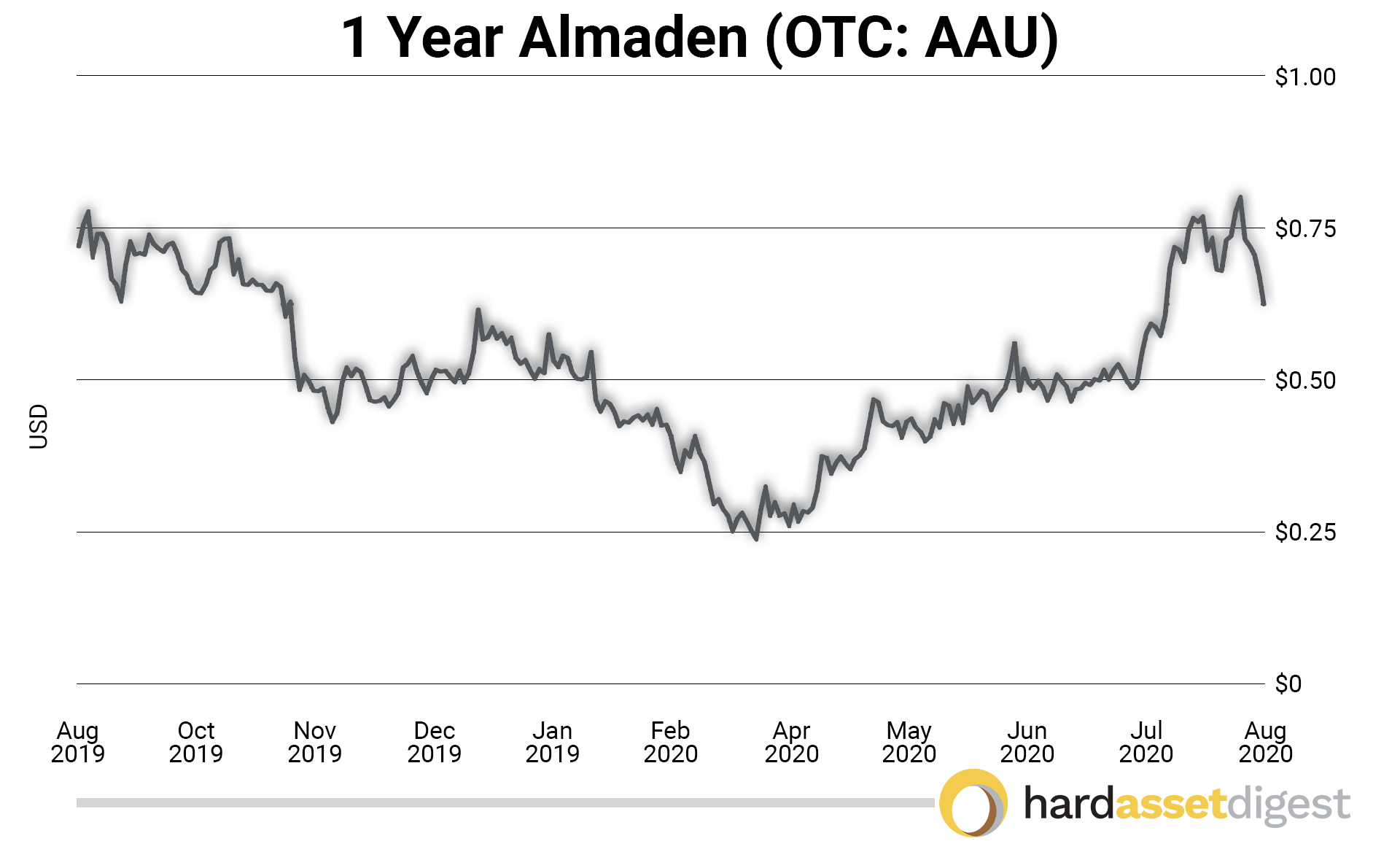

MF: Almaden Minerals, which I own a small position in, was trading around US$0.70 back in October and pulled back substantially before heading back to that same level.

This is a company that’s had some permitting issues of its own at its multi-million ounce Ixtaca Gold-Silver Deposit in Puebla State, Mexico.

I understand Almaden announced a resource update and Feasibility Study in late-2018. What’s the story there, and is Almaden Minerals still a buy?

JP: Mike, I think Almaden Minerals (TSX: AMM)(NYSE American: AAU) is one of the most undervalued speculations in the entire gold space.

I too am a shareholder, and I also consult with their management team with a focus on limiting shareholder dilution on the financial side and to protect my own investment. I’m also friends with their largest individual shareholder, Ernesto Echavarria, who’s a very high net worth individual of Mexican descent.

I always laugh when people say there's permitting issues with Almaden. I don’t think I’ve ever seen an advanced-stage mineral exploration company that hasn't run into permitting issues — whether that’s in the US, Canada, Africa, Mexico, Peru or what have you.

Mike, you know this as well as I, that nothing really ever happens on-time in the resource space (laughs!) and, of course, Almaden is no exception.

If you look at Almaden, it's very advanced. It has a Bankable Feasibility Study on its Ixtaca Gold-Silver project from early last year.

Almaden also owns the Rock Creek Mill – a state-of-the-art mill designed to process 7,000 tonnes of ore per day – which it purchased at the bottom of the market for about US$6.5 million plus 400,000 shares.

That same mill would run you about US$75 million today!

To sum things up, in late-2019, Almaden was hoping to get their permit. Unfortunately, it was put on hold by Mexico’s environmental authority, SEMARNAT, which was put in charge of the process because there’s some lawsuits that really don’t have anything to do with Almaden.

A couple of US environmental groups, which are party to one or more of these lawsuits, are actually suing Mexico’s congress, senate, and president over past indigenous peoples rules that are in effect. So everything got put on hold for Almaden at no fault of their own.

I think without COVID-19, Almaden's situation would have been resolved back in March. I’ve spoken at length with the company’s largest shareholder, Ernesto Echavarria, who's very well connected in Mexico — and he sees the situation the same way I do.

So while the court cases have put a slowdown on things, I’m confident once things open back up, the courts will come to the realization that the suits have little to nothing to do with Almaden.

And the permits will finally be rubber stamped and issued to what has become a very patient Almaden management team.

All in all, Ixtaca is an advanced project with a very substantial resource that was discovered by the company through actual boots-on-the-ground staking in 2010.

So what you have with Almaden is a highly knowledgeable and motivated management team that’s 100% committed to seeing Ixtaca through to production.

Mike, you’ll have to check the exact numbers, but I believe the project has proven and probable reserves somewhere north of 1.3 million ounces of gold and 85 million ounces of silver.

Estimated annual production is somewhere in the neighborhood of 90K ounces of gold and 5 million-plus ounces of silver over the first 9 years of open-pit production.

The project comes in at an incredible IRR of 42% and an NPV of over US$400 million. If you factor in today's gold and silver prices, which are much higher than they were during the Feasibility Study, we’re talking about a NPV that’s likely closer to US$1 billion.

In the last gold bull market, we saw assets of that size selling for US$0.5 billion to US$1 billion — that was back in 2010-12.

When you consider the fact that the company trades at a market cap of around US$85 million, which is only slightly above the value of their fully-paid-for mill… well, you get the picture: It’s a tremendous asset that you can buy fairly cheaply below a buck a share.

Of course there are always risks, and no one particularly likes court cases. Yet, I do see things moving in the right direction for Almaden, and it’s a stock I believe is going to trade much higher in the coming quarters.

MF: Excellent. Jeff, can you give my readers a couple more names from the junior and/or mid-tier resource space you’re buying now or that you like at current price levels?

JP: Sure, Mike. We can talk about Chakana Copper and Regulus Resources as a couple of juniors I like from the copper-gold space.

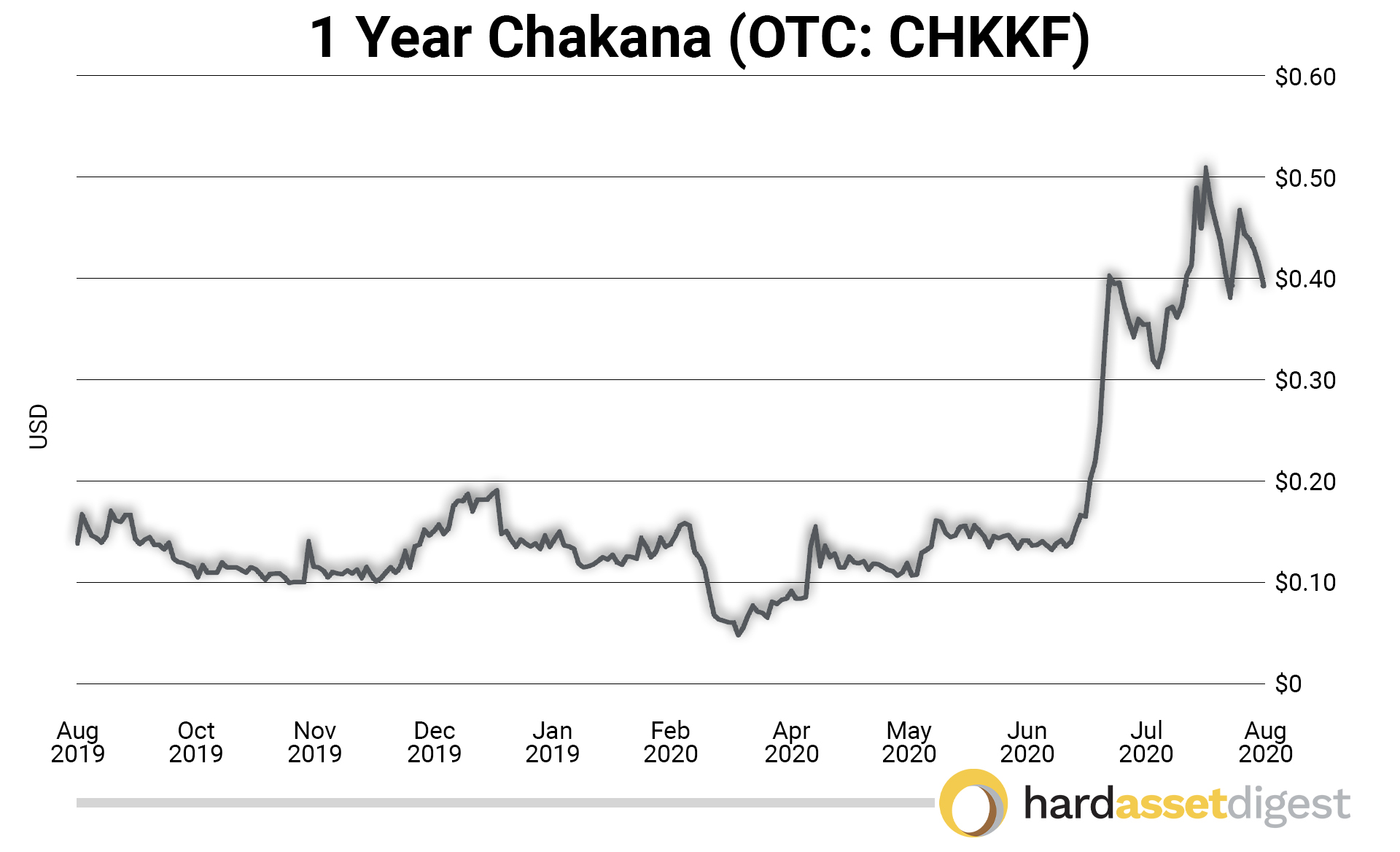

Chakana Copper (TSX.V: PERU)(OTC: CHKKF) is trading at about US$0.40 per share, and I believe a colleague of yours, Gerardo Del Real, has recently talked about them.

You literally could have bought all the Chakana shares you wanted below US$0.20 a share for months on end! Yet, the company is finally beginning to generate some market attention, and you can see that in the recent share-price performance.

As its Canadian trading symbol “PERU” would suggest, the company is advancing the Soledad Copper Project in central Peru — about 150 miles north of Lima.

It’s actually a diverse deposit made up of copper, gold, and silver.

The Soledad Project is coming along quite nicely. I think they’ve completed 30,000 meters of drilling, and they’re about to start another 15,000 meters.

It’s a breccia pipe deposit. They’ve hit some impressive intervals in the neighborhood of, I believe, 1.5% copper, 3 grams per tonne gold, and 30 grams per tonne silver.

So the early positive results are certainly there… and 15,000 meters is a pretty aggressive drill program, which means there should be no shortage of newsflow in the coming months.

Like we were discussing earlier, it has taken Chakana quite a while to get their drilling permits issued. Yet, things were finally settled last month, and the company is now fully permitted to drill some of its highest priority targets identified through geophysics and surface sampling.

Chakana also has a solid backer in Gold Fields, which I believe is the 6th or 7th largest gold producer in the world. They’ve invested C$8 million and now own 16% of Chakana.

That’s the type of institutional investor I was referring to during our discussion on the importance of management and share structure. To me, it reveals that Gold Fields saw something significant in Chakana’s early data and wants a stake in any future upside.

Chakana is in the midst of a temporary pullback to around US$0.40 a share — so perhaps an opportune time for your readers to read up on the company and also to consider establishing a small position.

If Chakana can deliver solid drill results and come out with a resource by, say, year-end — there’s a strong possibility we’ll see the company trade substantially higher in the months ahead as word gets out on the future potential of the Soledad Copper Project.

MF: Excellent. I actually own a small position in both stocks. Let’s get into Regulus Resources… what’s happening with them?

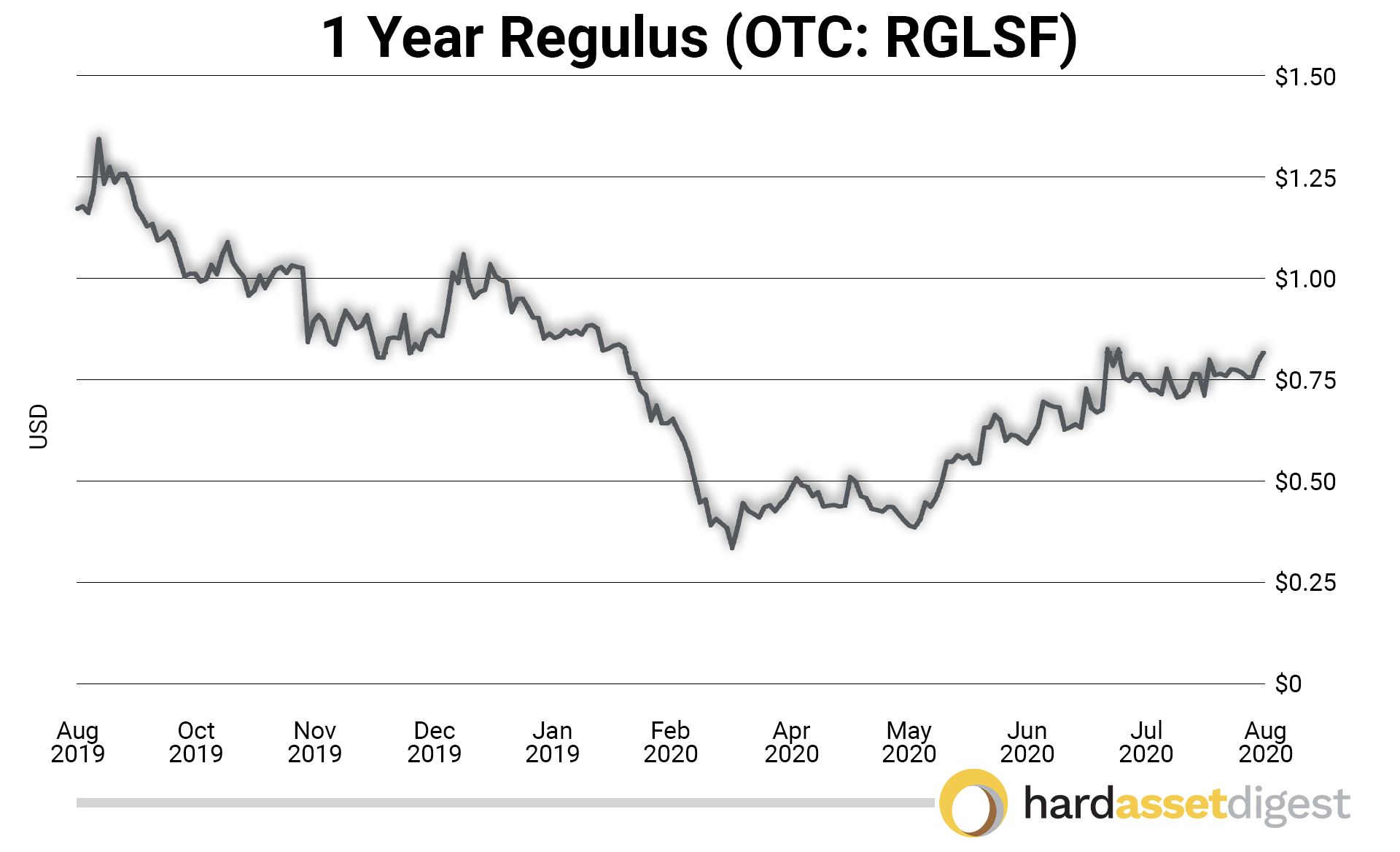

JP: Great! So Regulus Resources (TSX.V: REG)(OTC: RGLSF) is a company that, again, I own shares in, and I actually would like to help them raise additional capital in the future.

Similar to Chakana, Regulus is advancing a Peruvian copper-gold-silver project called the AntaKori Project located in northern Peru about 400 miles north of Chakana’s Soledad Project.

At last check, I believe the company was trading right around US$0.75 per share.

Regulus is run by economic geologist John Black and his team. John was the founding president of Antares Minerals before its sale to First Quantum Minerals for C$650 million back in 2010.

Regulus is one of only a handful of juniors that controls a world-class or part of a world-class copper deposit in Peru.

They completed Phase 1 drilling at their AntaKori Project in 2018, and I believe that was over 20,000 meters of drilling — so quite robust.

They started Phase 2 drilling, which I believe is slated to be another 25,000 meters, but were temporarily shut down due to the pandemic. They released a few drill-hole results in the early part of this year, prior to the shutdown, including something like 350 meters at 0.57% copper with some gold and silver mixed in.

You’ll have to check the exact numbers… but pretty impressive early results.

Things are starting to open back up in Peru so I fully expect Phase 2 drilling to resume shortly. The company has a number of high-priority targets just to the north of the main resource area that have yet to be drill-tested.

All said, the company has a tremendous resource at AntaKori as compared to most other copper development stories in the Americas — and I think the company is quite undervalued.

I’ll be watching for a resumption of Phase 2 drilling followed by a PEA.

In terms of the recent share-price performance, Regulus hasn't participated as much as I thought they would have in this initial phase of the bull market.

But that’s okay… as it creates opportunity!

To let your readers in on what I’m doing… I’ve been buying Regulus Resources, and my plan is to get more involved with them as they progress through this next development stage.

I think it’s a great asset run by a top-notch team.

MF: Jeff, thank you as always for your insights and for sharing a few of your top picks. Let’s do it again soon.

JP: Anytime, Mike. And let’s plan on taking that drive up north to check out MP Materials’ Mountain Pass Project for a site survey.

MF: Definitely! I’m excited to check out my first rare earths deposit… and to think it’s just a couple hours away!

JP: Alright… I will set that up. Talk soon, Mike.

MF: Take care, Jeff.

Editor’s Note: Jeff and I mentioned Van Simmons in our discussion about rare coins. Van is one of our distinguished experts and is the president of David Hall Rare Coins and cofounder of the PCGS (Professional Coin Grading Service).

You can access my most recent interview with Van by clicking here. And you may contact him directly via email at Van@DavidHall.com or toll-free at 800-759-7575.

We have four reports now available highlighting several opportunities for investment in the resource space.

- The Book of Levi: Picks-and-Shovels for the New Gold Bull Market

- Mid-Tier Takeovers for 2020 and Beyond: Two Top Candidates for Premium Takeovers

- The New Standard in Silver

- Exploration Opportunities

Opportunities discussed in those reports and past issues include:

- Lynas Corp. (OTC: LYSCF)

- MP Materials: Private Company

- Leading Edge Materials (TSX.V: LEM)(OTC: LEMIF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Revival Gold (TSX.V: RVG)(OTC: RVLGF)

- Almaden Minerals (TSX: AMM)(NYSE: AAU)

- Chakana Copper (TSX.V: PERU)(OTC: CHKKF)

- Regulus Resources (TSX.V: REG)(OTC: RGLSF)

- Sprott Inc. (NYSE: SII)

- Franco-Nevada (NYSE: FNV)

- B2Gold (NYSE: BTG)

- Great Bear Resources (TSX.V: GBR)(OTC: GTBDF)

- Energy Fuels Inc.(NYSE American: UUUU)

- Bluestone Resources (TSX-V: BSR)(OTC: BBSRF)

- First Mining Gold (TSX: FF)(OTC: FFMGF)

- Libero Copper & Gold (TSX.V: LBC)(OTC: LBCMF)

- GR Silver Mining (TSX.V: GRSL)(OTC: GRSLF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Skyharbour Resources (TSX-V: SYH)(OTC: SYHBF)

- Ivanhoe Mines (TSX: IVN)(OTC: IVPAF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Teranga Gold (TSX: TGZ)(OTC: TGCDF)

- Sibanye-Stillwater (Nasdaq: SBSW)

- Wheaton Precious Metals (TSX: WPM)(NYSE: WPM)

- Franco-Nevada (TSX: FNV)(NYSE: FNV)

- Bluestone Resources (TSX-V: BSR)(OTC: BBSRF)

- Blackstone Minerals (ASX: BSX)

- Pan American Silver (NASDAQ: PAAS)

- Hannan Metals (HAN.V)

- Agnico Eagle Mines (TSX: AEM)(NYSE: AEM)

- Kirkland Lake Gold (TSX: KL) (NYSE: KL)

- Pan American Silver (TSX: PAAS) (NASDAQ: PAAS)

- Lynas Corp. (OTC: LYSCF)

- Canopy Growth (TSX: WEED) (NYSE: CGC)

- OrganiGram Holdings (TSX: OGI) (NASDAQ: OGI)

- Ely Gold Royalties (TSX-V: ELY)(OTC: ELYGF)

- Trilogy Metals (TSX: TMQ)(NYSE: TMQ)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Realgold (private)

- 1903-1926 Gold Commemorative Coins

- Pre-1933 Liberty, Indian, St. Gauden Coins

- Sprott Inc. (TSX: SII)(OTC: SPOXF)

- Alacer Gold (TSX: ASR)(OTC: ALIAF)

- Alamos Gold (TSX: AGI)(NYSE: AGI)

- Silvercrest Metals (TSX: SIL)(NYSE: SILV)

- EMX Royalty Corp. (TSX-V: EMX)(NYSE: EMX)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Almaden Minerals (TSX: AMM)(NYSE: AAU)

- Revival Gold (TSX-V: RVG)(OTC: RVLGF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)