Hard Asset Digest April 2020

This month, you’ll be hearing from financial newsletter publisher, editor, and speculator Nick Hodge.

Click here to jump straight to the interview.

Founder and president of The Outsider Club, co-owner of this platform, and an editor of several newsletters himself — Nick, as a generalist, has the unique advantage of seeing the business from multiple perspectives.

For over a dozen years, Nick has been strapped to his chair, learning the ins and outs of financial publishing, marketing, small-cap speculating, and junior mining — starting when he came onboard at Angel Publishing in 2007 to research and write about cleantech stocks.

Young and greener than the stocks he was hired to write about, Nick proved a quick study, co-authoring his first book the next year: Investing in Renewable Energy: Making Money on Green Chip Stocks.

He mostly retained his love for the energy sector — writing Energy Investing for Dummies in 2013 — but The Great Recession of 2008 crystalized his mistrust of the system. Libertarian and contrarian by nature, this served as the inspiration for the creation of The Outsider Club and his gravitation to hard assets.

Nick personally writes and edits three paid financial newsletters:

Wall Street’s Underground Profits — a monthly publication focused on hard assets and dividends with a contrarian perspective.

Early Advantage — a weekly letter where Nick talks about all things markets and his personal speculations.

Nick’s Notebook — offers access to private placements Nick sources from his network.

Oftentimes, Nick is writing checks into those private placements alongside his subscribers, giving him significant skin-in-the-game that sets him apart from many newsletter writers.

He has raised tens of millions of dollars of investment capital for resource, energy, cannabis, and medical technology companies — reflecting his generalist nature.

When he's not writing, investing, or flying around the world speaking and conducting due diligence, Nick can usually be found somewhere on his small ranch in the Pacific Northwest raising his three young children with his wife and pursuing the outdoor activities he grew up enjoying.

Of course, Nick’s not doing much flying these days… so he was pretty easy to track down for our interview!

In our talk, Nick discusses the COVID-19 situation and the historic bailout package that is really just beginning and how that should translate to even higher gold prices going forward. Before we get to that, here’s my take on this ever-evolving crisis.

A bailout for the ages…

Already, the Fed’s coronavirus bailout package has surged to about $3 trillion — and we’re only a couple of months in. Compare that to the Fed’s 2008 rescue package, which took until the end of 2010 to reach $2.8 trillion.

We’re in a much more dire situation now. The 2008 financial crisis was just that — a financial crisis.

The COVID-19 pandemic is a global health crisis that’s causing a global financial crisis… and it’s affecting everyone to some degree.

Looking back at the 2008 financial crisis, unemployment reached a peak of just over 10%... and it took until the end of 2009 for that to happen.

With COVID-19, some 26.5 million Americans — or about 16% of the total workforce — have already lost their jobs. This happened in just four weeks’ time and doesn’t even include many of the millions of Americans in the GIG economy who are no longer working and aren’t eligible to file for unemployment.

That means the real unemployment rate is likely already closing in on 20% and may ultimately eclipse 25% — a truly sobering statistic. And again, we’re only at the very beginning of the crisis.

A grand experiment of global scale!

Millions of American workers (and workers all across the globe for that matter) are now facing an almost unthinkable choice of either risking their health and the health of their loved ones by going back to work before the virus is adequately contained OR defaulting on their mortgage payments.

One particularly poignant example are the US meat processing plants where some workers are voicing concern over a new executive order compelling the plants to remain open despite obvious health concerns.

Georgia’s plan to reopen gyms, hair salons and the like early (prior to attaining 14 days of fewer cases as outlined by the White House) is really a microcosm of what I like to call a “grand experiment of global scale.”

Las Vegas mayor, Carolyn Goodman, is, inexplicably, taking things a step further by imploring her state’s governor to reopen the city’s casinos via a modern day survival-of-the-fittest plan. “Let the businesses open and competition will destroy that business. If, in fact, they become evident that they have disease, they’re closed down. It’s that simple,” she says.

I wholeheartedly disagree with her “Let them eat cake” posturing — and, so far, her governor is ignoring her ill-timed pleas.

I hesitate to even bring up statistics because they’re changing so rapidly, but from last month’s issue of Hard Asset Digest (March 23), there were 40,000+ confirmed COVID-19 cases in the United States and around 470 deaths.

Today, just over a month later, those numbers have skyrocketed 25-fold and 125-fold, respectively; now one-million-plus cases and 60,000+ deaths.

Already, the death toll in the United States has eclipsed that of every other nation in the world. In fact, more people have died of COVID-19 related illness in New York alone than in any other country excluding France, Spain and Italy.

Nursing homes have been particularly hard hit, and it’s important to take time to reflect on the monstrous human toll this virus is causing as well as the bravery of our valued healthcare workers, first responders, and essential workers.

Hope is not a plan…

It’s true that we have successfully flattened the curve in the US through social distancing and other mitigating measures such as face masks but we’ve yet to see a sustained decline in new cases or deaths.

And we still don’t have adequate testing, which everyone agrees is requisite for what everyone hopes will be a relatively smooth reopening of our economy.

Of course, hope is not a plan.

And what’s particularly alarming is that we’re now four months into this global crisis and we still have far more questions than answers.

First off, without adequate testing capacity, testing errors, and the difficulty of tracing asymptomatic cases here at home — we’re completely in the dark as to the full extent of the spread of the coronavirus.

Experts generally agree that the actual number of US cases could be anywhere from 5 to 20 times the current number. That’s a wide range but one can reasonably extrapolate that millions of Americans have already contracted the virus and millions more will become infected in the months ahead.

The idea of creating a safe work environment before we have adequate testing and contact tracing does not seem to square on any level.

A clear path out?

And that brings us to how we get out of this as a nation. Remember, we have a largely consumer-driven economy. Around 70% of our GDP is generated through consumers opening up their pocketbooks.

That’s not happening now, and may not happen for several more quarters.

There’s still so much we don’t know about the virus. We initially thought that the first coronavirus death in the US occurred on the last day in February in Washington State. We now know that the virus killed someone in the Bay Area more than three weeks earlier.

That means the virus was circulating here in the US well before any travel ban was implemented.

Of further detriment, drugs that were recently touted as a potential treatment for COVID-19, such as the malaria drug hydroxychloroquine, are showing very little promise. In fact, a newly-released study of that drug showed no benefit against the disease over standard care and was in fact associated with a higher rate of death.

One bright note... early trial data from Gilead Sciences’ coronavirus drug candidate remdesivir is showing a clear cut positive effect in diminishing recovery time for patients infected with the virus. So we’ll be watching those developments very closely.

Meanwhile, medical experts are raising the alarm as to what this virus might do after the initial wave subsides. CDC director Dr. Robert Redfield warns that a second wave of the novel coronavirus will be far more dire because it is likely to coincide with the start of flu season.

CDC director

Thus, even if we’re able to successfully reopen, we may be forced to shut things down again… and no one has any idea as to how long. It doesn’t require any stretch of the imagination to foresee things getting a lot worse before getting better.

We’re already seeing protests against stay-at-home orders across multiple states… human beings were not meant to be locked inside… imagine how nuts things could get if this virus does indeed come back with a vengeance in the fall, or worse, mutates.

A “Manhattan Project” for a Vaccine

The smartest scientific minds in the world are using all of the knowledge gleaned from previous coronavirus outbreaks in order to develop a vaccine to stem the spread of infection, bring down death rates, and allow countries to reopen their economies.

Worldwide, there are currently more than a half-dozen vaccine programs in the clinical trial phase and more than 80 in preliminary phases.

Perhaps the most optimistic news yet… Pfizer, in collaboration with a German biotech, has begun human trials of a potential COVID-19 vaccine that could supply millions of doses by the end of the year and potentially ramp up to hundreds of millions of doses in 2021.

Further, scientists at Oxford University's Jenner Institute in the United Kingdom have begun testing a potential coronavirus vaccine on humans — and, depending on trial results, may be ready as early as this coming September.

Of course, the real worry is that by the time a vaccine is produced, the world may be looking at a completely new version of the virus, which would be disastrous for human health.

Until such time as we have a viable vaccine available to the public, economies will have to continue to rely upon other mitigating measures including social distancing, enhanced testing (including antibody testing), and herd immunity as we adapt to living with the virus.

A silver lining that’s here… NOW!

As I discuss with Nick Hodge (below), never before has it proven more prudent to be financially free simply by living within your means.

That doesn’t mean you have to be rich. It means ensuring you have adequate liquid assets/savings on-hand to turn to during times of unforeseen tumult.

And one of the simplest ways to attain that is by never taking on large levels of unnecessary debt and by allocating a certain percentage of your wealth to savings.

For those with ample savings and investment capital at their disposal, the opportunities for wealth accumulation will be immense. Look for continued irrational gyrations in the broader markets both to the upside and downside as we make our way through this crisis.

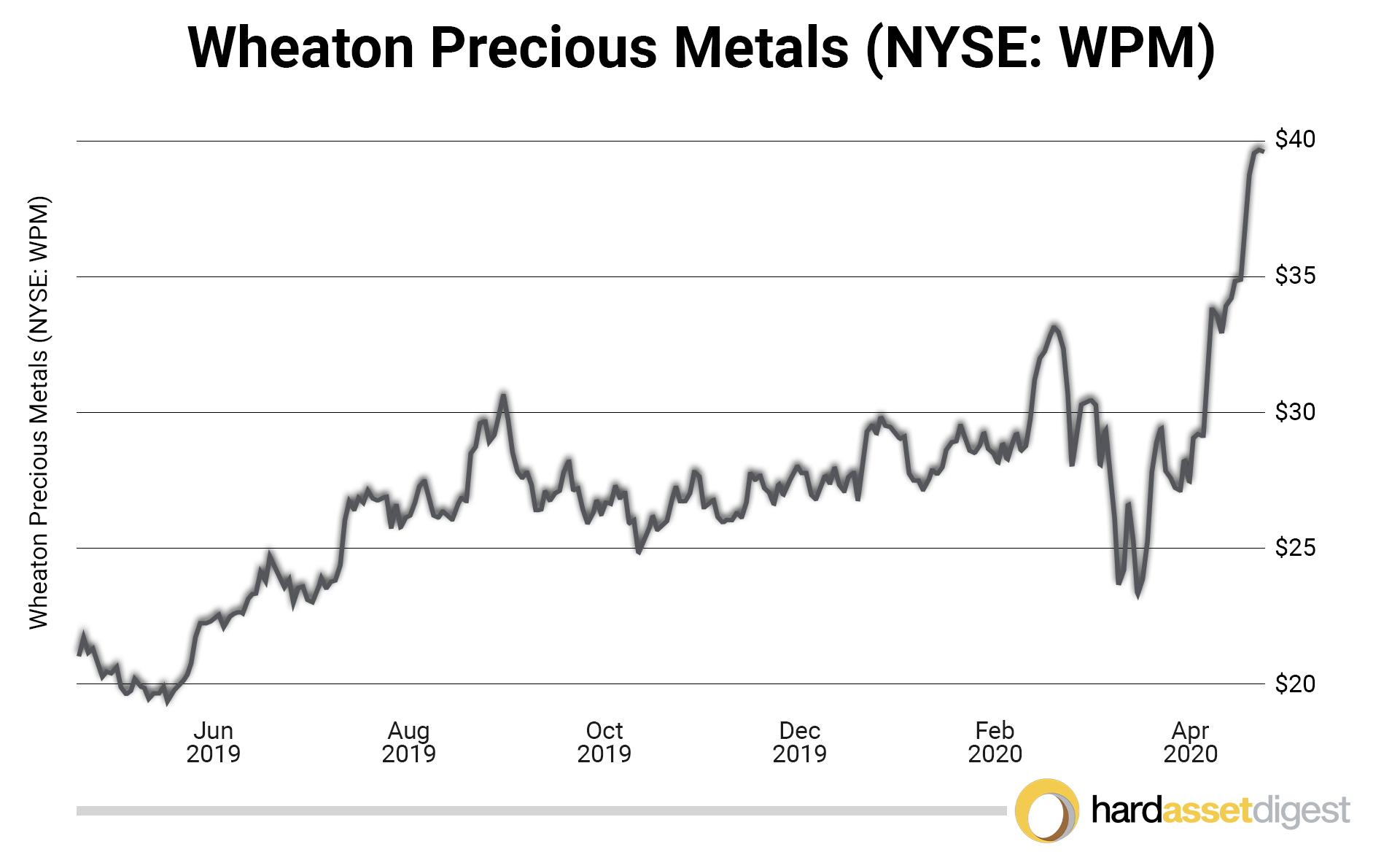

One area where we are seeing a silver lining with a little less volatility is the precious metals space. Gold has surged from $1,500 an ounce to around $1,700 an ounce in just the last month — and Bank of America is now forecasting $3,000/oz gold within 18 months citing impending pressure on fiat currencies.

Gold bullion and rare coins are, in my opinion, about as safe a bet as you’ll find… as long as you know what the heck you’re doing. Do not — I repeat — DO NOT buy rare coins off the TV or internet unless you’re already an experienced numismatist who can readily differentiate between value and hustle.

If you’re no expert (and that includes yours truly by the way!), be sure to re-read our December 2019 issue here where I interview Van Simmons of David Hall Rare Coins. Van has guided both me and Nick Hodge in our budding rare coin pursuits… and he can do the same for you no matter how much or how little you’re looking to invest.

Precious metals equities, like all stocks, carry a certain degree of risk. Nevertheless, I believe we’re at the early stages of a long-term bull market in gold. And, in the gold stock sector, there’s no better way of mitigating some of that risk variable than a rising market for the yellow metal itself.

All in all, that’s what we’re here for… to bring you sound, contrarian investment strategies and ideas from the experts we’ve assembled at Hard Asset Digest.

Please enjoy my exclusive interview with Nick Hodge.

Yours In Profits,

Mike Fagan, editor

Hard Asset Digest

Exclusive Interview with

Nick Hodge — The Outsider Club

Mike Fagan: Nick, great to catch up with you during these crazy times… and we certainly can delve into the COVID-19 situation in just a bit. Let’s start with your background… your “Outsider” mindset so to speak. I’ll pose the question… who is Nick Hodge?

Nick Hodge: Thanks, Mike, excellent to be with you as well. The Outsider mindset… yes, well as the late great George Carlin once said…

So coming of age during 9/11 and watching the fallout of the wars and the Patriot Act… and then watching the previous financial crisis unfold made me seriously question authority and the system.

It was clear to me that what the elite were doing was criminal — and yet they never received any consequences.

I remember former New Jersey Governor Jon Corzine being appointed the head of MF Global in 2010. By 2011, it was bankrupt and there were hundreds of millions of dollars in missing customer funds.

Corzine hired the same attorney, Andrew J. Levander, that represented Lehman and Merrill Lynch in 2009 and Barclays after it got caught manipulating Libor. He ended up settling for a paltry $5 million.

They always get to settle. It made me sick.

I didn’t understand the bailouts in 2008, and after, either. Failure is a part of capitalism and, without it, what we’re practicing isn’t capitalism. It’s some bastardized version of it — kleptocracy, corporatism, oligarchy… pick your poison.

I could — and maybe should — rant more about it but I think this line I wrote back in 2012 sums it up nicely:

Politicians, bankers, and the executives that form the “Insider Club” have self-serving and unspoken alliances. You and I will never be a part of it — and they are using their influence to make us their insurance policy.

And that’s really how The Outsider Club was born. I actually thought of the name and concept while sitting in a deer stand — a story for another time.

I was fortunate to meet great people along the way. Thirteen years ago, when solar stocks were the talk of the street, I would go to all sorts of solar and wind and smart grid conferences and meet all sorts of people. Movers, shakers, financiers, celebrities.

I met the late Larry Hagman of Dallas fame — white hat and all — when he was the spokesman for a German solar company back in 2010. The schtick was that his oil days were over but he was still in the energy business. I found myself on a private yacht with him and Ted Turner and a bunch of cleantech entrepreneurs. Sadly, Larry passed away just a couple short years later.

Ultimately, my contacts led me to Brien Lundin of Gold Newsletter. Brien was nice enough to invite me to speak at his New Orleans Investment Conference. And I have to say, getting to know Brien has proved far more beneficial than any celebrity encounter because of the wealth of introductions.

It’s ultimately how I met Jeff Phillips, Gerardo Del Real… and some of the other guys who came together for this letter like Rick Rule, Brent Cook, Van Simmons, and the legendary Mr. James Dines.

The cleantech boom didn’t last forever. I was fortunate to catch that wave early and luckily made some calls in the energy space that turned out really well. I was buying Chinese electric car companies in 2008 and made several hundred percent by 2010.

No one had even heard of Tesla back then!

Of course, I watched as the cleantech space withered away in the face of the 2008 financial fallout. That’s where I really began pivoting to hard assets like gold. I saw how easily and recklessly the government could create money along with its willingness to bailout large companies that made incredibly bad decisions.

And I appreciated natural resources as the building blocks of all things.

The network I was able to assemble proved vital. And as my publishing reach grew, I had access to something a lot of small companies covet: The ability to reach a lot of investors.

So I began getting pitched on a lot of deals, learned some stuff the hard way, and was very fortunate that Jeff Phillips and a few others were so generous with their time and willingness to share their expertise.

It really expedited what can be a long learning curve.

MF: That really speaks home to me, Nick, as some of those same folks have been instrumental in my understanding of markets and investing over the years as well.

So, turning to the coronavirus pandemic, I know that you took steps years ago to prepare yourself and your family for such an event. Can you tell my readers a little bit about that?

NH: Sure, as you know, Mike, I took my family out of Baltimore several years ago after growing tired of watching the city’s perpetual decline. Now, my family and I live on fifty partially-tillable acres in the Pacific Northwest.

We have two wells, a pond stocked with fish, and relationships with local ranchers for meat. We actually took delivery of half a pastured heritage hog this month.

Root vegetables just went in the drip-irrigated garden and everything else will go in once the danger of frost has passed… around early-May. For me, Mike, it was easy to see that another crisis, of one sort or another, would come given the response to 2008. That’s why I took the steps that I did for my family.

The Fed’s paper job couldn’t last forever. But I don’t think anyone foresaw things happening so quickly. The virus has proven to be the perfect catalyst in that respect — showing the precariousness of not just the financial system, but the healthcare system, supply chains, and even the antiquated ways we vote.

At Outsider Club, I’ve long told readers that when the next crisis comes, people with debt and no savings will be the worst off. They'll be the first ones with cardboard signs on the street – either in protest or begging at an intersection. And sadly, we’re seeing that in a very real way today.

The best way to come out ahead in any disruption is to be in a place where you can distance yourself from the disruption. And the only way to do that is by being financially free, which I’d point out is a good place to be — pandemic or not.

The first thing you can do is get out of debt. Now. Debt in this country, both public and private, has become a chronic condition. Using debt to finance consumption is suicidal.

You should also build cash. This goes for investment accounts and for your pocket. Now is a time to hold large cash balances in your accounts so that you're liquid enough to take advantage of the bargains that we'll see down the road. We'll be sure to bring many of them to your attention in these pages. You should also have enough cash on hand to cover your living expenses for a minimum of three months. Have it in your possession.

The next thing is to hold physical precious metals. Look at these holdings as an insurance policy. Your best hope is they become family heirlooms. Buy it, stash it, and keep it secret. Van Simmons is one of the best in the business for helping you out in that regard. He’s a contributor to this letter and we’re lucky to have him.

Editor’s Note:

Van Simmons is partner and president of David Hall Rare Coins — one of the largest and most respected rare coin companies in the country. Check out our December issue with him to get a feel for his expertise and for info on how to get in touch.

It’s no secret I’m also a big believer in personal liberty, responsibility, and accountability. It's a noble and sublime feeling to be confident in your ability to provide for your family.

Get a long-term food storage program in place. At a minimum, you should be 100% confident in your ability to live for a few weeks without having to go to the grocery store. Prepare to the level you feel is practical.

You know, Mike, someone told me they took a poll once. It turns out 100% of criminals prefer their victims to be unarmed! Own a firearm and possess the ability to use it under duress.

And by all means, take pride in your liberty. Let your opinion be heard not through the prism of left or right, but through the lens of right and wrong.

I often think about the lyrics to A Country Boy Can Survive. Hank Williams Jr. wasn’t lying, “A country boy can survive.” You can bet I’ve got a rifle, a shotgun, and a four-wheel drive!

I’ve been urging people to buy rural real estate for some time now. Not only is that paying off as far as how we’re riding out lockdown orders, but also real estate search data is already beginning to show a shift toward buyers increasingly looking at rural areas because of how the coronavirus is gripping cities.

Again, the Fed is running the printing presses at full steam with the monetary response to the pandemic already surpassing that of the entire 2008 financial crisis.

I mentioned earlier how I’ve pivoted toward hard assets like precious metals, and that strategy is working out well with gold currently at 7-year highs — and we still have a very long way to go.

Mike, you’ve read my articles… you know they all end with my signoff: Call it like you see it.

I practice what I preach!

MF: Absolutely! So sticking with the pandemic a moment longer, if you will, we’re clearly all in this for the long haul. Nick, how do you see us making our way out of this crisis?

NH: That’s really a tough one to answer, Mike, because I think it’s still really early in the crisis, which clearly has two parts.

The first, of course, is the virus itself. It’s no secret that I believe the federal government’s response to it has been completely botched. I was writing in early-March about how the government was telling doctors here in Washington State to stop testing for the virus in January. They knew it was here and spreading then.

Meanwhile, senators on both sides of the aisle were dumping stocks while failing to warn their constituents — a true “insider” move. But I digress…

We still don’t have the testing we need. The president has been saying testing is going to ramp up next week for the past month — and it still hasn’t materialized.

At last check, we were testing ~150,000 people per day, well short of the half a million daily tests experts agree are needed before we start getting back to any sort of normal.

I am very hopeful in the scientific community’s ability to come up with both a treatment and a vaccine. Though it’s hard to say what a timeline for that might look like; most timelines from major pharmaceutical firms are projecting broad access to a vaccine sometime in 2021.

So we’re clearly a long way from being out of the woods.

Singapore experienced a nasty second wave that saw a higher number of infections than the first wave. And there are also significant concerns from the medical community about virus mutations and any treatment’s ability to keep up with them. Much remains to be learned and caution is still prudent.

I would suspect we start selectively returning to work and school this summer and fall… but the return to normalcy is going to take much longer.

And that’s the second thing… the economic, financial, and political implications… and the response, fallout, and recovery, which, while sparked by the virus, are completely separate from it.

The response has already been staggering… and still not nearly enough. The monetary and stimulus packages are already larger for this crisis than they were in 2008 and seemingly growing every day. We’re already at $10 trillion globally. And I’m loath to site specific figures here because they are changing so quickly.

So far, we’ve seen the aid largely going to banks, corporations, and private equity. You’ve got the Fed using BlackRock to buy debt via ETFs.

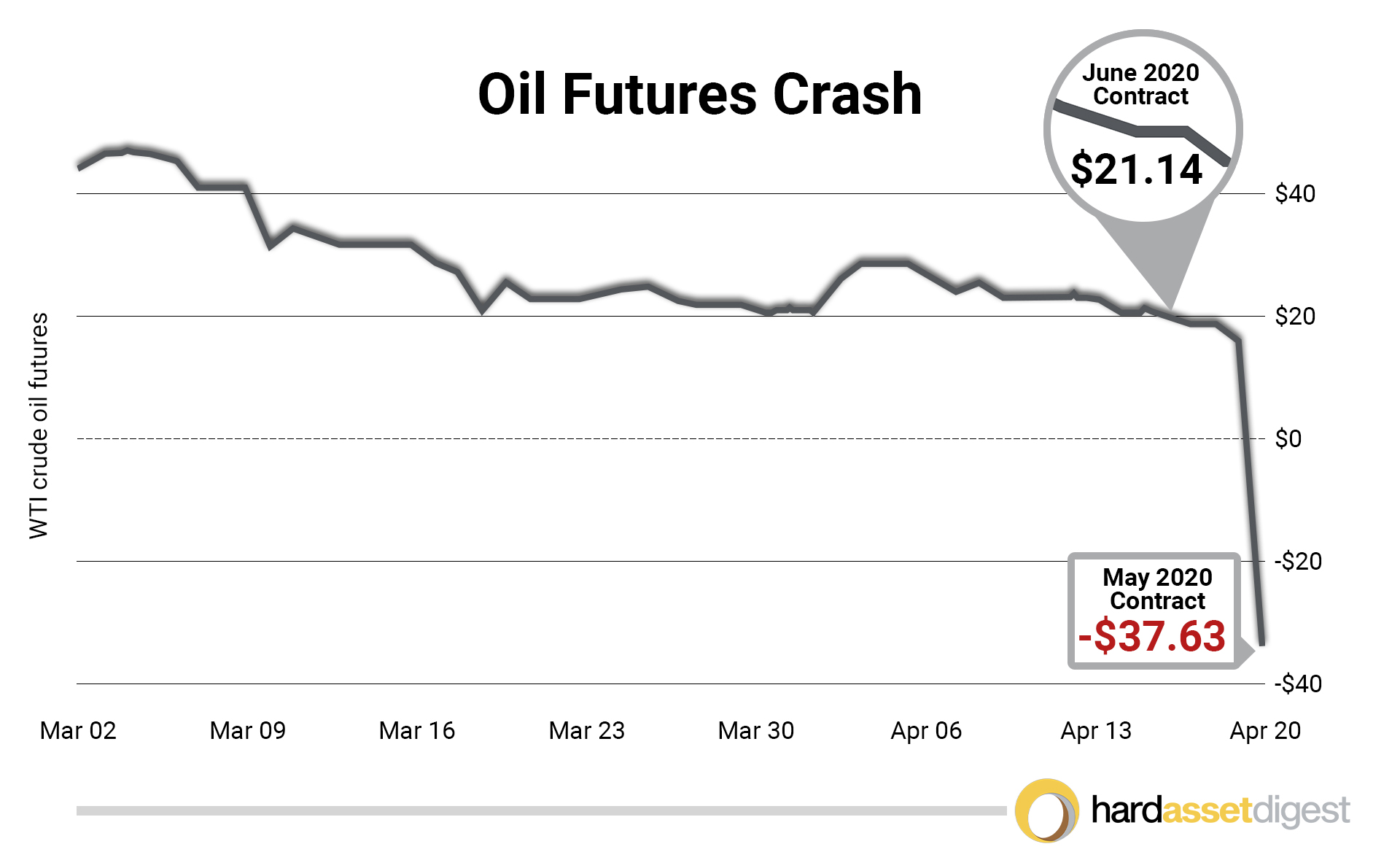

Oil traded to nearly -$50 per barrel on April 20th before closing at -$37.63. That’s minus $37 dollars, Mike. The sellers were paying the buyers to take it because there’s no place to store it. It’s never been seen before.

The pain is deep and severe, and there will be more response. The Fed has said it will buy stuff in whatever quantities needed. This is going to get weird.

The backlash from the people this time is going to be more severe I think, with subsequent protests making Occupy Wall Street look like the walk in the park it was.

Already, we’ve seen banks taking the paltry $1,200 that Americans received if their accounts were overdrawn. That’s just plain mean! We’ve seen large corporations swoop in and take all the funds meant for small businesses — and the banks are all too eager to encourage it. I think you’ll get a vociferous response to that.

And the last point would be that the economy was already slowing heading into this. Corporate earnings had already peaked, and a recession was already long overdue.

The virus exacerbated this — with over 26 million Americans now out of work. The pain is very real. I’ve been talking to the president of the local food bank here in Spokane where we’ve already made multiple donations to help their cause. He says he has never seen demand like this before with hundreds of cars lining up each morning to get food before they even open. And now I’m reading this is becoming commonplace in other states as well.

You’ve got the IMF and other firms and organizations saying this is going to be worse than the Great Depression. And some of the early numbers are backing that up.

How long does a monetary reset take, Mike?

MF: Exactly, especially when you’re talking about “unlimited” money printing here in the United States. Yet, this time it’s the entire globe participating in an unprecedented money printing experiment.

I mean, gold has to continue to go up, right?! Otherwise, every argument about gold as a safe haven in the face of perpetual currency devaluation is out the window!

NH: Exactly, and that’s why we’re all here, right? From Jekyll Island to Tricky Dick — we’ve seen the damage governments and institutions can do to the monetary system.

And throughout history, gold has always responded favorably as a store of value when things go haywire.

Mike, I used to be a much more hardlined conspiracy theorist… The Creature from Jekyll Island… None Dare Call It Conspiracy… the whole nine yards. But then I had kids, and not only does that soften you up, but it takes away from your conspiracy theory time.

Still, you don’t need to spend much time in a rabbit hole when you’re staring down a national debt of $22.7 trillion and a global debt of over $250 trillion.

We already have negative real interest rates around the globe. And now we’re getting really close to that in the US as well.

It’s been deflationary to be sure. The dollars aren’t chasing anything. Everyone wants to hoard them. That’s why the Fed has had to provide so much liquidity, even stepping back into the repo market before the virus hit, don’t forget.

All of the inflation the Peter Schiff’s of the world have been calling for years has only materialized in one place: the stock market. That’s how it hit new high after new high even after earnings began to slow and even as 40% of publicly traded companies failed to turn a profit.

A battle for the ages is now emerging between Austrians and Keynesians; between modern monetary theory and sound money principals.

Can the Federal Reserve and the government create untold trillions out of thin air — already at a quarter of GDP or more — without real-world consequences? Can they alter a cycle that’s played out throughout human history? Can they defeat gravity? Is it different this time?

Or is the world going to have to pay for the rampant debt accumulation and currency debasement as it has throughout history?

I’m still long on the latter, but they aren’t going to go down without kicking and screaming.

Either way, I think gold goes much higher over the next few years. If it doesn’t… we’ll all have some very hard questions to ask ourselves.

MF: Yeah, it seems crazy to even entertain the possibility of gold NOT moving higher in the current macro environment. But these are strange times indeed, so certainly nothing is a guarantee.

But since we both believe gold is poised to move even higher this year and over the next few years at a minimum — how are you playing the precious metals space?

NH: Mike, I’ve always liked the traditional advice of having 5% to 10% of your assets in precious metals. And I like what Jim Rickards adds to that: Seasoned to taste.

I’m partial to the physical component as well, but if you must buy another instrument, make sure it’s backed by a physical component such as the Sprott Trusts.

From there, you look at major royalty companies and producers. I have recommended Wheaton Precious Metals (TSX: WPM)(NYSE: WPM) and Franco-Nevada (TSX: FNV)(NYSE: FNV), for example.

This may be elementary to some but was new to me when I first came into the space. Hopefully, there are new people coming into the gold space now, and into this letter, which is why I’m providing a high level overview.

After producers, you move down the food chain to the developers and the explorers, or what many refer to as the juniors. That’s where I spend most of my speculative time because those are the stocks capable of providing the most torque in a rising gold environment, which is where I believe we are now.

It took my blind squirrel brain a long time to understand leverage, which is maybe an admission I shouldn’t make. But really it can be boiled down to selling your product for a rising price while your costs stay the same, so your cash flow rises — or torques or levers — quickly and, ipso facto, related share prices do the same.

I guess it took me a while to understand it because the juniors don’t actually produce anything. So in my little brain, they weren’t producing anything to lever. Learning about sensitivity changed this for me.

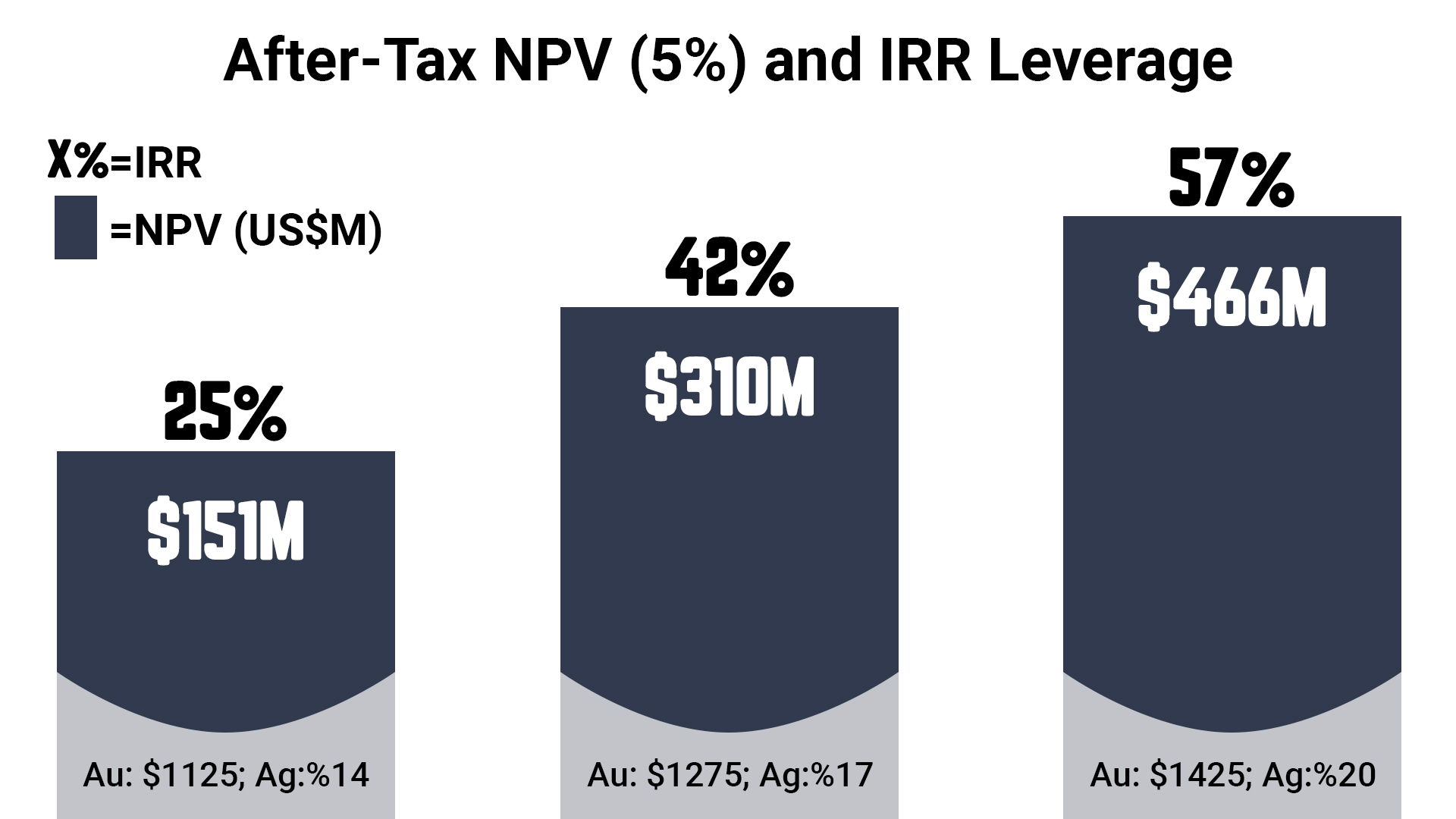

MF: Nick, would you mind going into “sensitivities” for those who may not be familiar with the important relationship between the price of the underlying commodity and NPV & IRR?

NH: Sure. Net present values and internal rates of return are sensitive to the underlying commodity price. Take one of my longtime holdings and recommendations, Midas Gold (TSX: MAX)(OTC: MDRPF).

At $1,350 gold, where the prefeasibility study was done back in 2014, Midas’ Stibnite Project had a net present value of US$832 million. But at $1,650 gold — which we’re actually above today as the company approaches the end of permitting — the NPV goes to US$1.4 billion, after tax.

Stack that against Midas’s current market cap of US$110 million, and it’s easy to see why I view it as a quality speculation.

The fact that Midas is going to remediate what would otherwise be a superfund site as part of the mining process while creating $1 billion in economic activity in Idaho adds to the likelihood this project gets built, in my mind.

Similar stories with companies like Almaden Minerals and Magna Gold.

Almaden is permitting a large gold/silver project in Mexico called Ixtaca. At $1,425 gold and $20 silver, the project has a net present value of $US466 million and an internal rate of return of 57%.

Gold is $200-plus higher than that and Almaden is trading with a US$40 million market cap — a significant disconnect worsened by a permitting halt that I expect to be resolved leading to an erasure of the current undervaluation.

Magna Gold was recently able to acquire the San Francisco Gold Mine from Alio Gold for 9.74 million shares and $5 million — a steal considering there is ore on the leach pads now and tens of thousands of ounces of gold that will be able to be produced in short order.

The transaction not only makes Magna a near-term producer with over 2.3 million gold ounces but also provides excellent exploration potential that the team is intimately familiar with.

It was Magna Gold CEO, Arturro Bonillas, that originally put the mine into production in his former role as president of Timmins Gold. Magna is currently halted with a C$15 million market cap pending the closing of the deal. That’s $6.50 an ounce for a producing gold mine.

And I don’t want to get too carried away mentioning companies, but these are three that either I have participated in placements or bought in the open market in the past few months.

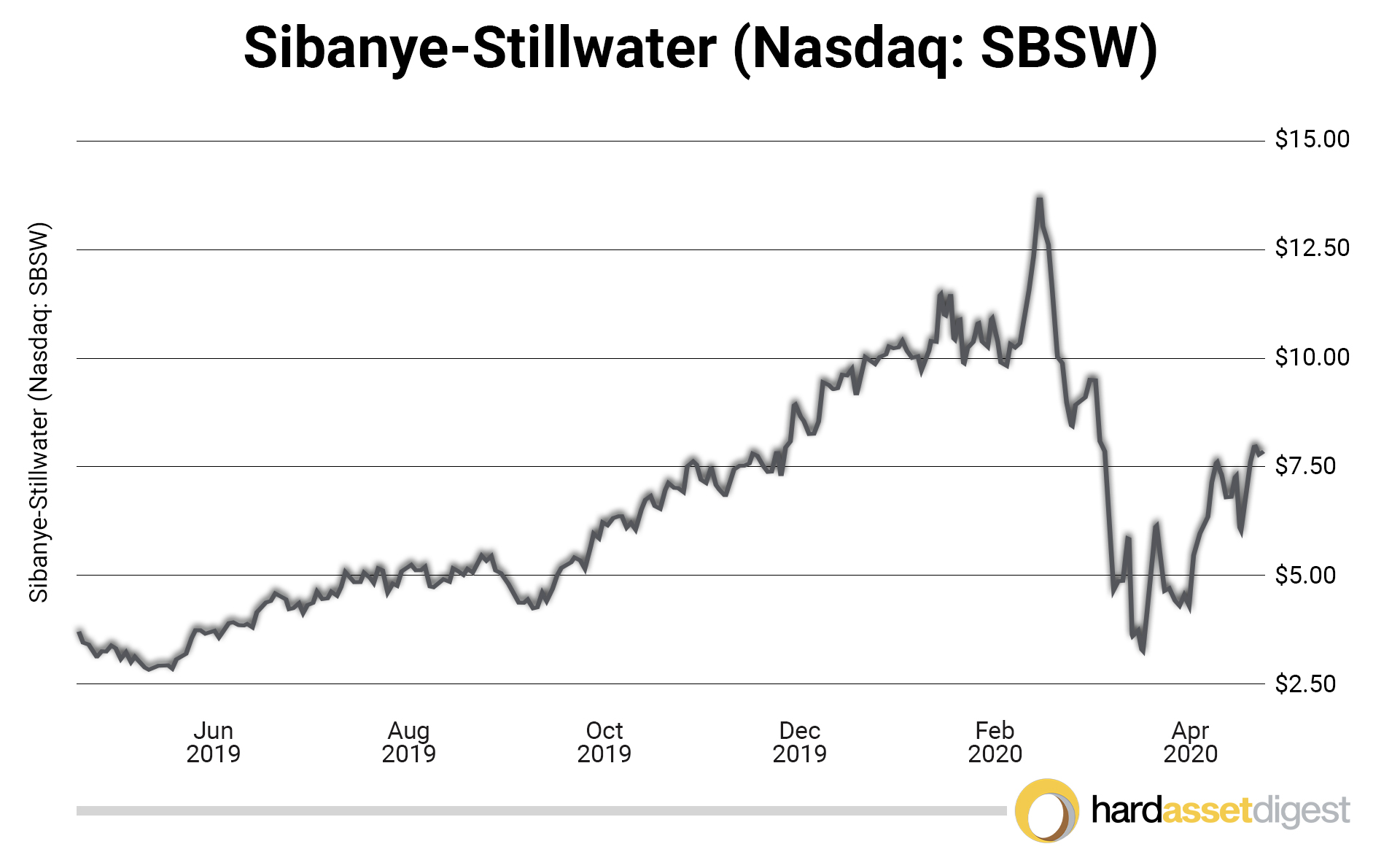

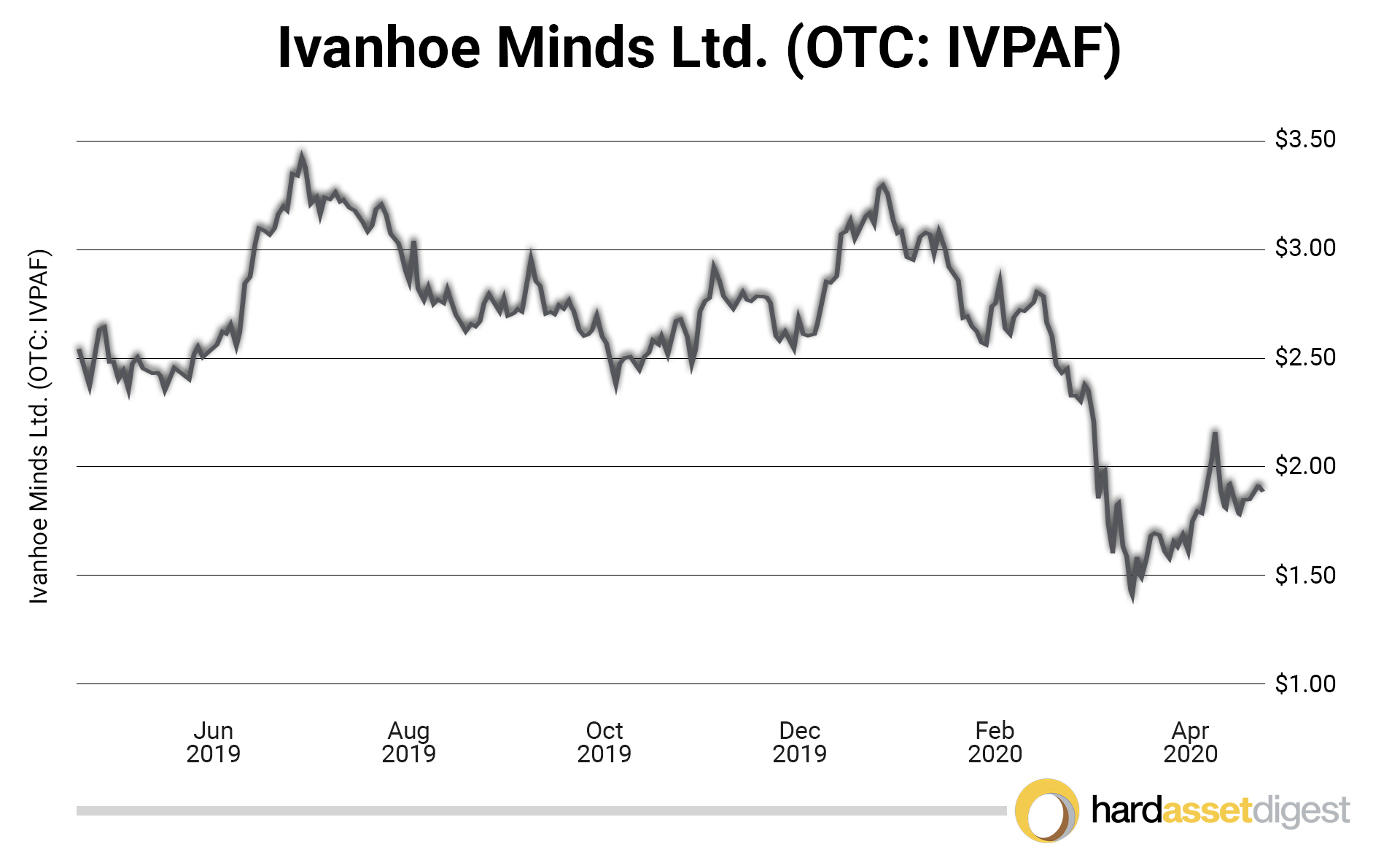

Considering all that’s going on, it’s really not all that many moves. In fact, outside of starting to establish a new position in Ivanhoe Mines (TSX: IVN)(OTC: IVPAF), I haven’t done much else trading-wise recently.

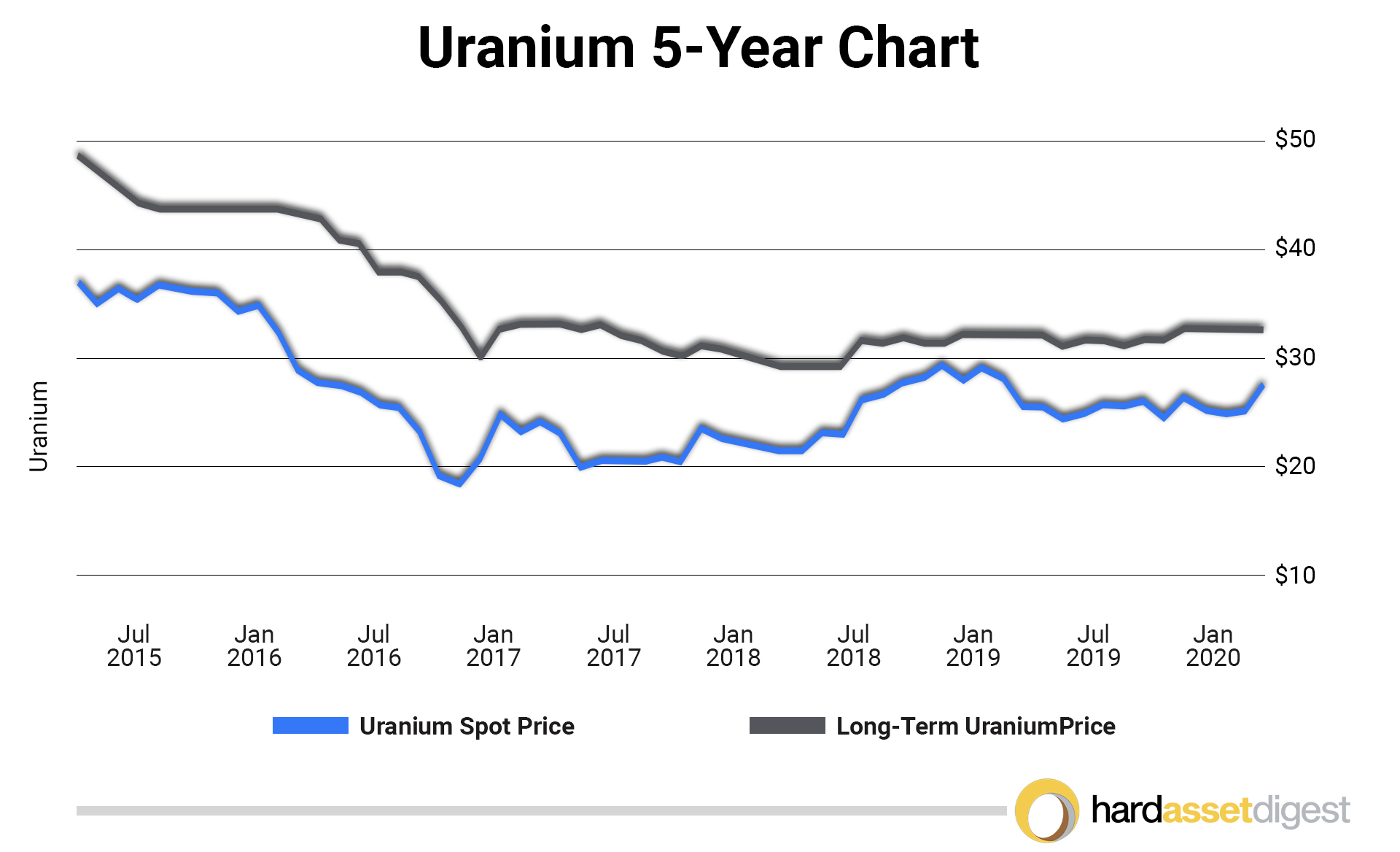

The only other thing, and it’s probably a good place to end on, is that we’re seeing the virus fast-forwarding through catalysts not only for precious metals but also for uranium.

Gold has the monetary thing going, and uranium doesn’t to be sure. Yet, in both cases, supply has been taken offline and prices have quickly risen — a true Black Swan.

MF: Yeah, I’ve been reading a lot about the recent supply cuts in the uranium space both in Canada’s Athabasca Basin and globally.

NH: Yep! Already, Cameco has taken Cigar Lake offline and KazAtomProm says it is idling its in-situ operation for three months. As a result, spot prices are up near $30/lb for the first time since 2016, uranium stocks are rising, and investors have been willing to participate in the sector again, including me.

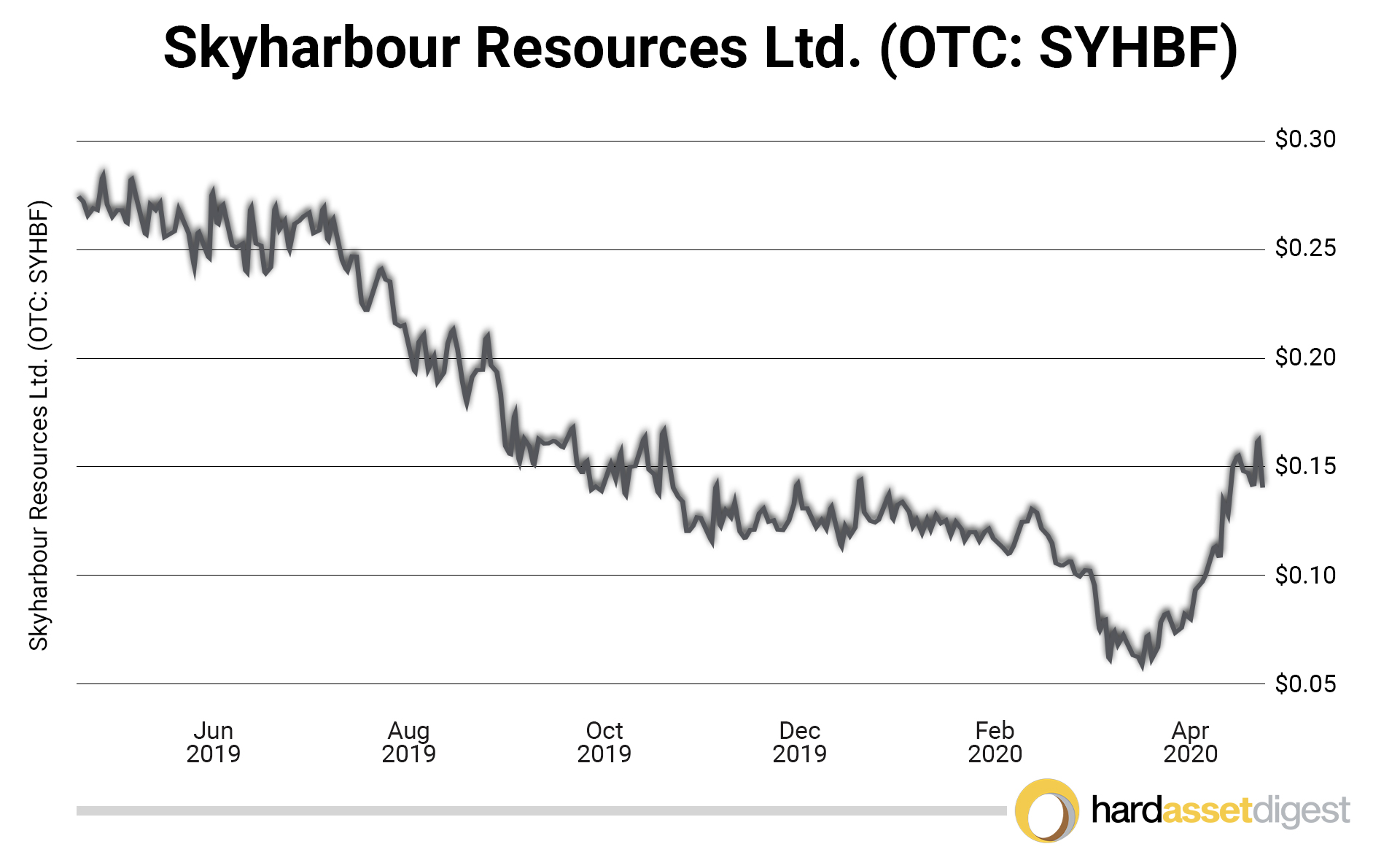

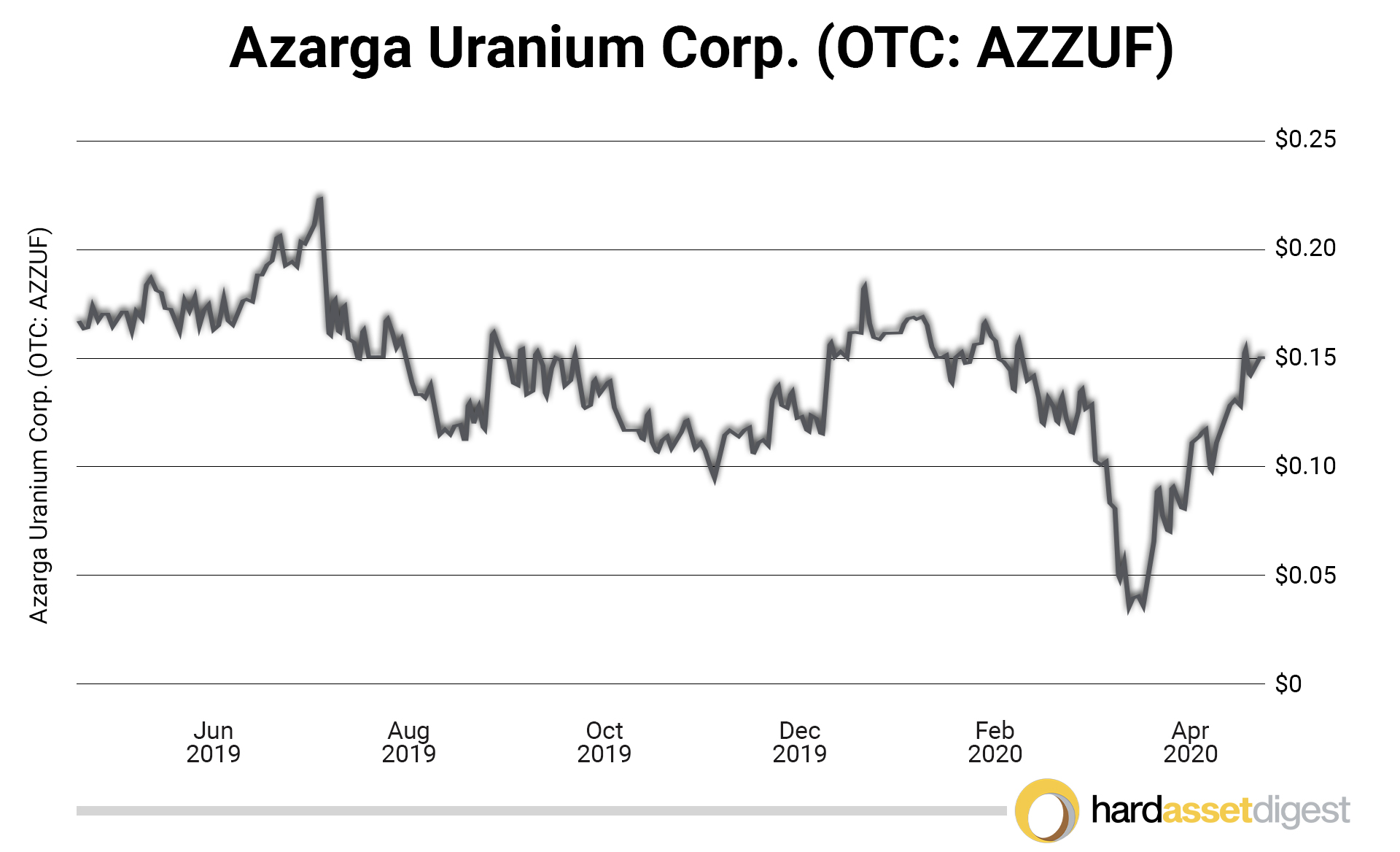

I’m participating in a Skyharbour Resources (TSX-V: SYH)(OTC: SYHBF) private placement this month and have been buying a bit more Azarga Uranium (TSX: AZZ)(OTC: AZZUF).

Skyharbour is a prospect generator — a model you’re familiar with, right, Mike?

MF: Yeah, I’m pretty sure my dad, Brian, thinks he pioneered the prospector generator model (laughs!) and I’d have to agree with him. Here’s his 1980’s Brican Resources video to prove it!

NH: I know… I dig that video. Anyone who’s interested in the junior mining space should watch it. But, yeah — Skyharbour is up in the Athabasca Basin of Saskatchewan.

And Azarga controls what many consider to be the best undeveloped in-situ asset in the US — Dewey Burdock — which just resolved the last contention for its Nuclear Regulatory Commission (NRC) license.

That means it can now get its EPA permits and build the project or sell it to someone else to build. I believe you have a report on Azarga we can share.

MF: Absolutely, I do! Here it is.

NH: And of course, all of that is against the backdrop of the Nuclear Fuel Working Group stuff going on in the US. So there is a lot going on, as you know!

And a lot of it is proving positive for the resource space. It’s funny how stuff works out. Last year, when gold was starting to rise, I told my readers that we’d only had one lick of the golden lollipop to come — and that it might even have a uranium center.

Here’s hoping this sucker lasts a while.

MF: I certainly believe it will! Nick, always an enlightening discussion. Let’s do it again soon… and next time hopefully in person with no face masks!

NH: Mike, that is absolutely the goal! Stay safe and I look forward to it!

We have four reports now available highlighting several opportunities for investment in the resource space.

- The Book of Levi: Picks-and-Shovels for the New Gold Bull Market

- Mid-Tier Takeovers for 2020 and Beyond: Two Top Candidates for Premium Takeovers

- The New Standard in Silver

- Exploration Opportunities

Opportunities discussed in those reports and past issues include:

| Issue Mentioned: | Mentioned By: | Opportunity: |

|---|---|---|

| March 2020 | Brent Cook | Bluestone Resources (TSX-V: BSR) |

| March 2020 | Brent Cook | Blackstone Minerals (ASX: BSX) |

| March 2020 | Brent Cook | Pan American Silver (NASDAQ: PAAS) |

| March 2020 | Brent Cook | Hannan Metals (HAN.V) |

| February 2020 | James Dines | Agnico Eagle Mines (TSX: AEM)(NYSE: AEM) |

| February 2020 | James Dines | Kirkland Lake Gold (TSX: KL) (NYSE: KL) |

| February 2020 | James Dines | Pan American Silver (TSX: PAAS) (NASDAQ: PAAS) |

| February 2020 | James Dines | Lynas Corp. (OTC: LYSCF) |

| February 2020 | James Dines | Canopy Growth (TSX: WEED) (NYSE: CGC) |

| February 2020 | James Dines | OrganiGram Holdings (TSX: OGI) (NASDAQ: OGI) |

| January 2020 | Mickey Fulp | Ely Gold Royalties (TSX-V: ELY)(OTC: ELYGF) |

| January 2020 | Mickey Fulp | Trilogy Metals (TSX: TMQ)(NYSE: TMQ) |

| January 2020 | Mickey Fulp | Azarga Uranium (TSX: AZZ)(OTC: AZZUF) |

| January 2020 | Mickey Fulp | Realgold (private) |

| December 2019 | Van Simmons | 1903-1926 Gold Commemorative Coins |

| December 2019 | Van Simmons | Pre-1933 Liberty, Indian, St. Gauden Coins |

| November 2019 | Rick Rule | Sprott Inc. (TSX: SII)(OTC: SPOXF) |

| November 2019 | Rick Rule | Alacer Gold (TSX: ASR)(OTC: ALIAF) |

| November 2019 | Rick Rule | Alamos Gold (TSX: AGI)(NYSE: AGI) |

| November 2019 | Rick Rule | Silvercrest Metals (TSX: SIL)(NYSE: SILV) |

| November 2019 | Rick Rule | EMX Royalty Corp. (TSX-V: EMX)(NYSE: EMX) |

| October 2019 | Jeff Phillips | Midas Gold (TSX: MAX)(OTC: MDRPF) |

| October 2019 | Jeff Phillips | Almaden Minerals (TSX: AMM)(NYSE: AAU) |

| October 2019 | Jeff Phillips | Revival Gold (TSX-V: RVG)(OTC: RVLGF) |

| October 2019 | Jeff Phillips | Azarga Uranium (TSX: AZZ)(OTC: AZZUF) |