Categories:

Energy

Topics:

General Energy

A Primer On Uranium Revisited: The Patterson Lake Project Has Come A Long Way

Disclosure: I am long ESOFD.PK. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

This article covers micro-cap stocks. Please be aware of the risks associated with these stocks.

Uranium Market Overview

Over the last 6 months, the uranium spot price has stabilized in the low $40/lb range and term prices remain just under $60/lb, while macroeconomic drivers remain directionally positive and unchanged. To summarize:

1. The HEU program (Megatons to Megawatts) expires later this year and consensus is that it will not be renewed for somewhat obvious reasons. To summarize: 1) the Russians have been getting less-than-ideal pricing over the term of the 20-year agreement, and 2) downblending HEU for nuclear fuel is like melting down your vintage Ferrari for the value of the scrap metal. This effectively takes 24 million pounds of uranium supply out of the market, which is about one-sixth of annual demand. There is some excellent analysis on the uranium sector provided by Casey Research (link to a supply/demand article here) and I believe that anyone serious about this sector should browse through the Casey Research materials (note: I have no relationship or affiliation with them).

2. In Japan, current expectations are for more clarity on the reactor restart process by "mid-year," which could literally mean any week now. It is worth noting that the Yen has been under pressure from the dramatic QE program spearheaded by Japanese PM Shinzo Abe. This is particularly relevant because the core of Abe's economic revitalization plan must, at some point, address the cost of power for the country's citizens and industry. Japan is currently (barely) making up for lost nuclear generating capacity by importing and burning LNG. This is not coming cheap. LNG is being imported at a cost of around $15/mcf and pressure on the Yen continues to put pressure on power consumers and Japan's trade balance. The increased gas imports are costing Japan an incremental US$3B per month relative to pre-Fukushima levels (see the chart here).

3. In recent developments, ~5% of global uranium production was taken offline when one of Areva's largest mines was attacked last month in Niger. This obviously highlights security-of-supply concerns and underscores the importance of jurisdiction with respect to uranium mining. Jeb Handwerger provides good commentary on this in his Seeking Alpha article, linked here.

4. J.P. Morgan expects spot prices to rise to $70 in 2 years and $90 in three years, which is an adjustment from last year's view, essentially pushing their price curve back a year. The key with uranium is that you have to plan for tomorrow, today. The market surplus created by Japan's reactor shutdown has depressed prices for longer than expected, which has led to the deferral of new mine (or expansion) projects (some good market commentary here) and has led to limited investment in earlier-stage exploration and development. Delineating, planning, permitting, and building a new uranium mining project takes years. Industry players know this and account for it, while the broader market generally does not. In short, I believe investors will do better if they focus less on where spot isand instead focus more on where it is likely going.

5. Russian-backed ARMZ's purchase of Uranium One (SXRZF.PK) is expected to close sometime in June, which will see an additional ~10% of global uranium production secured under the ARMZ banner. This is perhaps the transaction that was the "light bulb" moment for me with respect to the inevitable direction of the uranium sector. For context, the Uranium One purchase by ARMZ is comparable to someone buying all of Saudi Arabia's production in the oil market (Saudi Arabia is a little more than 10% of the oil market, but I think the point is clear). If that were to happen in the oil market, the oil price would go ballistic. To think that uranium is any less strategic than oil would be a tough position to take, yet the significance of the transaction was only lightly discussed or appreciated at the time. There is simply no substitute for uranium in terms of fueling the world's existing and growing nuclear fleet and 10% of that supply is about to go into the waiting arms of ARMZ. Despite this fact, the broader market still generally ignores the pending issue with respect to the looming gap between future mine supply and reactor demand.

6. In Canada, the Saskatchewan provincial government recently announced sweeping changes to its royalty structure in order to encourage new uranium investment and development (more detail here). This effectively cements the Athabasca Basin as the premier uranium mining jurisdiction in the world... not only are the grades 10-50x higher than the global average, but the regulatory and fiscal regimes are among the best in the world. This is particularly relevant in light of the topic of the second half of this article, which revolves around the high-grade Patterson Lake discovery owned by 50/50 partners Fission Uranium (FSSIF.PK old ticker, FURNF.PK new ticker) and Alpha Minerals (ESOFD.PK).

The Patterson Lake Uranium Project

Readers can review my prior articles for the play-by-play of what was discovered during the first large-scale drilling program conducted on the Patterson Lake uranium project, but the end result is summed up by a quote from Fission Energy Exploration VP, Ross McElroy, "The winter program at PLS represents one of the most impressive uranium exploration programs I've ever seen or been a part of...".

Results were so good in fact that the market appears to have turned its nose up at some final results which were released today, which included 63 meters grading 1.15% U3O8. To put that hole in perspective, that is like drilling 13% copper over 63 meters, or 2/3 of an ounce of gold per ton over the same interval, all at depths that may very well be open pitable, or a shallow underground mine at worst. When compared to highlight holes of 53m of 6.57% U3O8, 49m of 6.26% U3O8, 34m of 4.92% U3O8, and 20.5m of 8.57% U3O8, it is easy to see how investors may be spoiled, but make no mistake, 63m of 1.15% U3O8 that close to surface is a world class hole.

50/50 JV partners Fission Uranium and Alpha Minerals plan to start their $7 million, 11,000 meter drill program in early July, at which point results will start flowing again. Anyone who knows me will have already been asked the simple question, "Do you think they found all the uranium there is to find at Patterson Lake with the first drill program?" My belief is emphatically "no" and the data seems to support that view, given that all zones remain open to expansion in all directions and there are multiple untested geophysical and radon-based target areas (recall that the only source of radon gas in the environment is the natural decay of uranium). Analyst estimates from Cantor Fitzgerald and Dundee Securities peg the outlined Patterson Lake resource potential in the 25-30 million pound range based on current drill data alone. Combined, the JV partners currently have about $35 million in cash, with over $50 million on a fully diluted basis. That is a veritable war chest of cash when one considers that the total budget for the entire 2013 calendar year at Patterson Lake, which will include over 20,000m of drilling, is likely to come in at under $12 million on a 100% basis.

The scarcity factor of the Patterson Lake deposit cannot be overstated. Quite simply, no one has found a deposit of this grade at this depth in the Athabasca Basin in over 30 years. The single most important factor in mining any commodity is grade. The second most important factor is depth. Patterson Lake has both of these attributes going for it and the running room is substantial, all in what is arguably the best uranium mining jurisdiction in the world. These facts will not be lost on the majors, so I expect Patterson Lake to be priced as a premium asset in the market. In terms of valuation, I believe it's quite likely that the $10/pound-in-the-ground valuation will be used as the benchmark. I strongly suspect Patterson Lake will not garner an "average" market valuation, as there is nothing "average" about the project. I have highlighted the valuation history of Hathor Exploration, which is undoubtedly the best comparable... the article is linked here.

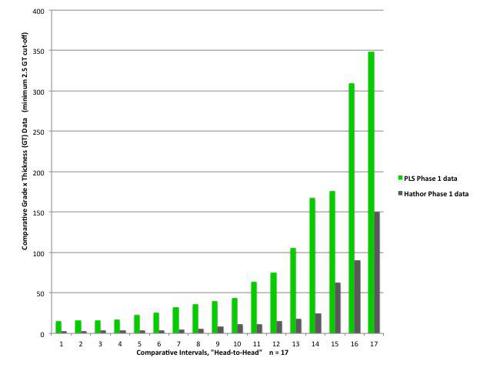

In addition to being at one-half to one-quarter the depth, the drill data from Patterson Lake exceeds the data that came out of Hathor's Roughrider at the same stage of the project in terms of grade-thickness as well. I have re-included a visual comparison of the results from each company's initial drill program below in Figure 1.

It is clear that Patterson Lake (PLS) has delivered exceptional comparative results.

Figure 1: Head to Head Comparison of Phase 1 Hathor Results vs. Phase 1 PLS Results

(click to enlarge) (Data Source: Company reports & press releases)

(Data Source: Company reports & press releases)

The figure above shows the top 17 drill results from each project after their respective full winter drill programs (the sample size of 17 correlates to a minimum grade x thickness product cutoff of 2.5).

Valuation

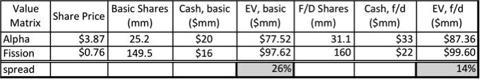

A comparative valuation table of the two JV partners is shown below in Figure 2. It appears that Alpha Minerals trades at a 14-26% discount to Fission Energy depending upon whether or not you look at the companies on a fully diluted or basic basis. Each company has "other" assets (exploration properties) outside of Patterson Lake. Both sets of assets are good, and debating potential valuation differences based on the perceived prospectivity of land with no comparative valuation metric is a pointless exercise.

Figure 2: Spread Analysis of Fission Energy and Alpha Minerals

(source: company reports, calculations by the author. *all numbers are approximate)

Ideally, both companies will merge Patterson Lake into a single entity which is entirely devoted to the Patterson Lake South project. Quite simply, if the JV partners are to extract maximum value from the PLS asset, it will require the complete focus of any combined management team. Additional properties and JVs can actually become a distraction at that point. Fortunately, the combined exploration assets of Fission and Alpha would make for a formidable exploration junior. So, if investors are lucky, my wishful thinking would see shareholders with a spinco at some point in the future.

In terms of comparative historical value relative to Hathor's Roughrider at a similar stage, Patterson Lake is trading at quite a discount. The Patterson Lake project is currently valued at between C$175-185 million on a 100% basic versus fully diluted basis. In 2008, Hathor's Roughrider project was valued in the $300-350 million range, despite having lesser results that what has been seen at Patterson Lake while at the same stage of exploration (see Figure 1, above). Uranium sector sentiment at that time for HAT was poor. Uranium had fallen from $147 per pound in 2007 to $60 per pound at the time of Hathor's discovery. I mention this because I think it's important to also have psychological context in any historical valuation comparison. As an investor in HAT in those early days, I can also say that there was never this much running room with HAT. It was very difficult to define the potential strike length, aside from the size of the property itself, then known as Midwest Northeast (which was much smaller in comparison to PLS).

Summary

In a single drill program, the Patterson Lake discovery has transformed from a decent speculation to a deposit that is already regularly being mentioned in sentences alongside the words "world class." With a drill program set to begin in about 4 weeks and significant expansion potential, shareholders are likely in for an interesting summer.

Results to date have been nothing short of spectacular, setting Patterson Lake South in a class of its own in the current market. I believe the macroeconomic, regulatory, and strategic factors are highly supportive and that Patterson Lake stands a very good shot at being the next premier high-grade acquisition target in the Athabasca Basin. As I mentioned before, when I ask myself, "Do you think they found all the uranium with the first drill program?", the answer is "no" every time. As a result, I look forward to the summer drill program as Fission and Alpha go back to drilling, this time with even more drills and more money. By its nature, this is still a speculative venture, but the risk profile has clearly been mitigated by the drill results to date.