Categories:

Base Metals

/

General Market Commentary

Topics:

General Base Metals

/

General Market Commentary

Tax-Loss Buying Candidate Kutcho Copper Completes 2018 Drill Program; FS Scheduled for Q2/19

The Critical Investor explains why he sees this company as a "solid buying opportunity."

1. Introduction

Although Kutcho Copper Corp. (KC:TSX.V) remains under the radar of most it seems, it doesn't seem to lose a lot of time, and continues doing the heavy lifting in order to advance its flagship project, the Kutcho high-grade copper-zinc project in British Columbia, Canada. Backed by a financial package arranged with Wheaton Precious Metals Corp. (WPM:TSX; WPM:NYSE), Kutcho completed its 2018 drilling and exploration campaign at the end of October as planned (winter break), and is processing all data now. A Feasibility Study (FS) is planned for the end of Q2, 2019. The company's blockchain initiative MineHub isn't shelved either, and management intends to publish a news release with current developments and partner names within a few weeks from now.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US dollars, unless stated otherwise.

Please note: the views, opinions, estimates or forecasts regarding Kutcho's performance are those of the author alone and do not represent opinions, forecasts or predictions of Kutcho or Kutcho's management. Kutcho has not in any way endorsed the information, conclusions or recommendations provided by the author.

2. Update

The Kutcho Copper project appears to be managed very timely and professionally, but the markets fail to recognize what exactly is being done here. With a profitable (post-tax IRR of 28% @$2.75/lb copper, @$1.10/lb zinc) project that has a post-tax 2017 PFS NPV8 of C$265M, which is 18 times bigger than its current market cap, Kutcho deserves better instead of this chart in my view:

Share price over 1 year period

As mentioned in former analysis, the share price indeed went down last week at the peak of tax loss selling, as expected, and one seller even brought down the stock to C$0.20 by then, which was a golden buying opportunity in my view. CEO Sorace didn't like the cheap pricing of the last few months at all, and had a shareholder rights plan adopted by the Board of Directors (BoD), shareholders and the TSX Venture. According to the accompanying news release, this is what it was about:

"The SRP has been adopted to ensure, to the extent possible, that all shareholders of the Company are treated fairly and equally in connection with any unsolicited take-over bid or other acquisition of control of the Company, and that the Board is provided with adequate time to consider and evaluate such a take-over bid or other acquisition and, if appropriate, identify, develop and negotiate any value-enhancing alternatives. Furthermore, the SRP will allow the Board to pursue, if appropriate, other alternatives to maximize shareholder value and to allow additional time for competing bids to emerge."

In short, it gives management and BoD time and options to fight a hostile takeover attempt. Such an attempt isn't unrealistic, as there are very few economic copper deposits around, and the outlook for the metal is still very robust.

The copper price remains side-ranging at US$2.68/lb Cu, as trade war concerns seem to dominate commodity demand, and zinc trades at US$1.16/lb Zn. The fundamentals for copper are still very strong for the next three years, with a 5-10Mt deficit expected by 2021. Zinc is developing/behaving differently, as it is less fragmented as a market, warehouse inventories have impact, smelters have even more impact on pricing and basically control the zinc market anyway.

Whereas competing base metal prices are falling left and right as far as profitability of their projects is concerned, the Kutcho project isn't losing any profitability at the moment as the base case metal prices were almost set at today's prices. It is very rare to see this happening for a base metal project these days, and shows the strength of its economics. Updating of tonnage is on its way and will likely be a significant improvement regarding the current 10.4Mt. Improving recoveries of copper and zinc, higher metal prices and further optimization of, for example, mine plan and opex could help economics even more. As the Canadian dollar loses strength toward the US dollar as the Canadian economy is dependent on the dropping oil price, FX effects might help as well in the future.

In the meantime, Kutcho has been busy on all fronts.

3. Exploration results

Kutcho's 2018 drill program involving nearly 11,000m (7,000m of geotechnical drilling and 3,850m of infill/expansion, both at the Main Zone and Esso) has been completed at the end of October of this year, and the FS data collection has been completed mid October, all according to plan. Metallurgical results are expected in February 2019.

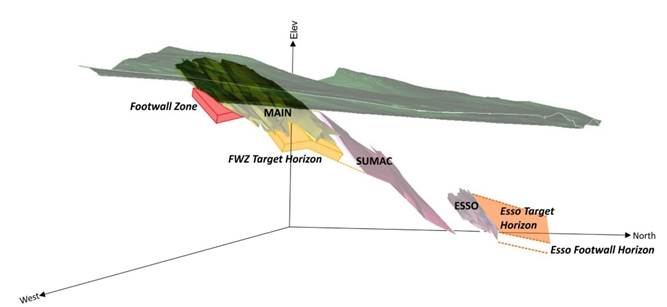

I would like to highlight a number of assays and sections from a series of news releases involving the 2018 drill program. For a better understanding, here is a 3D model of the three deposits: Main, Sumac and Esso:

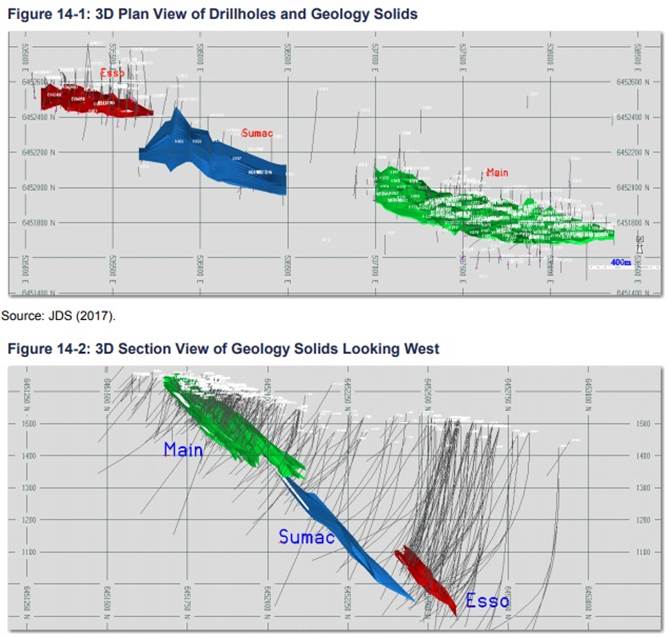

Looking at the orebodies in a bit more detail, the plan and 3D section including drill holes are represented like this (taken from the 2017 PFS):

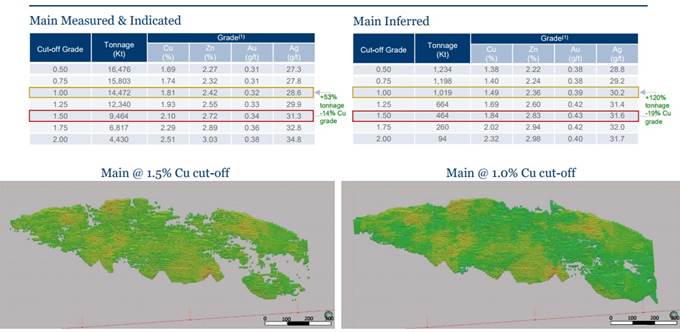

And as a reminder, here is a table that indicates the increased tonnage at Main by lowering the cut-off grade from 1.5% Cu to 1.0% Cu:

The 2017 Main Zone Reserves figure shows 8.1Mt @ 2.59% CuEq, but in my view this is likely to increase towards a pretty conservatively estimated 11Mt figure after using the lowered cut-off. The Esso resource figures stand at 2.3Mt @4.05% CuEq Probable Reserve, the Esso M&I resource stands at 2.4Mt @ 4%, so there was hardly any dilution when converting from resources to reserves at Esso so far. Therefore, total Probable Reserves are likely going to 13.4Mt just based on this data.

Click here to continue reading...

Click here to see more from Kutcho Copper Corp.