Categories:

Base Metals

/

General Market Commentary

Topics:

General Base Metals

/

General Market Commentary

Hidden zinc stocks cloud upcoming surge in supply

LONDON (Reuters) - Hidden zinc inventories are helping to keep stocks low in exchange-approved warehouses and prop up prices, but increasing production is due to hit the market in coming months.

Zinc CMZN3, mainly used for galvanizing steel, has been the best performer on the London Metal Exchange over the past three months, gaining 4.7% versus a 0.3% rise for copper CMCU3.

Prices have been supported as bottlenecks at smelters this year lasted longer than expected, putting a lid on refined output even as mine production has been growing.

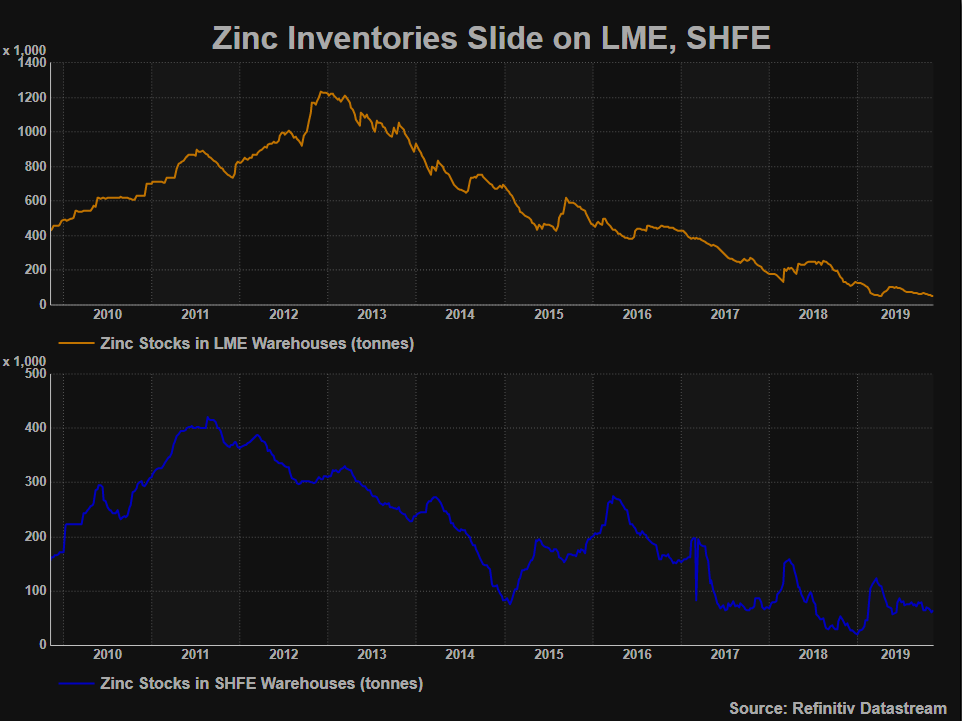

This has been reflected in shortages outside of top consumer China and a slide in inventories in LME-approved warehouses MZNSTX-TOTAL, which have more than halved so far this year to 53,250 tonnes, the lowest in two decades.

Stocks in Shanghai Futures Exchange depots ZN-STX-SGH have declined by nearly half to 63,797 tonnes since mid-March.

“We’re in this lingering state of tightness,” said Oliver Nugent, analyst at Citigroup in London.

Zinc Inventories Slide on LME, SHFE

While smelters are still struggling with mediocre production outside of China, within the country output of refined zinc has been rebounding in recent months.

“There’s a real disparity. There is a loosening story that is already underway in China. It’s a timing question of how long that takes to knock on to ex-China and the LME,” Nugent said.

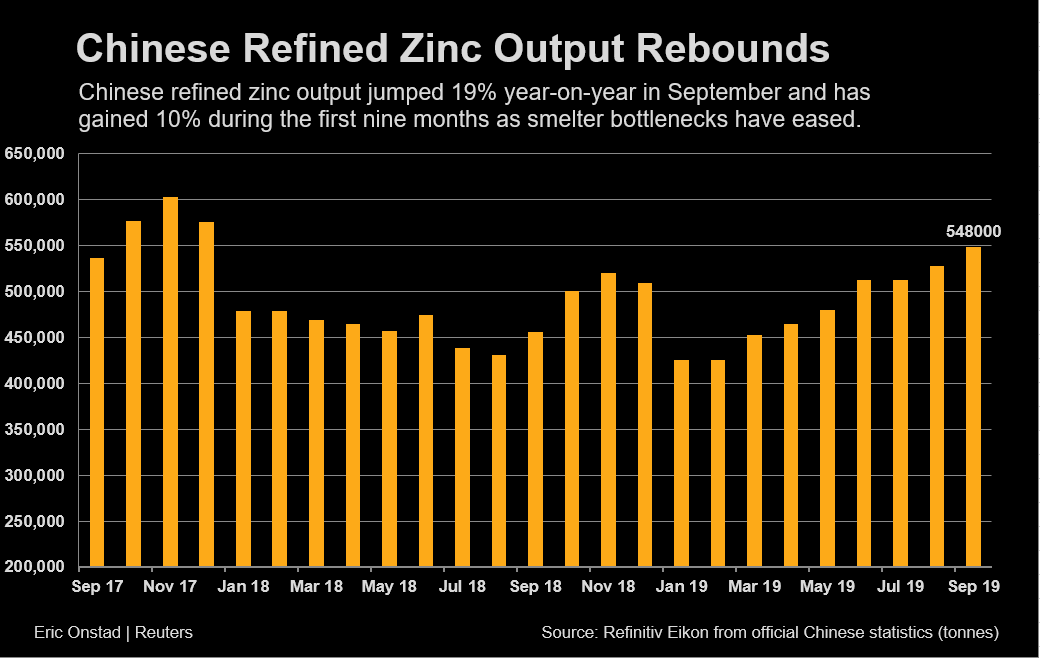

Refined zinc output in top metals consumer China surged 19% year-on-year in September as smelter bottlenecks have eased.

Smelters have also been taking advantage of strong zinc treatment and refining charges, which miners pay to smelters to process their ore concentrates into metal. Spot levels have soared this year AM-TC50-ZNCONto the highest in over a decade.

Chinese Refined Zinc Output Rebounds

Higher Chinese production is not showing up in exchange warehouses partly because the additional output is being stashed away in private storage facilities, analysts and traders said.

“We’ve been told that the Chinese smelters are producing as much as they can and basically it’s going into off-warrant, private warehouse financing,” said Sucden Financial senior broker Liz Grant.